This article first appeared in The Edge Malaysia Weekly on July 3, 2017 - July 9, 2017

FINANCIAL comparison sites have been around for over a decade in Malaysia, but it has only been in recent years that the platforms have gained traction with banks — their clients — and the public.

Most, if not all banks here, foreign and local, are working with at least one comparison site to reach out to consumers. Today, there are six comparison sites — up from three in 2013. The six are RinggitPlus, iMoney, Loanstreet, CompareHero, BolehCompare and GoBear.

According to industry players, these sites — which are also online financial aggregators — saw an average of 300,000 monthly visitors in 2013 and that has grown to 2.5 million today. In the UK, Moneysupermarket.com saw on average 23.4 million unique visitors a month last year.

“In Malaysia, there were about 500 credit card approvals via comparison sites in 2013, and that has increased to 80,000 year to date. Personal loan approvals also saw an uptick, rising from 300 to 18,000 in the same period. Personal loan disbursements from online financial aggregators have expanded from RM5 million in 2013 to RM300 million today,” the head of a comparison site, who declined to be named, tells The Edge.

Interestingly, in the first quarter this year, comparison sites accounted for over 30% of credit card sales and over 50% of personal loans out of all digital sales for the industry, notes Deniz Guven, global head of design and client experience at Standard Chartered.

“A customer who is comparison shopping for a loan on this channel has already explicitly demonstrated interest in a financial product. From a return on investment perspective, comparison sites have proved to be highly effective paid marketing channels and they consistently contribute a high volume of sales to our overall digital sales numbers,” he tells The Edge.

“We see the value in financial comparison sites. Not only do they deliver convenience, value and credibility to customers, they offer greater transparency. Customers can clearly see what products and rates they are eligible for. For banks, online comparison sites provide insights into sales trends and the direction of market demand.”

Financial institutions need be where the customers are, says Malayan Banking Bhd group chief strategy officer Michael Foong.

“Customers today still do go to bank branches to understand [the] products, but their initial point of research would be online. But where online? Well, they either go to the individual bank websites or to comparison sites where it is easier to compare the products across several banks. If a particular bank is not on the site, it could miss out on a potential customer. However, what we have found in countries like Malaysia, where there is a manageable number of banks, customers do take the time to research products and services beyond comparison sites. Some use comparison sites as a starting point,” he says.

Financial comparison websites are online portals that allow users to compare financial products and services, such as fixed deposit accounts, mortgages, credit cards and personal loans. The sites list the prevailing rates and terms of financial products, and provide online application services. The sites receive a fee from the banks, such as a referral fee.

While comparison sites are not listed locally, the UK site Moneysupermarket.com shows that the business model is profitable. Listed on the London Stock Exchange, the group’s net profit increased 16% year on year to £73.5 million for its financial year ended Dec 31, 2016, and revenue rose 12% to £316.4 million in the same period.

Indeed, Moneysupermarket.com, which is over 20 years old, did have a head start and the platform has expanded its product offerings to include comparing travel packages and mobile phone deals. At home, while Malaysian sites are still building up their offerings, what is certain is that banks and consumers are making a beeline for the digital sphere.

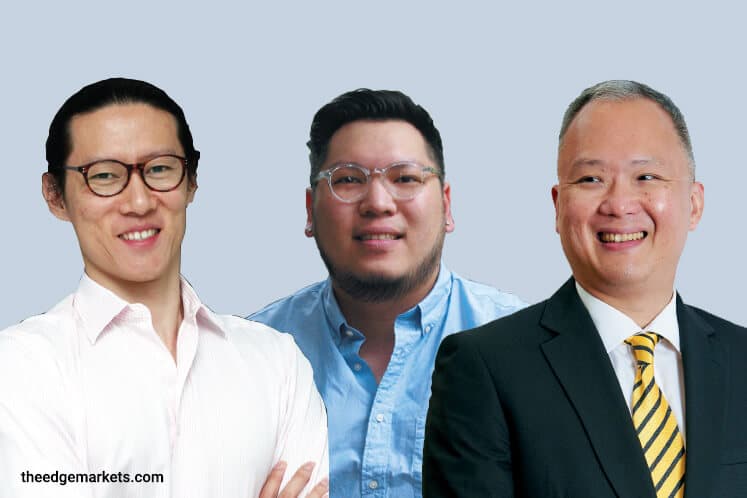

Naturally, banks want to go where the customers are and there is a sizeable market of digital-savvy consumers in Malaysia today, says Siew Yuen Tuck, CEO of Jirnexu Sdn Bhd (formerly known as Saving Plus Sdn Bhd), which owns RinggitPlus.

“We see consistent growth, thanks to internet growth. One big shift, which has been very lucky for comparison sites, is the broader interest in fintech (financial technology) that started last year. Before that, there was definitely a sense within the banking industry to venture into the tech space … but the big explosion was last year with the fintech initiatives launched for the industry. That helped create a sense of urgency for fintech businesses, ideas and services,” says Siew, the co-founder of RinggitPlus, which was established five years ago.

As to why banks would rather work with third parties than build their own platforms, Siew believes it is because financial institutions want to work with companies that specialise in specific tech areas when it comes to certain segments, rather than spend time building it themselves.

“The solutions and services comparison sites offer are based on specific core specialities. From what I have observed, it is difficult for banks to build certain tech solutions quickly. And it is not just the banks that face this difficulty — in any industry where a large corporate is trying to build tech solutions, you have a situation of the smaller specialised company that has focus, speed and agility versus the larger corporates that have bureaucratic red tape,” he says.

Benny Chee, managing director of CompareHero.my — a three-year-old entrant to the local market — says: “Comparison sites offer banks a wider and different reach to consumers. For example, a bank that is limited to 10 branches nationwide will now have a different touch point with the general public, and more beneficial, a seriously untapped customer profile of the young, savvy and affluent. Inflows of young customers will essentially bring forward the general life cycle, adding more years of critical data and an overall increase of lifetime value.

“Online is definitely the future. Businesses are moving towards online and banks are no exception. However, core banking IT systems are usually dated and less flexible, hence, fintechs are filling the void. The current economic climate and pressure on banks to reduce their cost-to-income ratio are the top priority, leading to the existence of non-biased financial comparison sites like ourselves. On top of that, we make it our mission to educate consumers on financial literacy and match them with the right products that suit their needs and spending patterns, at zero cost to them.”

He says the most popular choices on comparison sites are credit cards and personal loans as they give consumers a full view of the local landscape and product offerings.

“This helps save time on research, and with the right overview, they can to decide on the best product that suits their needs. While the Malaysian market is still very much focused on basic financial products, there is a huge opportunity for more sophisticated ones in the future, such as investment-linked products, insurance or convoluted loan packages that require more information and explanation,” Chee says.

Maybank’s Foong points out that if the current model of financial comparison sites is maintained, they will continue to complement banks.

“They may benefit from referral fees, if any, and the banks get the customer reach,” he says.

StanChart’s Guven believes that banks and comparison sites have a symbiotic relationship that will continue for the long term.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.