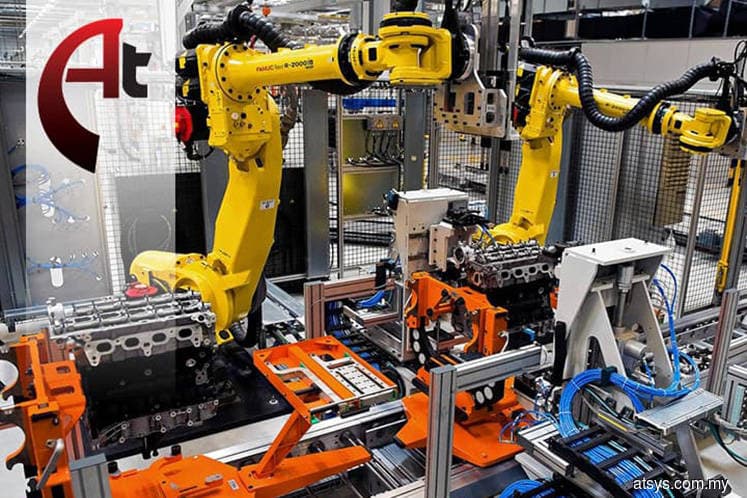

KUALA LUMPUR (July 5): Loss-making precision engineering and industrial automation firm AT Systematization Bhd has signed an agreement to manufacture and supply high quality machined components to subsidiaries of Swiss company Rieter Machine Works Ltd.

The Penang-based company said in an exchange filing today that the agreement, which is for a three-year period with an automatic extension for a further year, includes aluminium profiles to be used in Rieter’s textile machines.

According to the filing, a basic purchase agreement (BPA) was signed between its wholly-owned AT Precision Tooling Sdn Bhd and Rieter Machine Works Ltd, which replaces its prior arrangement with Rieter.

The prior agreement involved a 75:25 joint venture with Fong's Engineering & Manufacturing Pte Ltd (FEM) named Fong's & AT Venture Sdn Bhd (FATV).

Accordingly, AT Systematization will acquire the remaining stake in FATV from FEM and terminate the prior agreement with the latter company.

Under the BPA, AT Systematization said the price to be paid by Rieter’s subsidiaries for the contractual products is stipulated in the BPA, and that the base prices, excluding London Metal Exchange and currency exchange rate fluctuation, will be negotiated annually for the following calendar year.

The group added that it will commit to supplying Rieter’s subsidiaries with spare parts and the documentary material necessary for servicing, for a period of ten years after discontinuation of its production of the contractual products.

AT Systematization said strategic business relationship with Rieter is expected to augur well for the company’s future prospects.

“This direct arrangement with Rieter is expected to facilitate better communication and faster delivery of products to Rieter, as compared to the previous arrangement under the Old BPA, which involved FATV and FEM.

“In turn, this will help to promote smoother operations and foster closer business relationship with Rieter. In addition, the direct arrangement with Rieter may lead to higher profit margins for the company, since it no longer involves an intermediary party,” AT Systematization said today.

The ACE Market-listed AT Systematization has been loss-making for the past four financial years (FY) from FY16, with an accumulated net loss of RM659,000.

The stock was last done today at 4.5 sen, after 233,700 shares exchanged hands, giving it a market capitalisation of RM20.88 million.