This article first appeared in Personal Wealth, The Edge Malaysia Weekly on June 10, 2019 - June 16, 2019

Mukesh Pilania lost his uncle unexpectedly a few years ago. As a result, the family struggled to support themselves and relied on the money left by his uncle in fixed deposits and unit trust funds.

But it was not enough. As someone who worked in the insurance industry, Mukesh asked the family to check whether his uncle had bought a life insurance policy.

It turned out that the family did not know whether he had done so. After checking, they discovered that he had a policy and tried to make a claim, but failed to do so. They learnt that his uncle, who was known as an organised and astute man, began to lose his memory years ago and forgot to pay his premiums. As a result, the life insurance policy was declared inactive by the insurer.

“Then I thought, this cannot be a one-off case. So, I did some research and found that this was a common problem in our society,” says Pilania, who was born and raised in India.

He did further research and discovered that the topic of insurance itself was widely considered a taboo and rarely discussed even among family members. As a result, many were unaware of the policies their loved ones had bought until it was too late.

In India, more than US$2 billion worth of insurance money remained unclaimed as at July last year. In Malaysia, unclaimed insurance and takaful benefits stand at more than RM300 million, according to Bank Negara Malaysia’s Financial Stability and Payment Systems Report 2018.

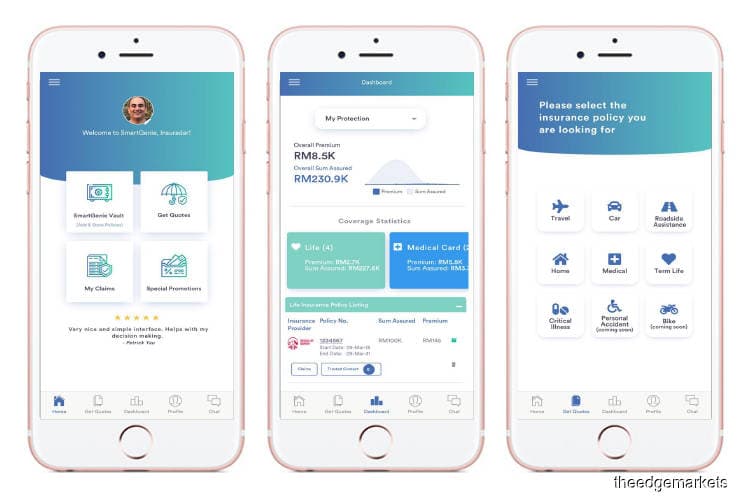

This, along with other factors, led Pilania to develop SmartGenie in the first quarter of last year. The technology-powered app is “not just for digitising insurance policies but also providing a digital vault to prevent future cases of unclaimed insurance money”, he says.

SmartGenie’s core function is Smart Vault, a digital vault that allows users to store insurance policies. They can upload their own policies as well as those of their family members. The app will prompt users to pay their premiums before the due date specified in their policies. It will continue to remind users daily to make their payments until they click on the “paid” button.

The vault allows users to assign a trusted contact, who will be notified of the existence of their policies should the app remain inactive for a period of time. The time frame is determined by the users themselves. The contact does not need to be a nominee in the policy.

The idea is to make your loved ones aware of the existence of the policies, says Pilania. “For example, if you set a time frame of six months, you are telling the app to notify your trusted contact that this policy exists and to assume that something has gone wrong.

“As for previously unclaimed insurance money, users will have to enquire with the Accountant-General’s office. But we are [trying to ensure] that people do not face this problem again.”

Pilania started working on the app early last year and launched it in March. A lot more features will be added in the future, he says.

His company currently has 15 people working on SmartGenie. The team has expertise in artificial intelligence, machine learning, digital web development, user experience design and user interface design.

SmartGenie currently has four functions — Smart Vault, Smart Analysis, Smart Buy and Smart Claim. Smart Analysis is a protection-gap analysis of the policies the user uploads using the app. If there are any coverage gaps, the user will be notified. Smart Buy allows users to make in-app purchases of products while Smart Claim provides users with the specific information needed to make a claim for the policies they have.

“For Smart Buy and Smart Claim, the app currently takes you to the insurer’s website, with the relevant details to complete the process. However, the next step is to seamlessly integrate it with the insurers’ systems,” says Pilania.

“We are a bridge between the customer and the insurance company. We do not want to be a financial adviser but a technology platform that enables the digitisation of insurance policies. We are also looking to offer SmartGenie to existing intermediaries such as financial advisers and brokers so they can provide this as a service to their customers.”

SmartGenie adheres to the Personal Data Protection Act and has implemented bank-level security measures. But it is looking forward to the implementation of Bank Negara’s Open API (application programming interface) guidelines, which will allow for better integration between the user, the app and banks.

Pilania emphasises that data security and privacy remains the company’s top priority, especially when establishing a vault service with sensitive information. SmartGenie has a two-factor authentication process and 256-bit data encryption. It has also appointed an independent third-party IT security company to secure the users’ data.

“The insurance companies we approached were also concerned about security and recommended the external security company. All the data is hosted and stored in Malaysia and we have ensured bank-level security so that there are no phishing attacks,” says Pilania.

Disrupting the industry

Pilania has been in the insurance industry for 17 years, focusing on customer experience. That was why he wanted to create a user-centric product. With the vast amount of digitalisation happening in the country, Malaysia has the right ecosystem for the company to test and launch the app, he says.

“Malaysia has the right population size for a start-up. The added value is that the country has high internet penetration, strong government support and a population that is digitally savvy. Bank Negara has also been actively pushing the digital movement and it helps that there have been regulatory changes such as the detariffication in the general insurance industry.”

Detariffication in the general insurance sector was implemented in phases beginning in July 2016. Before that, most insurers sold similar products at similar prices because of the tariffs in place. Following the detariffication, insurers are able to set their own prices based on the risk covered by each policy. The move also empowers users because it gives them freedom of choice, says Pilania.

“It completely changes the market dynamics because customers get to select not only the brand but also the coverage and price points. The value proposition comes into the picture and this is a huge opportunity for players to come in and help the customer make that decision,” he adds.

Since the launch of the app, Pilania has received encouraging feedback from industry players here. However, the penetration rate of digital insurance remains abysmally low in the country. Those who have been more open to such products are millennials aged between 25 and 40, who want products to be simple, transparent and trustworthy.

“Millennials are a much more demanding generation. They want control [over their policies] and to get things fast, simple, easy and affordable,” says Pilania.

“But we need to look at things positively because there is a strong push by the regulator and government to move things digitally to increase insurance penetration in the market. Realistically, one of the ways to do so is by going digital because it allows you to reach the last-mile customer seamlessly and in a much more cost-efficient way, making things easy, transparent and simple for customers to understand.”

He believes that SmartGenie fits right into the digital insurance market as it can help with the marketing and advertising of policies to the public. “There is digital awareness and awareness of the need for insurance, but the expectation gap needs to be filled by the right bite-sized products that can be bought online. But right now, at the very least, people should be made aware that it is available online in the first place,” he says.

The five insurers currently working with SmartGenie are AXA Affin Life, AXA Affin General Insurance, Allianz Life, Allianz General Insurance and Berjaya Sompo General Insurance. The company is also in discussions with other industry players.

Currently, users can purchase travel, car and roadside assistance, home, medical, term life and critical illness insurance policies. The app will offer personal accident and bicycle insurance policies in the near future.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.