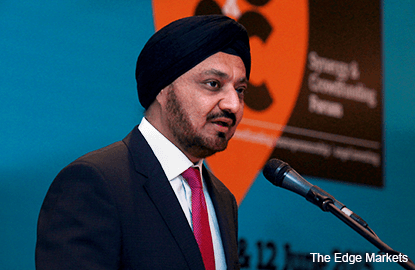

KUALA LUMPUR (Sept 3): Securities Commission (SC) chairman Datuk Ranjit Singh believes that Malaysian shares will "pick up" despite the recent selldown of ringgit-denominated assets, due to political uncertainty and a depreciating currency.

Ranjit said fund managers indicated the country had strong financial and capital markets. He was speaking to reporters on the sidelines of the World Capital Market Symposium here today.

"Most fund managers we spoke to this morning acknowledge that Malaysia has built a very strong financial and capital market system," he said.

Ranjit's comments came at a time when the ringgit had depreciated to fresh levels against major currencies, after China devalued the yuan and cut interest rates. The ringgit, which tracks crude oil prices, also weakened in anticipation of US rate hikes this year.

On Aug 26 this year, the ringgit weakened to a new point against the US dollar, at 4.2995. Compared to the Singapore dollar, the ringgit depreciated to a fresh level at 3.0563.

Today, the ringgit changed hands against the US dollar at 4.2325. Compared to the Singapore currency, the ringgit was traded at 2.9865.

The FBM KLCI have fallen significantly before rebounding to current levels. The KLCI closed at a one-year low at 1,532.14 points on Aug 24 this year, compared to a high at 1,874.12 on Sept 9, 2014.

Today, the KLCI rose 12.67 points or 0.8% at 12:30pm to settle at 1,602.86.

Besides external factors, current ringgit and local share-trade dynamics come amid investigations on government-owned 1Malaysia Development Berhad (1MDB).

Reuters, quoting Swiss authorities, reported yesterday (Sept 2) that they had frozen funds in Swiss banks, amid investigations of Malaysia's troubled state investment fund 1MDB, on suspicion of corruption and money laundering.

In Malaysia, 1MDB noted the report and said in a statement: "As far as 1MDB is aware, none of the company's bank accounts have been frozen. 1MDB is in the process of developing a better understanding of the on-going investigations in Switzerland, so the company can cooperate to its fullest extent."