This article first appeared in The Edge Malaysia Weekly on December 28, 2020 - January 3, 2021

FOR the first time in 22 years, Malaysia’s retail sales are seen contracting by as much as 15.8% this year, as retailers across the country fail to make their cash registers ring as much as they had hoped for.

The 15.8% forecast contraction would bring the total value of retail sales to RM90.5 billion, which is RM21.9 billion less than the RM112.4 billion originally projected based on 4.6% growth. Nevertheless, the decline would be less severe than the 20% plunge registered during the 1998 Asian financial crisis.

With borders remaining closed and movement restricted, thousands of retailers were forced to shut down, and thousands more are expected to do so this year. Renowned department stores such as Singapore’s Robinsons closed shop for good and more recently, US ice cream chain Ben & Jerry’s announced its exit from Malaysia.

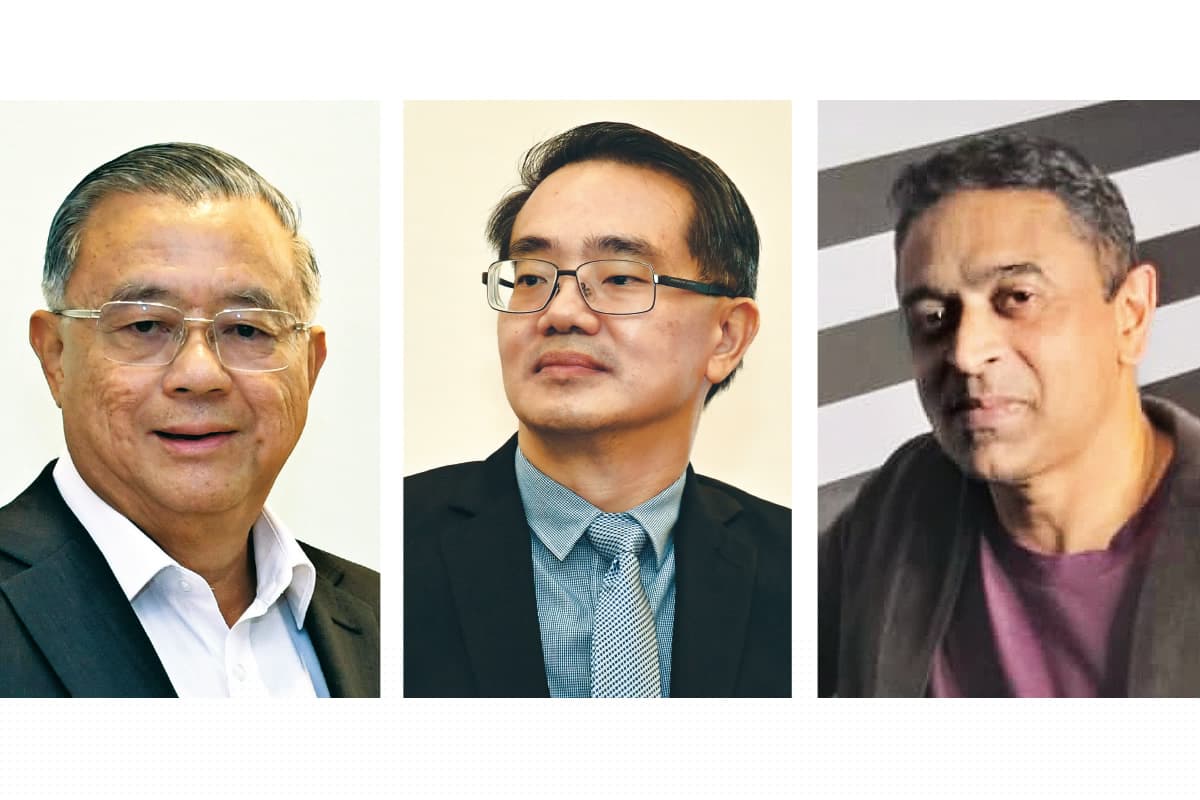

Retail Group Malaysia (RGM) managing director Tan Hai Hsin says an estimated 51,000 stores, or 15% of the country’s total retail supply, are expected to cease operations between March 18, when the Movement Control Order (MCO) was imposed, and January 2021.

Closures are expected to accelerate from October and peak in January 2021, following the end of the six-month banking loan moratorium on Sept 30.

The second Conditional MCO (CMCO) imposed on several states, including Kuala Lumpur and Selangor, will also hasten the closure of stores, particularly those located in the Klang Valley, he says.

Malaysia Shopping Mall Association (PPK) says mall vacancies, which stood at 13% in the first quarter of 2020, are projected to reach between 20% and 30% by 2Q2021, and will worsen if any anchor tenant leaves.

As retail businesses close, jobs too are lost.

The retail industry employs 1.55 million people, says PPK. The number of employees at retail outlets within malls plus mall management staff account for 452,000 people, of whom 68,000 have been let go.

Still, there is light at the end of the tunnel.

Retail industry to recover in 2021

RGM expects the retail industry to turn around next year, growing at a forecast 4.9%, which would bring RM95 billion in total retail sales. All retail sub-sectors — fashion, department stores or grocery — are expected to rebound.

However, he cautions that because the Klang Valley is a critical retail market, accounting for 60% of the country’s retail sales, any restriction on inter-district and inter-state travel may derail the recovery.

RGM data includes fashion, optical, hardware, and food and beverage (F&B) retailers. Big-ticket items such as cars and houses, and service providers like cinemas and hair salons, are excluded. Retail purchases via mobile phones or computers are included only if the shopping site is operated by a brick-and-mortar store.

Separately, data from Euromonitor International estimates that online shopping will surge by 50% to RM16.68 billion this year from RM11.17 billion in 2019. In 2021, it is forecast to reach RM21.35 billion in sales.

Retailers suffered due to prolonged lockdowns and confusing SOPs.

Recounting the earlier part of 2020, Tan says retailers were not expecting non-essential stores to close completely for six weeks from March 18. He describes the pandemic as a black swan, and that it has taught retailers anything can happen at any time due to circumstances beyond one’s control.

“Having a crisis management system and always maintaining a financial reserve of up to one year are critical measures for long-term survival of a retail business,” he adds.

PPK president Tan Sri Teo Chiang Kok tells The Edge that the pandemic came without warning and caused a catastrophe like no other for shopping malls and the entire economy.

While lockdowns and standard operating procedures (SOPs) were implemented with the objective of controlling infections, they also caused paranoia and fear, which led to a plunge in shopping footfall and turnover.

Adding to that difficult period was a series of ever-changing SOPs, which constricted normal retail businesses, limited sales for the F&B sector, and completely closed entertainment outlets for almost nine months.

He points out that the imposition of the various MCOs made things worse as it eroded whatever retained reserves and funds retailers had. This resulted in an increase in closures, delaying business recovery and making it harder to survive.

According to him, footfall at shopping malls had returned to 70% of pre-MCO levels since July. However, the state-wide CMCO, which was reimposed in October in all states except for Perlis, Pahang and Kelantan, led to a drop in shopper traffic of between 10% and 25%.

Teo says whatever progress in recovery the shopping centres have seen has been derailed by the recent spike in Covid-19 cases, which led to an abrupt drop in footfall to 10%, before recovering recently to between 35% and 50%.

“Malls have earnestly complied with the conditions of the various MCOs and SOPs but due to different interpretations by the enforcement agencies, it has caused undue fear and panic among shoppers and negatively impacted footfall,” he laments.

“After collective representations from the retail and shopping mall industry to tweak and relax certain SOPs for more clarity and practicality recently, coupled with pre-festive shopping during the year-end, footfall has improved slightly to 60%,” Teo says. However, he is unsure whether this can be sustained.

How has retail changed?

Savills Malaysia associate director Murli Menon says while all retailers had been talking about preparing for online/e-commerce, most did not realise its true value, and the need to look at it as an integral part of offline retail and not as a separate business entity/profit centre, until the coronavirus came along. The pandemic also proved that e-commerce can cut across all demographics and age groups and that online business is applicable across all categories of products, from premium items to even homemade nasi lemak.

“It debunked some myths like “online does not apply to particular categories or segments of consumers”, Menon says.

Retailers, he notes, learnt to adapt and adjust to new norms pretty quickly, whether it was during a full or a partial lockdown, as they had no other alternative.

For RGM’s Tan, the local retail market continues to remain somewhat unpredictable.

He says any development — whether it is a fourth wave of Covid-19, another MCO, the collapse of the world economy, a change in the ruling political party, a general election or a new cluster in a major shopping mall — can influence the retail market.

And while Tan expects retailers in every state to regain growth momentum simultaneously in 2021, he does not expect any pent-up demand as many consumers have already resumed shopping at physical retail stores since the first CMCO on May 4.

Also, due to their reduced purchasing power, they are buying less. Still, Tan believes that “Malaysians have not stopped shopping and have not stopped visiting shopping centres”.

Murli disagrees. He expects to see pent-up demand next year, be it for travel, dining or retail.

“At the end of the day, retail offers that social experience that online cannot and hence, there is bound to be recovery and some amount of revenge shopping and dining. We already saw bursts of that each time restrictions were loosened.”

PPK’s Teo concurs. He, too, expects to see pent-up demand. He says once the situation improves, shoppers will return to malls, especially as they have become places to socialise.

One of the biggest retail industry changes Tan expects to see in 2021 is better integration of technologies. He emphasises that retailing today is omnichannel and that traditional retailers cannot rely solely on physical stores to grow. A retailer needs to offer both physical and online stores.

Operational changes made this year due to the pandemic are expected to continue in a post-Covid-19 world. “For retailers and F&B operators, selling goods through both online and physical stores will become a new norm,” Tan says. He anticipates that more manpower and investment will be spent on ensuring a smooth integration of technologies with bricks-and-mortar stores.

He also foresees a greater emphasis on F&B, dining and other services to entice shoppers.

“There is [a] need to integrate digital and online across all levels and all channels and individual touch points, rather than looking at it as an afterthought or as an add-on/incremental feature,” Murli says.

For Teo, he does not believe in a “new normal”. He says the current pattern of behaviour is due to the pandemic and once this is over, things should be “back to normal”.

“Malls are always evolving and adapting to changing expectations and new products, formats and offerings, and customer wants and demands. Already, the tenant mix has been changing significantly for the past years with more emphasis on entertainment and F&B offerings,” he observes.

Even though online shopping has been gaining traction, Teo does not expect it to replace physical retail stores, noting that shoppers visit them for the ambience, and to see and be seen. However, he acknowledges that in order to be sustainable in the long term, malls and retailers will need to integrate online with brick-and-mortar stores.

As such, he sees e-commerce serving as an add-on to the channels for shopping as malls have already been adapting to cater for, and complement, this new channel.

“More technology will be introduced — from more sophisticated computerised operations and building management to communicating with shoppers through social media and the introduction of more electronic-based interactions like e-wallet transactions,” he says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.