This article first appeared in The Edge Malaysia Weekly on October 14, 2019 - October 20, 2019

BUDGET 2020 is modestly expansionary, if one were to exclude the bulky one-off items that caused a sharp year-on-year fall in both the government’s projected revenue and operating expenditure next year. Yet, even whether to make the exclusions is debatable, but more about this later.

When Budget 2019 was tabled last November, there was a clear RM37 billion consumption boost for the economy this year as the new Pakatan Harapan government tapped national oil company Petroliam Nasional Bhd (Petronas) for RM30 billion in special dividends to make Goods and Services Tax (GST) refunds of RM19 billion and return RM18 billion excess income tax owed to people and businesses by the previous administration.

That RM37 billion consumption boost was about 2.4% of gross domestic product (GDP) for 2019. The RM30 billion special dividend — on top of the RM24 billion normal dividend for 2019 — caused Petronas’ credit rating to slip to one notch above Malaysia’s sovereign rating (it was two notches higher before) even though the sum was one that the oil giant could afford, the government said. Petronas is only tapped for RM24 billion for Budget 2020 versus RM54 billion for Budget 2019.

Excluding the RM30 billion Petronas special dividend from the government’s 2019 revenue and RM37 billion one-off tax refunds from its operating expenditure (opex) makes sense when it comes to gauging the year-on-year changes in the federal government’s so-called usual spending for 2020.

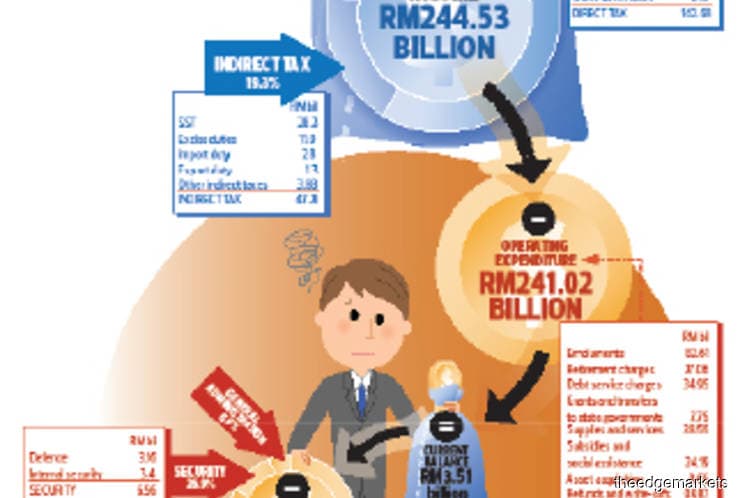

Federal government opex of RM241.02 billion for 2020 would be RM15.76 billion or 7% higher year on year from the normalised 2019 revenue of RM225.26 billion.

The headline figures would show an 8.1% year-on-year decline in opex for 2020, if one were to ignore the one-off items instead of normalising them by excluding RM37 billion refunds from the 2019 headline opex of RM262.26 billion.

At the same time, there is no denying the year-on-year loss of consumption boost, which, some argue, overshadows the expansionary spending planned for next year.

Still, as the RM37 billion tax refunds were not paid out in one go, one could well see the economy getting some consumption lift in the second half of 2019 and boosting expenditure in 2020, especially when the right carrots are dangled by policymakers, an observer notes.

As at end-August, RM15.2 billion (66.4% of the RM19 billion allocation) had been paid for GST claims while RM12.5 billion (69.4% of RM18 billion allocated for) in income tax refunds had been paid, according to the Fiscal Outlook and Federal Government Revenue Estimates 2020 (FOR2020).

Malaysia’s economy is expected to grow “at a respectable rate of 4.7% in 2019” and “rise at a faster pace of 4.8% [next year], backed by strong fundamentals that include strong and trustworthy public institutions, a healthy labour market, low and stable inflation, comfortable current account surplus, and a well-diversified economy,” Finance Minister Lim Guan Eng wrote in the Economic Outlook 2020 report (EOR2020).

The global economy, meanwhile, is expected to grow 3.5% in 2020, up from 3.2% in 2019, according to the International Monetary Fund’s projection in July, which also noted that risks to forecasts are mainly to the downside. These include unresolved US-China trade and technology tensions damping investments, mounting disinflationary pressures and constraints in monetary policy to counter downturns. The last is no thanks to the strange zero-rate world, which brings to the forefront the need for highly effective fiscal policy.

“It is essential for the government to manage its fiscal policy effectively by finding the balance between supporting economic growth and keeping all of its debt and liabilities on a sustainable path. Resources are limited and any allocation should be optimised according to socioeconomic priorities while maintaining a comfortable fiscal space,” Prime Minister Tun Dr Mahathir Mohamad said in the foreword of FOR2020.

To expand fiscal flexibility, the government says it is optimising expenditure, looking at measures to improve its revenue base and exploring new sources of sustainable revenue. It is also ensuring effective implementation of various fiscal measures to address issues related to public finances. It is understood that further specific measures will be announced in due course.

“The announcement on the formation of legislation related to fiscal responsibility and government procurement will further enhance the credibility and accountability of public finances. Furthermore, the government will be fully converting to accrual-based accounting by 2021 for a more transparent disclosure of its debt and liabilities. These initiatives, coupled with good governance, will create new fiscal space for countercyclical measures, if it is necessary,” Mahathir adds in the foreword.

The additional fiscal space will prove handy, whether or not global economic conditions turn out to be worse than expected.

“Countercyclical fiscal policy has a greater role to play in economic stabilisation today,” says Prof Jomo Kwame Sundaram, a prominent economist and member of the Economic Action Council. He notes how research has shown how recession deepens when governments (the public sector) go into austerity mode or spend less during downturns.

“Fiscal consolidation can and should be delayed under such circumstances [where monetary policy options are inadequate],” he tells The Edge.

He calls for fiscal spending that would put money into people’s pockets to counter the decline in aggregate demand and be a buffer during economic downturns. He also supports targeted spending that lays stronger foundations in human capital and infrastructure upgrades necessary for the country’s future growth.

The fiscal deficit for 2020 of 3.2% of GDP — the lower end of the 3.2% to 3.5% of GDP expected by economists — leaves room for countercyclical measures, if required.

As expected, the 3.2% is higher than the guidance of 3% pencilled in Budget 2019 but Socio-Economic Research Centre (SERC) executive director Lee Heng Guie reckons that the deviation is “acceptable to allow for some targeted expansionary spending to safeguard the domestic economy against the high risk of a bigger global economic slowdown”.

Calling Budget 2020 “an expansionary yet responsible budget for sustaining economic growth, job creation, lifting productivity through reskilling and upskilling as well as enhancing competitiveness”, Lee does not expect rating agencies to downgrade Malaysia, given that the government remains committed to meeting the medium-term fiscal framework (MTFF) for fiscal consolidation.

In absolute terms, the 3.2% or RM51.72 billion deficit — or the extra amount spent using debt on top of the government’s revenue — expected for 2020 is slightly smaller than the RM51.76 billion revised estimate for 2019 and RM52.08 billion originally forecast for 2019 when the national budget was tabled last November.

Pushing the deficit to 3.5% of GDP would provide an additional RM4.85 billion spending for so-called additional pump-priming to prop up growth should economic conditions call for it next year, a back-of-the-envelope calculation shows.

That is, provided GDP does not slide. That would be enough to roughly double the RM5 billion allocated for Bantuan Sara Hidup (BSH) for 2020 that is expected to benefit 3.6 million households, for instance.

Incidentally, subsidies spending is already higher year on year at RM24.19 billion for 2020, up 2.62% from the RM23.57 billion revised estimate for 2019 but lower than the RM27.52 billion actually spent in 2018.

It is understood that the potential savings from the implementation of targeted fuel subsidies system from Jan 1, 2020, in Peninsular Malaysia have not been taken into account in the subsidies amount for 2020 as the savings are expected to be gradual. The plan is to ease consumers into the new system, a government official says.

No stupid spending

Any increase in public spending needs to be carefully targeted, given Malaysia’s huge debt burden. (See box on debt and debt service charges)

As seen with Malaysia’s 22 years of budget deficit during both boom and downward cycles since 1998, fiscal policy needs to be applied correctly to benefit the country and its people.

Jomo, for one, is against putting public money into buying over assets that do not enhance the country’s economic capabilities or output. Neither can Malaysia afford to put money and limited resources into poorly conceived public and industrial policies, he adds.

Of the various opex items, one positive surprise came from debt service charges. Although the expenditure remains high at RM33 billion for 2019 and is expected to rise further by 5.9% year on year to RM34.95 billion in 2020, the expected increase is already below the year-on-year jump of 8.03% estimated for this year versus RM30.55 billion in 2018.

The weighted average interest rate on outstanding market debt instruments as at end-June stood at 3.848%, lower than 4.106% in 2018. This is largely due to lower average coupon rates for debt paper issued during the first half of 2019, due to the favourable low interest rate environment, high liquidity and increased investor confidence, the FOR2020 report says.

The report also says there are 1.4 million civil servants and 874,000 pensioners and beneficiaries, lower than the previous headline civil service number of 1.6 million and 853,000 pensioners. It is not immediately certain whether this is because some civil servants have been converted into contract workers as well those who have retired.

Expenditure for public sector emoluments and pension totals RM109.67 billion for 2020, making up 44.85% of government revenue, compared with 46.55% in 2019.

As debt service charges are 14.3%, these three opex items (emoluments + pension + debt service charges) will take up 59.1 sen of every ringgit the government earns in 2020 — albeit slightly lower than the 60.7 sen of expenditure on every ringgit earned, based on 2019 revised estimates.

“About 75% of retirement charges comprise monthly pension payments for about 874,000 pensioners and beneficiaries. In view of the escalating pension commitment and concerns over the sustainability of the present scheme, the government is exploring options for a more robust scheme to efficiently manage future pension obligations,” says the EOR2020 report.

The remaining opex for retirement charges consists of gratuities for civil service pensioners as well as cash compensation in lieu of leave not taken, according to the details of the government’s 2019 expenditure estimates. (For details, read The Edge, Issue 1287, Oct 7)

In total, the planned opex of RM262.26 billion for 2020 is 81.15% of the total budget with development expenditure making up the remaining 18.85%. The absolute amount of development expenditure is higher year on year at RM56 billion for 2020 compared with the revised estimate of RM53.7 billion for 2019. This is mainly to accelerate implementation of programmes and projects in support of growth momentum and strengthening the long-term capacity of the economy.

In 2020, development expenditure will be channelled towards promoting economic development, bridging the urban-rural infrastructure gap and enhancing the living standards of the people. Of the RM56 billion for development expenditure, RM53.2 billion will be a direct allocation for 4,744 ongoing projects while RM2.8 billion will be for 722 new projects.

The government also says it will channel its allocation to strengthen capital formation towards ensuring long-term growth sustainability. “In this regard, an additional injection of 0.2% of GDP is allocated through development expenditure to accelerate the implementation of projects with strategic and high-multiplier impact such as construction of railways and roads, upgrading of schools, clinics and water treatment plants as well as improving the suburban broadband infrastructure. These preemptive measures are expected to sustain the growth momentum and expand the economic capability, thus improving the well-being of the people,” the EOR2020 report reads.

The government needs to clearly define how it plans to execute the structural reforms necessary to take Malaysia forward, what it is prepared to invest and how it will reward people and businesses who work with it to achieve the goal of making Malaysia an Asian Tiger again and its society one that has prosperity to share.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.