THE Inland Revenue Board (IRB) is taking a closer look at Malaysian corporates that have units based in Labuan, the offshore financial centre, say tax consultants and lawyers.

“Recently, companies have had to declare whether or not they have a subsidiary or a related company in Labuan when they filed their tax returns. There is a section in Form C (tax return for a company) where companies have to make that declaration. If the company has such a subsidiary or related company, it must fill in the name of the Labuan entity, Labuan registration number and Labuan income tax number,” says a senior tax manager at one of the Big 4 accounting firms.

An executive tax director at a tax services firm says: “This is something new that was introduced a few months ago. Prior to this, companies did not have to declare whether or not they have a subsidiary or a related company in Labuan.”

Tax consultants say the taxman is monitoring these companies partly because it is believed that some are misusing Labuan’s preferential tax treatment.

“There are bound to be a few bad apples … But the clients who have come to us for advice on setting up a business in Labuan are genuine and do not have the intention to evade taxes. Part of the attraction for them is the tax-friendly landscape. Companies can do efficient tax planning for their businesses in Labuan,” says the senior tax manager.

A Labuan company carrying a Labuan business can choose to pay a fixed amount of RM20,000 or to be taxed 3% of its audited accounting profit.

“You have to take a step back and see what a Labuan company can and cannot do. To enjoy the preferential tax regime in Labuan, you must be a company carrying out a Labuan business activity. Generally, a Labuan business activity is any transaction with a non-resident done in non-ringgit terms,” the executive tax director, who declined to be named, says.

“So, for example, a Labuan company sells products to a Malaysian one, that transaction would be subject to the normal corporate tax rate of 25% and cannot enjoy the preferential regime of 3% or RM20,000 unless the MoF (Ministry of Finance) gives special approval.

“So, this is why the IRB is taking a closer look at such companies and analysing their transactions — to ensure that their tax declarations are accurate. The global focus now on BEPS (base erosion and profit shifting) is probably another reason.”

A corporate lawyer, who specialises in tax, says there have been a couple of court cases in which the IRB has challenged the authenticity of companies set up for business in Labuan — whether or not the companies are structured to be used for illegal tax evasion or for legitimate tax planning.

“They (the IRB) are taking a ‘substance over form’ approach and questioning whether these Labuan companies have commercial or economic substance.

“This is why we have been telling our clients that have Labuan subsidiaries or related companies to ensure they have their document trails in place. From my experience, the leasing structure is a popular structure with corporates looking at Labuan,” says the lawyer, who declined to be named.

It is learnt that Bank Negara Malaysia governor Datuk Muhammad Ibrahim is visiting Labuan this month and some quarters expect him to make an announcement that is positive for the business landscape there.

“We are not sure what the announcement is, but people are expecting it to be positive and potentially something that will revamp the business landscape there. The governor was an officer in Labuan before and the place is quite special to him,” says the corporate lawyer.

Labuan celebrated its silver jubilee last year. It became a Federal Territory in 1984, and in October 1990, it was declared an international business and financial centre (IBFC).

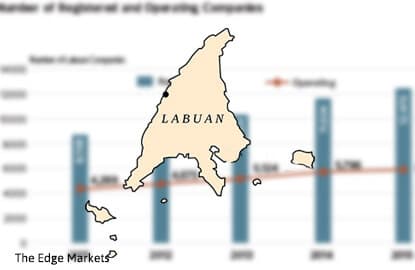

Last year, 836 new companies registered at Labuan IBFC, compared with 1,280 in 2014, according to the Labuan Financial Services Authority’s 2015 annual report.

Out of the 836 companies, 826 were limited by shares, seven were limited by guarantee and three were foreign companies. This means the total number of Labuan companies grew 7.2% year on year to 12,470.

The authority says that in terms of regional representation, 56.3% (2014: 56.4%) were from Asia-Pacific, largely from Malaysia, Indonesia, Singapore, Australia and Thailand. The Far East stood at 14.3% (2014: 14%), mainly from Hong Kong, Taiwan and Japan. Europe contributed 13.9% (2014: 13.5%) with the investors mainly from the UK, the Netherlands, Germany, Ireland and France. The Americas came in at 8% (2014: 7.8%) and the Middle East and Africa combined at 7.5% (2014: 8.3%).

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.