SENTIMENT for the broader market took a turn for the worse last week. The headline FBM KLCI closed lower in each of the four trading days, ending a cumulative 2.4% lower at 1,818. Last week’s losses wiped out gains from the preceding three weeks, and more, paring gains for the first four months of the year to just 3.2%.

Those who follow the “Stocks with Momentum” on The Edge Markets would also have noticed that the number of stocks that triggered its momentum algorithm has fallen quite sharply in the past few days.

I had noted previously that the FBM KLCI’s gains, thus far, appear to lack conviction and that confidence, especially amongst retail investors, was poor. From a broader perspective, nothing much has changed. I continue to view the market with caution.

Valuations remain high, by historical standards and when benchmarked against prospective earnings growth. This means that the margin for error is small. Uncertainties, on the other hand, are still aplenty — be it over the economy, corporate earnings or politics.

Emerging markets, including the local bourse, have enjoyed a return of foreign funds, as expectations for a US interest rate hike are pushed back and with massive quantitative easing programmes in Japan and Europe. On the other hand, their underlying economies are slowing. This could set the stage for greater volatility in the months ahead.

The US economy expanded by just 0.2% in the first reading for 1Q15, well below market expectations. The US Federal Reserve, in its meeting last week, attributed the weakness to transitory factors and offered a balanced assessment of the economy, though the tone seems slightly more cautious. The central bank gave no new guidance on the timing for rate hike. Market consensus, however, is betting against a June increase.

The US dollar, considered by many to be a “sure win” for months, reacted by falling against most currencies. Our ringgit held firm at around 3.56 to the greenback.

Total value for my portfolio was down 2.1% last week, in line with the broader market sell off, but fell less than the benchmark index.

Some of the export-oriented stocks in my portfolio may have also been hurt by the ringgit’s recent appreciation. I should stress that whilst these companies will benefit from a weaker ringgit, forex is not the deciding factor.

Currency gains are typically short-term phenomenon that will eventually be whittled away by competitive forces. More important would be considerations such as the company’s business model and its unique sustainable advantages, market positioning, management and governance, industry outlook, etc.

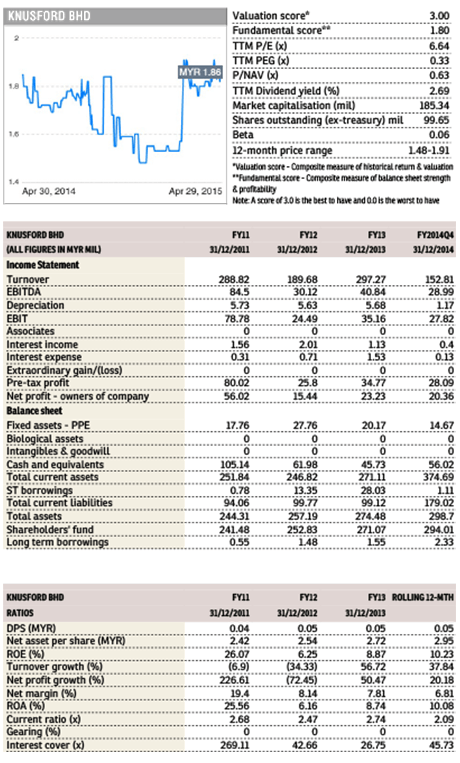

I acquired 8,000 shares in Knusford (Fundamental: 1.8/3, Valuation: 3.0/3) at RM1.86 per share last week.

The company has maximum valuation score of 3. Its shares are trading at only 6.6 times trailing 12-month earnings — compared with 20.2% earnings growth over the same period. Current share price is also well below book value of RM2.95, which includes net cash of about 53 sen per share.

Dividends totalled 5 sen per share in 2014 or just about 18% of net profit, suggesting room for future increases. At 5 sen per share, yields are not too shabby either, roughly 2.7%.

Knusford is principally a trading company for building materials. It also provides sales and rental of heavy machinery. Major shareholders are the Sultan of Johor and Tan Sri Lim Kang Hoo, who is also a major shareholder in Ekovest and Iskandar Waterfront City Bhd.

Knusford has a pretty good earnings track record. Except for the distortion from an exceptionally high profit in 2011 (that was lifted by completion of the RM538 million coastal highway project in Iskandar Malaysia), earnings have been trending higher. ROE improved from 6.2% in 2012 to 10.2% last year.

I am sanguine that Knusford will benefit from ongoing construction works in the country.

Earlier this year, Knusford formed a 45:55 joint venture with the construction arm of China’s state-owned Greenland Group to bid for major building jobs and infrastructure projects in Malaysia. The latter, a Fortune Global 500 company, has two massive waterfront developments in Johor Baru, namely Danga Bay and Tebrau Bay.

Total returns for my portfolio now stand at 7.5% since inception. I continue to outperform benchmark index, which is down by 0.6% over the same period. After last week’s transactions, I am now 86% invested.

This article first appeared in The Edge Malaysia Weekly, on May 4 - 10, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.