This article first appeared in The Edge Malaysia Weekly on December 6, 2021 - December 12, 2021

AS an increasing number of multinational corporations flock to Batu Kawan Industrial Park in Penang to set up their manufacturing plants, Vienna-listed Austria Technologie & Systemtechnik AG (AT&S) has instead chosen Kulim Hi-Tech Park in Kedah for its first production site in Southeast Asia.

The Austrian firm, which has a presence in Nanjangud, India; Chongqing and Shanghai in China; and Ansan, South Korea, is building a new state-of-the-art facility in Kulim with a planned investment of RM8.5 billion (about €1.7 billion) under Phase 1 of the project.

Construction work started in end-October and commercial operations are targeted to come on stream in 2024.

AT&S CEO Andreas Gerstenmayer says the Kulim plant is the group’s largest investment thus far in terms of initial investment for a single project. It is also the biggest single investment ever made by an Austrian company in Malaysia.

“If you look at our expansion in Chongqing, China, we have also invested a lot of money over the past 10 years. In terms of total investments, Kulim may not be the largest at the moment, but in terms of initial investment, it is definitely the largest because we will be investing €1.7 billion over a period of three years,” the 56-year-old German tells The Edge in an exclusive interview.

Gerstenmayer, who studied production engineering at Rosenheim University of Applied Sciences in Germany, held various management positions in the Siemens Group before becoming chairman of the management board of AT&S in 2010.

The first phase of the Kulim project is expected to lead to the creation of 6,000 new jobs, including for 4,500 blue-collar workers.

“To us, Chongqing is somehow the sister plant to the Kulim plant. In terms of workforce, we will probably see a similar size [at] these two plants. We expect them to collaborate as well as exchange technologies and know-how with each other,” he says.

AT&S is procuring 2,000 machines for its Kulim plant. Most of the high-tech equipment is sourced from Japan, the US, Taiwan and South Korea.

“It’s too early to talk about our Phase 2 investment in Kulim. Right now, we just want to focus on putting up our factory first. But yes, we might make further investments in the near future; the possibility is there,” he says.

Dörflinger Private Foundation and Androsch Private Foundation are the two largest shareholders of AT&S, with an 18% and 17.6% stake respectively. The remaining 64.4% shares are in free float.

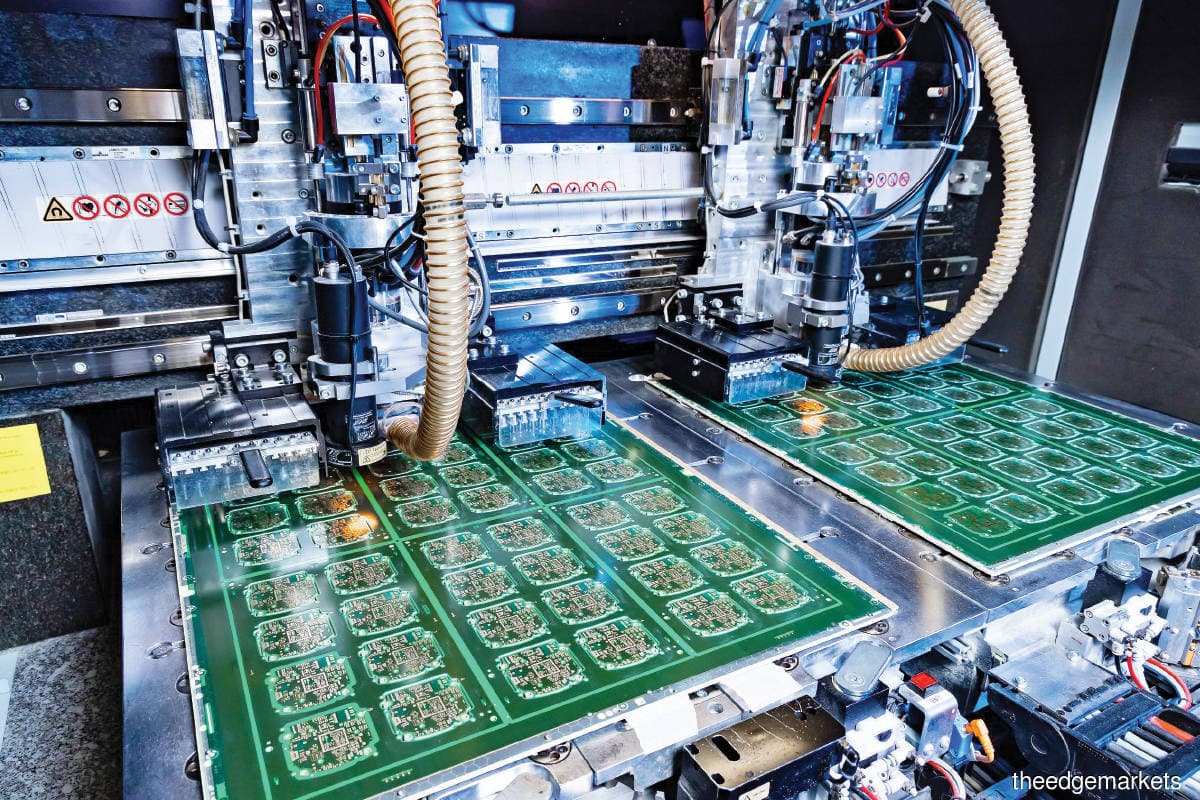

Founded in 1987, Leoben-headquartered AT&S is one of world’s leading manufacturers of high-end printed circuit board (PCB) and integrated circuit (IC) substrates, serving industries such as consumer electronics, computer, communication, semiconductor, automotive, aviation, industrial and medical.

IC substrates provide connections between silicon dies and PCBs. They are composed of several layers and a supporting core in the middle. IC substrates contain drill holes and conductor paths that exceed the density of conventional PCBs. They are used for cloud edge computing, data centres and server farms as well as for consumer devices.

Why AT&S chose Malaysia over Vietnam

AT&S embarked on a worldwide search to find the right location for its manufacturing expansion last year.

“We started with more than 200 possible locations, and then we came out with a very structured way to evaluate and assess the capability and environment of these locations. Finally, Malaysia was shortlisted because it met all of our criteria. The country shows the best proposal and most promising opportunities to us,” Gerstenmayer recalls.

He points out that Malaysia has the advantage of having decades of experience in the electrical and electronics (E&E) sector and being part of the global microelectronics supply chain.

“This means we would have access to (an existing pool of) skilled labour force. We will use multiple avenues to source the talents. We will collaborate with local universities and use labour agencies and our direct employer branding activities. Most likely, we will also be bringing some experts from Austria. We are happy to welcome anyone who is interested to join a fast-growing company like us in Kulim,” he says.

“Basically, Malaysia understands the needs of the E&E industry, and it has a mature education system. To be honest, Vietnam was also one of the locations shortlisted but after we applied our criteria to both countries, it was very clear to us that Malaysia is [the favourable location for us].”

Gerstenmayer concedes that AT&S was looking at Penang when it decided to come to Malaysia, but the group felt it would take more effort to do the piling works there than in Kulim.

“The lead time to expand our capacity is a very important factor when we decide on the location. To build a factory of this size, we need to drive 15,000 huge piles into the ground on site. It’s a very significant construction work,” he explains.

He observes that all of the infrastructure and utilities such as energy and water supply are readily available at Kulim Hi-Tech Park.

“I can’t comment much about the situation of utility supply in Penang but in the Kulim Hi-Tech Park, we know that we would have access to carbon-neutral energy in the future because they are building solar power plants there. Very soon, we will be getting in touch with NUR Power Sdn Bhd to move forward and progress there, and to us, that’s very important,” says Gerstenmayer.

AT&S raises targets on Kulim expansion

Despite a challenging year marked by the Covid-19 pandemic, AT&S saw its revenue grow 18.8% to a record high of €1.188 billion in the financial year ended March 31, 2021 (FY2021), up from €1.001 billion a year ago. The group’s profit also more than doubled from €19.8 million in FY2020 to €47.4 million in FY2021.

With its planned investment in Kulim, AT&S has raised the group’s mid-term revenue guidance from €2.5 billion in FY2025 to €3.5 billion in FY2026.

“We expect a significant portion of growth to be coming from our Malaysian operations. As a group, AT&S is very excited about the global outlook of the entire microprocessor industry. With the Kulim plant, we are more confident of becoming one of the leading high-end PCB producers in the world,” says Gerstenmayer.

Once the Kulim plant is fully operational, AT&S will be among the top three Ajinomoto build-up film (ABF) substrate producers in the world by FY2026. ABF can be found at the heart of most of the world’s personal computers, where they provide electrical insulation of complex circuit substrates for high-performance central processing units.

“We have raised our targets after we expanded into Kulim, especially our ambitious target for the substrates segment as it is closely linked to the Kulim expansion. Without Kulim, I don’t think we would have sufficient capacity to meet our targets. Although we can’t disclose the production output numbers, you could say our Kulim operations will increase our volume significantly,” Gerstenmayer states.

Still, the ultimate goal for AT&S is to become a leading-edge global technology firm rather than just becoming the largest player in terms of revenue.

“At AT&S, we have a two-step research and development (R&D) approach. We do more R&D activities at our research centre in Austria and subsequently, there will be further developments with our customers locally on site. On average, about 3% to 5% of our revenue in respective countries will be reinvested into R&D activities,” he says.

Shares of AT&S have gained about 70% year to date to close at €45.35 last Wednesday, giving it a market capitalisation of €1.76 billion. The counter is currently trading at a historical price-earnings ratio of 40 times.

On the stock’s potential upside, Gerstenmayer says: “Today, AT&S generates annual revenue of over €1 billion and our current market capitalisation is around €1.7 billion. So, if we could grow our revenue to €3.5 billion in FY2026, while our profitability remains strong, investors can actually do a linear calculation and obviously, there’s a lot of room for growth.”

He says investors should look at AT&S as a real technology leader that is growing by innovation and continues to deliver healthy growth rates.

“We have the expansion story in Kulim, where our capacity has almost sold out, which is a very nice situation for us. From the market’s perspective, our potential risk is very limited. Our job is to execute the expansion plan and make sure our group will continue to deliver good financial performance.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.