Oriental Food Industries Holdings Bhd (-ve)

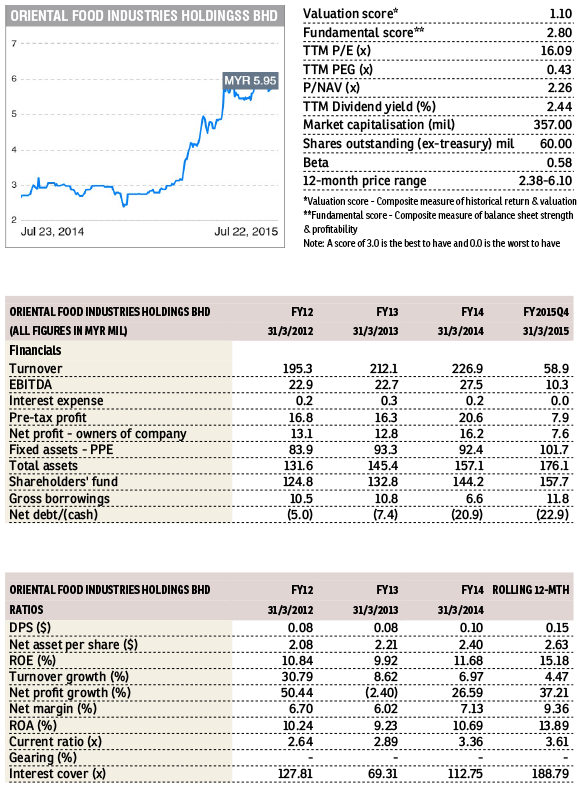

OFI (Fundamental: 2.8/3, Valuation: 1.1/3) was first recommended by InsiderAsia on October 23, 2014.

Its share price has since risen by a whopping 125.3% to close at RM6.05 yesterday.

It has done well financially. For FYMar2015, sales rose 4.5% to RM237.0 million while net profit surged 37.2% to RM22.2 million, lifted by higher export sales and foreign exchange gain. Export accounted for 54.8% of its sales in FY2015.

Sentiment was also likely buoyed by its proposed 1-for-1 bonus issue and 2-for-1 share split — expected to be completed by 3Q2015.

Nevertheless, valuations have risen with trailing P/E now at 16.1 times. By comparison, peers London Biscuits and Apollo Food Holdings are trading at P/E of 10.9 times and 14.7 times, respectively.

To recap, OFI is a leading snack food and confectionery manufacturer, producing a wide range of snack food products including potato and corn chips, wafers and bakery products. Its notable brand names include Super Ring, Rota, Jacker and Oriental.

This article first appeared in The Edge Financial Daily, on July 24, 2015.