KUALA LUMPUR (March 18): Non-governmental organisation Retail and Trade Brands Advocacy Malaysia (RTBA Malaysia) believes the government stands to gain an estimated tax revenue of more than RM300 million if appropriate vape regulations are introduced.

RTBA managing director Datuk Fazli Nordin said Malaysia has an opportunity to expand its revenue stream in this growing market.

"There is potential revenue of more than RM300 million for the government should the taxation framework include vape e-liquids with nicotine which is an option for new sources of revenue.

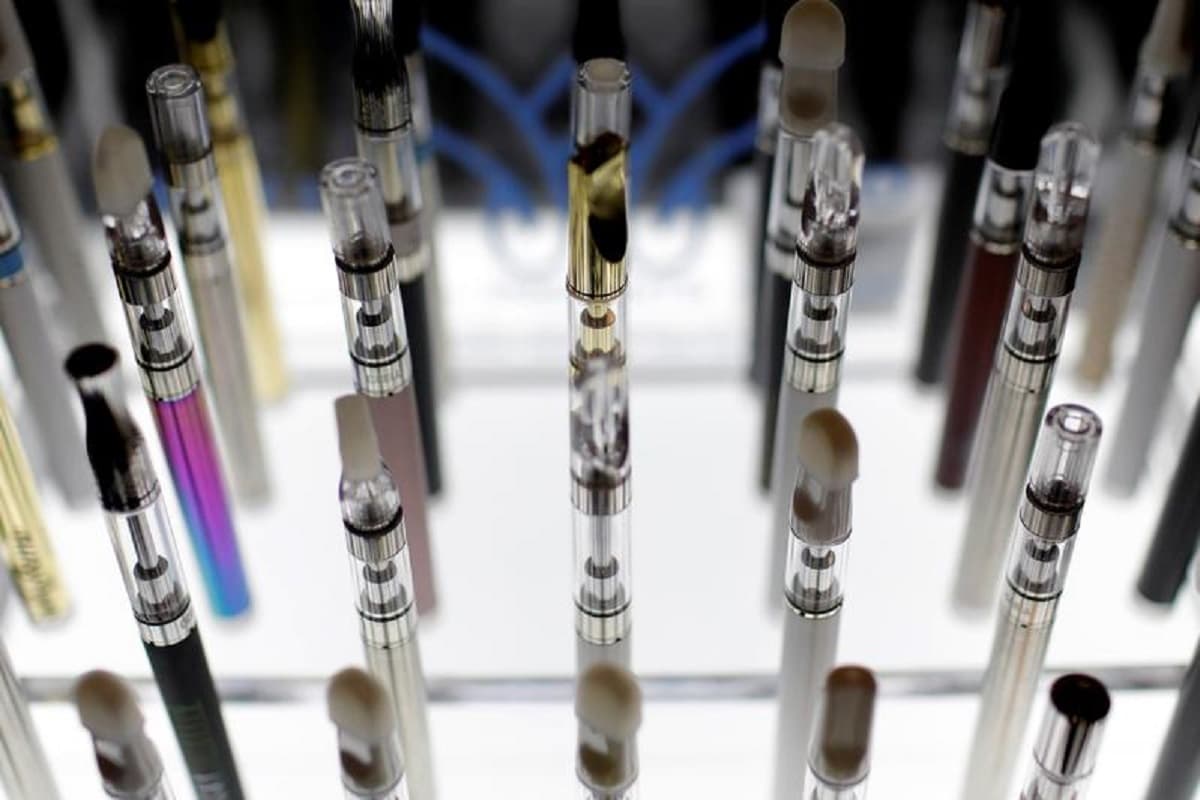

“The vape market is long established in Malaysia and there are already over one million consumers using the products. This is an untapped sector that the government can immediately gain revenue this year by expanding the taxation framework," he said in a statement.

The organisation said the government has already made the right step in imposing excise tax on vape products as announced during Budget 2021.

However, it said the taxation framework only covers vape devices and non-nicotine vape e-liquids which make up less than 5% of the total market.

Therefore, the tax framework needs to be expanded to include vape e-liquids with nicotine, according to RTBA Malaysia.

Fazli said the expanded taxation framework needs to be complemented with regulations on vape products as this will spur and generate economic activities in this growing industry.

“Introducing comprehensive regulations must be made a priority, more so as this presents an opportunity not only to strengthen the government’s revenue but also create jobs, develop local SMEs (small and medium enterprises), drive competitiveness, ensure quality and standard of products and attract foreign direct investments, as international vape companies may consider investing in Malaysia,” he added.

Citing the "Study of the Malaysian Vape Industry", a report published by the Malaysian Vape Chambers of Commerce, RTBA Malaysia said the country’s vape industry is valued at RM2.27 billion.

In the same report, it was estimated that the government can potentially gain up to RM300 million in excise tax revenue in the first year of the levies should vape e-liquid with nicotine be included.

“This data is based on the consumer consumption pattern especially on e-liquids with nicotine which form the largest component of the collectable taxes for the government and estimated monthly sales figures derived from 3,000 vape retailers in Malaysia,” said the organisation.