Sime Darby Bhd

(May 25, RM8.53)

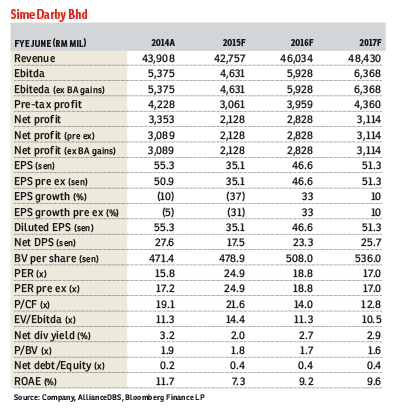

Maintain hold with lower target price (TP) of RM8.85 from RM9.20 previously: Sime Darby reported third quarter ended March (3QFY15) earnings of RM386 million, down 55% year-on-year (y-o-y) and 18% quarter-on-quarter (q-o-q), below our and consensus expectations.

This brought cumulative nine-month FY15 earnings to RM1.324 billion, a 39% y-o-y decline, representing 54% of our initial FY15 earnings forecast.

Disappointing contributions were apparent across most segments — plantations, industrial and motor. These were partly mitigated by a higher contribution from the property segment, while associates and joint venture as well as the “other business” segment contributed losses.

For 3Q, Sime Darby also booked RM228.1 million in net foreign exchange gains arising from settlement of inter-company loans.

As at end-March this year, the group’s net debt-to-total equity ratio stood at 47.1%, which was elevated relative to its historical level of 18% to 31%.

Debts expanded significantly by RM5 billion as a result of its acquisition of New Britain Palm Oil Ltd (NBPOL).

We understand Sime Darby has implemented strict controls on capital expenditure by prioritising spending and cost containment measures.

Imputing NBPOL’s hectarage and production, lower fresh fruit bunch (FFB) yield and higher contribution from the property segment, as well as lower margins in the industrial and motor divisions, we cut FY15 earnings by 13% and FY16’s by 6%.

Our TP is likewise reduced to RM8.85 per share, based on sum-of-parts methodology and discounted cash flow for plantations. We maintain our calendar year 2015 crude palm oil price forecast of RM2,400 for now.

We anticipate 4QFY15 earnings to rebound on a seasonal uptick in FFB output, lower plantations cost and higher property and NBPOL contributions. — AllianceDBS Research, May 25

This article first appeared in The Edge Financial Daily, on May 26, 2015.