Do young Malaysians invest differently than their parents? Not really, according to Personal Wealth’s Young Investor Survey 2016.

Conducted between Nov 25 and Dec 5, the survey aimed to uncover the habits of Malaysians aged 40 and below when it comes to their investments, risk appetite and investing strategies.

While young Malaysians are taking on greater risks in investing compared with their parents, most of them still tend to gravitate towards traditional investments with long-term track records such as unit trusts, investment-linked insurance, capital-protected investment vehicles such as Amanah Saham Bumiputera (ASB) and Tabung Haji, and blue-chip stocks.

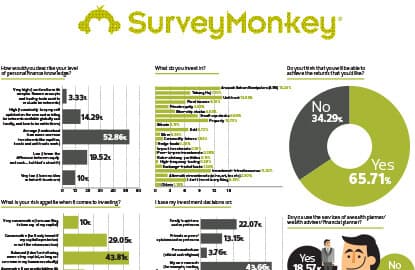

According to the survey, the top five investment types for the respondents are unit trusts (13.71%), ASB (13.32%), investment-linked insurance (11.39%) and properties (10.81%).

Other investments and vehicles are fixed income, private equity, small-cap stocks, bitcoin, gold, silver, commodity futures, hedge funds, robo-advisory portfolios, high-frequency trading, exchange-traded funds (ETFs) and alternative investments such as wine, art and tea.

The survey found that investment types differ according to age. The top three investment vehicles for those between 21 and 30 are ASB, unit trusts and investment-linked insurance. In the 31-to-35 age group, the respondents have invested in unit trusts (16.28%), properties (11.05%) and investment-linked insurance (12.21%). Meanwhile, for those aged 36 to 40, the top three investments are unit trusts and properties (both at 13.39%) and investment-linked insurance (12.50%).

The respondents’ confidence in these capital-protected vehicles is reflected in their expectation of returns. Some 44.76% of the respondents said they will be happy with returns of 5% to 10% for 2017, followed by a significant 28.10% who said they will be happy with 10% to 20% returns. When asked if they thought they would achieve the expected returns, 65.71% of them said yes.

The respondents, who were mostly in the 26-to-30 age group (47.37%), considered themselves as having either average or low level of financial knowledge.

Slightly over half (51.49%) of them classified their knowledge of personal finance as average: they understand common investments such as equities, bonds and unit trusts. About one-fifth of the respondents (20.15%) classified themselves as having a low level of personal finance knowledge: they know the difference between equities and cash and not much else.

Hence, it is unsurprising that in terms of making decisions, most of the respondents said that they rely on their own research (44.66%). The rest look to the opinions of family and friends (22.07%) and friends or peers’ opinion and experience (13.15%), as well as risk versus return calculation (10.33%). Only 5.63% have sought the advice of a financial planner.

It is interesting to note that although 81.43% of the respondents did not have a financial planner, 61.90% believed that it is necessary to use the services of one.

As with many survey reports, our survey found that Malaysian youth want greater control in growing their wealth. A large number of the respondents (45.71%) indicated that they would prefer to use a financial planner as well as a web-based wealth management app as the combination would provide flexibility and versatility, enabling them to consult an expert to gain an overall view of their investment choices and performance and be updated immediately on their investments.

However, 20.48% of the respondents preferred to have a financial planner as they did not have the time or the financial knowledge to manage their own investments.

We asked the respondents for their investment horizons: 40.48% invest for the medium term (5 to 10 years), 30.48% invest for the long term (more than 10 years) and 29.05% invest for the short term (less than 10 years).

The justification for their investment timeframes range from “do not have enough funds to hold for that period of time”, “need [additional] money to cover expenses” to “not willing to wait”.

Significantly, 82.44% of the respondents believed that they manage their wealth differently than their parents. But interestingly, they said that the best financial advice they have received were from family and friends. The common themes of the advice received range from “need to constantly save”, “diversify investments”, “buy properties” to “avoid taking loans to invest”.

Nevertheless, in terms of discipline, only 6.72% of the respondents are able to invest more than 30% of their monthly income while the majority (44.78%) are only able to allocate 5% or less of their monthly income.

Using SurveyMonkey, the survey was conducted in three languages — English, Bahasa Malaysia and Mandarin. Of the 210 respondents, 50.75% were male. The majority of the respondents (49.55%) earn RM4,001 to RM6,000 a month. Only 0.89% earn RM8,001 to RM10,000 a month.

What is the best financial advice that you have received, and from whom?

Don't judge the price, judge the return. – From a seminar

My mother advised me to avoid borrowing money. This is not in terms of mortgage or car loans, of course. She told me not to compromise relationships with friends and family by borrowing money from them. She told me to ensure that I live within my means so that I can eliminate the need to borrow.

From a property developer: Don't buy what I am selling (new terraced houses) because a person your age should go for secondary-market properties where you can generate rental income as soon as possible.

Be fearful when others are greedy and greedy when others are fearful. — Warren Buffett

Your wealth is not that of your parents. It should be your own, from your hard work. — My grandfather

Listen to the opinion of the oldest and most experienced people. Identify the expenses that can be reduced when you are young and learn how to spend wisely. Be more frugal, save your money and invest in the right asset classes. It will make your life harder at first, but things will be better at a later stage.

Rule No 1: Don't lose money. Rule No 2: Don't forget Rule No 1.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.