REGIONAL markets mostly ended in the red yesterday, in tandem with losses in the US markets last Friday. Only the Shanghai Composite Index bucked the trend, rising 1.89% to close at 3,302.41.

The US reported better-than-estimated jobs data, strengthening the chances of a decision by the Fed to raise rates by mid-2015. The Dow and S&P 500 fell 1.54% and 1.42%, respectively.

Crude oil price dropped on the back of the stronger US dollar. Brent crude and WTI crude are hovering around $59 and US$50 per barrel, respectively - at the time of writing.

On the home front, the FBM KLCI Index closed 15 points or 0.84% lower at 1,791.74. Market breadth was negative with decliners outpacing gainers by a ratio of two-to-1.

Meanwhile, the ringgit slumped to a six-year low against the greenback, down 0.9% to RM3.68 following the favourable US jobs data and rising expectations of a rate hike. Weaker than expected imports by China (down 20% y-o-y in Jan-Feb 2015) our second largest export market, did not help matters.

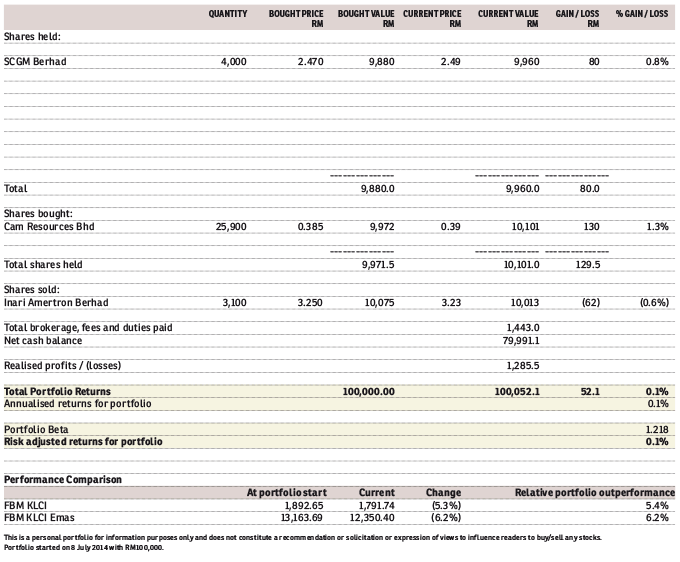

I bought 25,900 shares of Cam Resources at 38.5 sen each.

I also disposed of my entire stake of 3,100 shares in Inari at RM3.23.

I continue to hold SCGM (+0.8%).

My portfolio now has a total value of RM100,052.10 and is up 0.1% since inception. It has outperformed the benchmark FBM KLCI by 5.4%.

This article first appeared in The Edge Financial Daily, on March 10, 2015.