This article first appeared in The Edge Malaysia Weekly on June 3, 2019 - June 9, 2019

THE inclusion of Malaysia on the updated currency watch list of the US Treasury is not expected to have a direct impact on the country. However, any potential impact would likely be the result of market concerns over additional external uncertainties, economists say.

Last week, the US Department of Treasury Office of International Affairs published its currency report that included Malaysia on its “monitoring list”, which calls for close attention to currency practices and macroeconomic policies.

Malaysia was not the only country on the updated list — it also included China, Japan, South Korea, Germany, Italy, Ireland, Singapore and Vietnam.

Maybank Investment Bank Research group chief economist Suhaimi Ilias does not see the US Treasury comments on Malaysia as “threatening”.

One of the reasons the country is on the list is that the threshold for the current account surplus to gross domestic product ratio has been lowered to 2% from 3% previously.

“It is important to stress that Malaysia is only on the watch list and has not been officially branded as a currency manipulator. It is unlikely that there will be any real impact since the other countries have been on the watch list for quite some time without any action being taken.

“Being on the watch list means that the US will enhance monitoring and engagement with the authorities. At this juncture, the impact is likely to be market concerns over the additional layer of external uncertainty,” Suhaimi says.

He adds that as far as additional external uncertainty is concerned, it is important to keep a watch on a proposal by the US Department of Commerce to impose countervailing duties on countries that are deemed to have deliberately undervalued their currencies to benefit or subsidise their exports. “It is [still] unclear how the benefit or subsidy is defined as no specific criteria were identified for evaluation, pending a consultation process and feedback. The question is also whether the US Treasury report, released after the Department of Commerce announcement of the countervailing duties proposal, will have a bearing.”

For a country to be placed on the monitoring list, says UOB (M) Bhd economist Julia Goh, it means that it has met two of three criteria: (i) A significant bilateral trade surplus with the US of at least US$20 billion or 0.1% of US GDP; (ii) A current account surplus of at least 2% of GDP; and (iii) persistent, one-sided intervention occurs when the net purchases of foreign currency are conducted repeatedly in at least 6 out of 12 months, and these net purchases total 2% of GDP over 12 months.

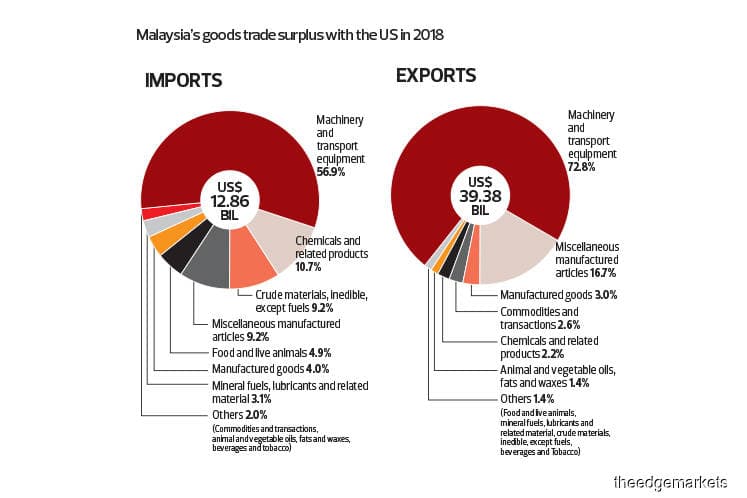

Malaysia meets the first two criteria. Its trade surplus with the US as at end-2018 stood at US$26.5 billion, an increase of US$2 billion from the previous year. The current account surplus stood at 2.1% of GDP as at end-2018.

The largest goods exports to the US were electrical machinery, optical and medical instruments, rubber and furniture while the largest imports from the US were electrical machinery, aircraft, optical and medical instruments and plastics.

Goh does not think the situation warrants any action by the US Treasury given that Malaysia only meets two out of the three criteria.

“We do not think that this should warrant further action ... to label Malaysia a currency manipulator in its next report in November/December. This is premised on Malaysia meeting only two of the three criteria. The US Treasury also acknowledges Malaysia’s narrowing current account surplus over the past decade and its external rebalancing in recent years, and encourages further measures to support this trend,” she says.

The report also points out that the International Monetary Fund’s most recent assessment estimated the ringgit to be 3% to 7% weaker in real effective terms relative to its fundamentals and desirable policies.

Suhaimi says the undervalued ringgit is not a result of deliberate policy while the economic fundamentals look fine.

“If we take the US Treasury estimate of 3% to 7% ‘undervaluation’ at face value, then USD/MYR should be around 4.07 to 3.92, which is the range USD/MYR has been trading (at) before, and not long ago.

“There are specific factors for the ringgit’s weakness or undervaluation, especially the sustained net foreign selling of Malaysian equities amounting to RM4.9 billion from January to May (2018: RM11.9 billion) and bonds of RM4.7 billion over the same period (2018: RM21.8 billion),” he says.

Goh says any ringgit weakness in the near term is more likely due to trade uncertainty as the US considers imposing further tariffs on China’s exports to the US in addition to the Huawei ban. Other looming US actions could also affect changes in the global electronics supply chain.

After the US Treasury report was released, Bank Negara Malaysia was quick to respond, emphasising that the country “supports free and fair trade and does not practise unfair currency practices”.

The central bank also said the ringgit exchange rate depends on market forces and is not relied upon for export competitiveness.

“As acknowledged by the report, Bank Negara intervention over the last few years has been in both directions of the foreign exchange market.

“Any intervention is limited to ensuring an orderly market and avoiding excessive volatility of the exchange rate that may affect macroeconomic stability. The fact that the ringgit has over the years faced multiple episodes of significant appreciation and depreciation points to the flexibility of the exchange rate,” the central bank said in its press statement.

Bank Negara reiterated that the local economy remains resilient, underpinned by strong economic fundamentals, and that there will be no consequences for the economy from Malaysia’s inclusion on the monitoring list.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.