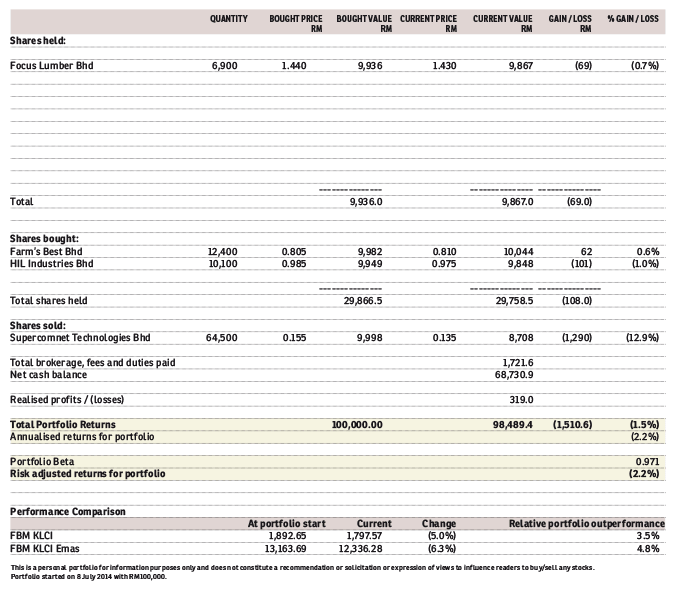

TOTAL value for my portfolio fell 0.76% on Wednesday, to RM98,489.40, dragged down by losses on disposal of Supercomnet. By comparison, the FBM KLCI closed some 0.54% higher at 1,797.6. Despite the headline gain, market breadth was negative with decliners outpacing gainers by around 1.8 to 1.

Regional markets traded mixed yesterday, following overnight losses in US stocks. The DJIA fell by 0.71% while the S&P 500 lost 0.33% as investors adopted a “wait and see” ahead of the Federal Reserve’s 2-day policy meeting that will conclude Wednesday. Bellwether indices in Hong Kong, Shanghai and Japan ended in positive territory while that in Indonesia and South Korea fell.

Crude oil markets remained weak with Brent crude futures hovering around $53 per barrel, at the time of writing. Weekly data is expected to show a continued increase in US inventories, adding to the global supply glut.

The ringgit slid marginally against the greenback, at RM3.71, after Fitch Ratings again brought up the possibility of a ratings downgrade for the country.

My portfolio is now down 1.5% since inception. Despite yesterday’s worse-than-market losses, I am still outperforming the FBM KLCI, which is down by 5% over the same period.

• Portfolio will buy stocks with positive momentum on the day

• Stocks in portfolio will be divested when they exhibit negative momentum

• Otherwise, stocks will be divested within a max 4-day holding period

This article first appeared in The Edge Financial Daily, on March 19, 2015.