This article first appeared in The Edge Malaysia Weekly on March 22, 2021 - March 28, 2021

UNLESS you have been hiding under a rock, you have probably heard of “non-fungible tokens” or NFTs, the new fad that is sweeping the cryptocurrency and art collecting world. Many have compared NFTs to the pet rock craze that swept the US in the late 1970s, when Americans paid US$3.95 to buy a small rock — a plain, ordinary, egg-shaped stone, something anyone could dig up in their backyard. NFTs, however, are no random piece of stone. They contain anything digital, including drawings, songs or items within video games, or even animated GIFs, or Graphics Interchange Format videos — indeed, anything in digital form that is collectible.

NFTs allow you to buy or sell “unique” digital assets, whether it is a JPEG digital image file, MP3 audio file or a Twitter tweet, and also keep track of who owns them using the blockchain — a database that collects information together in groups — which serves as a public ledger or a fixed record of data “blocks”. An NFT can be a painting, photograph, an artwork or a video clip, or popular tradable and collectible sports cards, with the blockchain keeping track of the ultimate ownership.

Let’s say you create something like a painting or take a photo that captures an iconic moment or shoot a really funny cat or baby video. As the creator, you can register the image, or for that matter, your cat GIF on the blockchain, which records the price of that piece of art, the history of its ownership and its unique identification or code. When you buy a digital asset, a unique token, such as a JPEG, is created, identifying you as the legitimate owner and the transaction is recorded on the blockchain, which serves as a certificate of authenticity. As such, not only is your sole ownership guaranteed in perpetuity, nobody can make a replica or knock-off and pass it off as the real thing, and no one can hack or change the blockchain record.

Digital collectibles

Think of NFTs as Bitcoins of collectibles — a digital asset that you own and that you hope will grow in value over time. Rare baseball cards still sell for tens of thousands of dollars. My generation had an attachment to physical things — pieces of art, photographs, books, audio or video CDs and other collectibles. Millennials and Gen Z are more comfortable with digital stuff. They listen to streaming music on Apple Music or Spotify, watch movies on video streaming services such as Netflix, AppleTV+ or Disney+. Not surprisingly, the new generation of collectors are more at ease with collecting music, videos, art and photos in digital form.

Once you have created a video or a piece of art, you can trade it on any of the NFT marketplaces and sell it for whatever a buyer is willing to pay. Rock band Kings of Leon just released their album When You See Yourself as an NFT. I could register this article that you are reading on the blockchain and then sell it on an NFT marketplace. Here is how it works: The owner of the item gives it to a dealer who can authenticate it by looking at its blockchain history and people can then bid for it. Since this creation is yours and trackable on the blockchain, every time it is sold, you get a cut of the transaction. Imagine if the next of kin of William Shakespeare or Monet could collect royalties from each sale of their works.

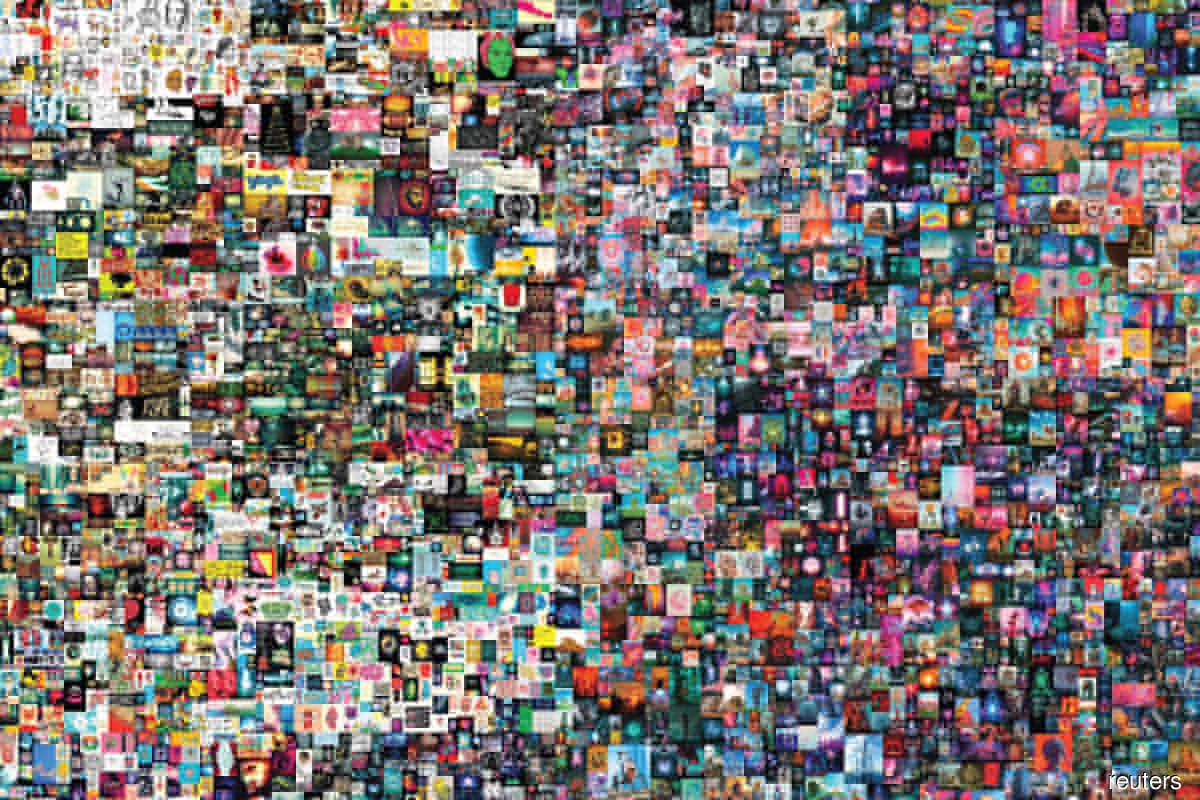

Over the past few months as the prices of Bitcoin, Ether and other cryptocurrencies have soared, NFTs or digital collectibles have followed suit. Twitter founder and CEO Jack Dorsey recently put up his first tweet for sale in an auction that will end on March 21. Miami-based collector Pablo Rodriguez-Fraile recently made over US$6 million (RM24.7 million) for reselling a 10-second video clip he had acquired for US$67,000 last October. Canadian singer, songwriter and visual artist Claire Elise Boucher, known professionally as Grimes, recently sold some artwork — digital computer files, not physical paintings — for US$6.6 million. Grimes is the partner of Tesla CEO Elon Musk, who on March 16 retook the title of the world’s richest person with a net worth of US$182 billion. In early March, a digital video clip of basketball star LeBron James sold for US$200,000. On March 11, British auction house Christie’s auctioned off a piece of virtual art, a digital collage titled Everydays: The First 5000 Days, in the form of a 319-megabyte JPEG file for a cool US$69.3 million. It was the third-most-valuable piece ever sold by a living artist.

The artist and the collector

The sale stunned the collage’s creator, Mike Winkelmann — a relatively unknown 40-year-old graphic designer from South Carolina who goes by the moniker Beeple. Winkelmann sold two of his digital works for US$660,000 each in October and another in December for US$2.5 million. That led to Christie’s approaching him in January, asking if he had more digital artwork to sell. He did, so he just sent his entire 15 years’ work in a collage, which fetched US$69.3 million.

The buyer was a crypto mega millionaire based in Singapore who goes by the pseudonym Metakovan. He owns and runs Metapurse, an NFT production studio and the world’s largest NFT fund, with a friend who goes by the name Twobadour. Several US and Canadian websites devoted to cryptocurrencies have identified Metakovan as Indian-born crypto entrepreneur Vignesh Sundaresan, who moved to Singapore in 2017 from Canada, where he ran several crypto firms. Sundaresan, co-founder of Bitcoin ATM vendor BitAccess and an early Ether investor, has said in interviews that he relocated to Singapore because of the uncertainty around crypto regulations in North America. The Edge was unable to reach Sundaresan to confirm that he used the pseudonym and indeed bought Beeple’s NFT. Metakovan used Ethereum, the world’s second-biggest digital coin, to pay Christie’s for the world’s most expensive digital collage. Ether was trading around US$1,820 to the dollar at 8am on March 18.

Why would you pay a ton of money for a digital image of a baseball player or indeed a photo collage done by an unknown web designer? Why not just google the images or search for the video on the YouTube portal? Sure, anyone can watch a digital video on YouTube or google an image but not everyone can actually own it. You are getting a chance to own a digital piece of whatever you fancy. If you had always wanted to own that funniest cat video on earth, you can now do that.

In late 2017, when Bitcoin surged to US$20,000 a coin, CryptoKitties, a blockchain game on Ethereum developed by Canadian studio Dapper Labs, sold digital cat images worth millions of dollars. You can still buy a CryptoKitty for US$50 on average or fork out hundreds of thousands of dollars for one, but with NFTs all the rage these days, collectors have moved on from those felines. Cats have gone viral before. Some of you might remember the Hello Kitty phenomenon of the 1990s, when Japanese design firm Sanrio turned a cartoon cat into an international icon.

If you own a Monet or another painting or the rights to classic movies such as Jaws, Titanic or something from your grandparents’ time like Gone with the Wind, you have to worry about storage cost, or whether it might ever be damaged or stolen, or whether years from now someone could take you to court arguing that they are the rightful owners. The blockchain takes care of all that because it has historical ownership records and you can store thousands of NFTs in your free Google Cloud or Apple iCloud account.

The tax angle

What is a digital piece of asset really worth? Let’s compare with traditional pieces of art. A recent Monet painting sold for US$110 million and the last Pablo Picasso work was auctioned for US$115 million, but you can probably still buy other lesser-known pieces by them for less than half that amount. If you are a crypto mega millionaire in America, you have a choice. You could convert, say, US$69 million of Bitcoin or Ethereum into US dollars. But that would mean paying anything from US$13 million to over US$26 million in capital gains tax depending on your annual income, the price you paid for the cryptocurrency and how long you have held the assets.

Or you could protect and preserve your wealth by buying another asset with cryptocurrency without converting the money into dollars first. Crypto millionaires and collectors of NFTs are betting that sooner or later, cryptos will be accepted for everything and they would not have to pay much capital gains tax as long as they exchange them for another asset. Eventually, of course, the Inland Revenue Service or IRS, the American income tax authority, will close the loophole.

The irony is that the booming NFT market is doing the earth more harm than good. At a time when the world is finally starting to focus on ESG (environmental, social and corporate governance), NFTs are environmentally damaging. They use a lot of electricity. A recent Cambridge University study found that mining Bitcoin consumes more energy per year than the entire Argentina does. Carbon emissions from global crypto mining will soon equal that from the entire Greater London area and Bitcoin emissions alone will raise the earth’s temperature by 2°C.

Moreover, with so much money being poured into NFTs, prices on NFT marketplaces have clearly got out of hand. The pet rock craze of the 1970s fizzled out in less than a year. Art experts believe NFTs are in a bubble, which will eventually burst because bidders like Metakovan are not collectors or genuine art enthusiasts but just seeking to park their crypto profits in a new asset class that they believe will appreciate over time.

The jury is still out on whether the advent of NFTs will change the way digital stuff will be owned in future. It is also unclear how long it will take before NFTs become mainstream. After all, Bitcoin has been around for 12 years and we still can’t go to the nearest Starbucks and pay for a Grande Caramel Macchiato with it.

Assif Shameen is a technology writer based in North America

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.