This article first appeared in The Edge Malaysia Weekly, on November 9 - November 15, 2015.

LAST Wednesday, oil and gas outfit SapuraKencana Petroleum Bhd announced that it had received the green light from Petroliam Nasional Bhd (Petronas) for a field development plan (FDP) for the SK310 B15 gas project off Sarawak.

The announcement, however, did not have the expected impact on the stock, which shed seven sen to close at RM2.19 last Thursday.

Naturally, SapuraKencana will not see any contribution from the development of the gas field in the near term, but it is likely to become a fresh recurring income source for the group in two years.

The share price had in fact rebounded from a historical low of RM1.47 recorded on Aug 25, gaining more than 50% — that is until last Thursday — possibly buoyed by the impending news of the FDP.

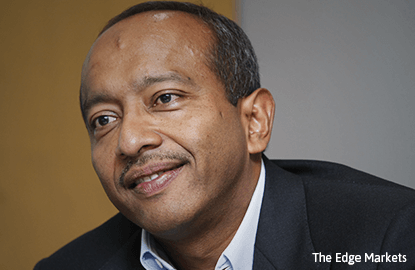

President and CEO Tan Sri Shahril Shamsuddin tells The Edge: “This is a significant milestone as we will begin the monetisation of the seven gas discoveries we have to date off Sarawak. First gas is expected to flow in the final quarter of 2017 and we will see healthy cash contributions over the life of this development.

“Looking ahead, given the discoveries and the ongoing exploration programme, SapuraKencana will be a strategic leader in the Malaysian liquefied natural gas business. We will have clear visibility of the cash flow once the development of these discoveries commences.”

The gas fields are a result of SapuraKencana acquiring Newfields Holding Inc’s Malaysian oil and gas assets for US$898 million early last year. Petronas had awarded Newfields, Mitsubishi and Petronas Carigali Sdn Bhd a production-sharing contract for Block SK310 off Sarawak in June 2008.

Newfields was appointed the operator of the block, which is located in water depths of between 50m and 100m in the Central Luconia Province, off Sarawak, and covers about 3,460 sq km.

“It [new gas field development] should be good with the supply of and demand for hydrocarbons reaching equilibrium in 18 to 24 months,” Shahril muses.

To recap, SapuraKencana has a 30% stake in the gas field while Petronas Carigali, the exploration arm of Petronas, owns 40%. The remaining 30% is held by Diamond Energy Sarawak Sdn Bhd, a subsidiary of Japan’s Mitsubishi Corp.

Besides the 30% of the profit it should rake in, SapuraKencana could also bag jobs for the development of the field. “Jobs will be tendered out for the project and not just us but everyone. SapuraKencana will have to be competitive,” Shahril says.

He is understandably tight-lipped, unwilling to divulge any details of the possible contracts the company is eyeing.

According to the company’s announcement to Bursa Malaysia, among the big-ticket items is a central processing platform (CPP) with a 35km gas evacuation pipeline that is tied to the existing infrastructure. SapuraKencana, of course, has the expertise in both the fabrication of CPPs and pipe laying.

Considering that the gas field is not that large, the CPP fabrication job should be worth a few hundred million US dollars while the pipe-laying contract, depending on a whole host of factors, could also come up to hundreds of millions of US dollars.

Should SapuraKencana win any of these jobs, that would add to its RM23 billion order book, comprising largely international transport and installation, and fabrication jobs in several parts of the world, including Brazil.

While Shahril would not comment on the likelihood of a gas sales agreement being concluded, Kenanga Investment Bank’s oil and gas analyst, Sean Lim, says: “We were guided that the gas sales agreement has a duration of 5.5 years and that the field is estimated to generate total Ebitda of US$83 million (US$25 million for SapuraKencana’s 30% stake) per annum for the field, assuming the field is able to ramp up to full production within three to six months of the commencement of operations at current oil prices.”

According to Lim, the field can produce 100 million standard cubic feet per day of hydrocarbon gas for Petronas LNG’s complex in Bintulu, Sarawak. While the selling price of gas at the point of production in 2018 is uncertain, at present, LNG is going for about US$3.60 per million British thermal units (mmbtu).

SapuraKencana, Petronas Carigali and Mitsubishi are expected to split the profits after deducting the cost of production, tax and royalties, among others.

An industry observer opines that with the locked-in gas sales agreement, there is limited risk for the three partners, but cautions that the earnings will only trickle in from 2018, which explains why there was no effect on SapuraKencana’s share price.

Says the oil and gas market watcher, “It [field development plan approval] will only start having an impact on SapuraKencana’s bottom line in 2018 as first gas delivery is likely to be in the fourth quarter of 2017.

“There are no earnings as yet, so there will be no impact [on the bottom line] until a few years, maybe three, from now and not many people factor in the three years ahead.”

She also says diversification into gas from just oil will add a new income stream to SapuraKencana, which augurs well for the company.

Like most oil and gas players, SapuraKencana has been adversely affected by soft crude oil prices, which have fallen off a high of US$110 per barrel in September 2013 to below US$50 per barrel now.

For its six months ended July 31, 2015, SapuraKencana registered a net profit of RM364.8 million from revenue of RM5.1 billion. It had cash amounting to RM1.8 billion, long-term debt commitments of RM9.5 billion and short-term borrowings of RM8.4 billion.

According to Kenanga’s Lim, the capital expenditure needed for the project is estimated at US$300 million, stretching up to the fourth quarter of 2017. He says SapuraKencana has already secured the funding for its 30% stake, which works out to US$90 million, through multi-currency facilities. This means there is no impact on the company’s gearing, which at present stands at about 1.3 times.

Lim maintains his “market perform” call on SapuraKencana and has revised his target price from RM2.04 to RM2.38, valuing the group at a target price-earnings ratio of 14 times to factor in better prospects from its gas project.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.