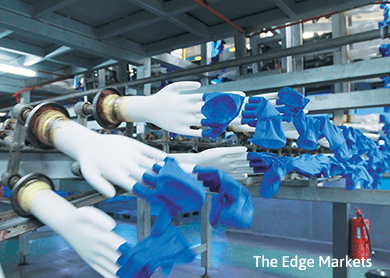

Rubber glove sector

Recommend overweight: Our rating is anchored by rising demand from advanced countries due to solid hygiene concerns, potential strengthening of the US dollar, the neutral impact of the goods and service tax, cost easing emanating from softness in global commodity price and robust capacity expansion by major rubber glove players.

However, we are concerned that our positive view may hit drawbacks due to stiff competition in the nitrile segment, hike in natural gas and electricity prices, and lower average selling price. Notwithstanding that, we continue to like Supermax Corp Bhd (Buy; target price (TP): RM2.30) for its Supermax Business Park with an estimate of 40 production lines and production capacity of 15.5 billion pieces per annum and diversifying its revenue stream into the contact lens business, with a profitable gross profit margin of up to 60%. We have a “hold” call on Hartalega Holdings Bhd, (TP: RM7.40), Top Glove Corp Bhd, (TP: RM5.61) and Kossan Rubber Industries Bhd, (TP: RM6.12).

Moving forward, the rubber glove sector remains bullish, moulded by capacity expansion as demand for gloves remains strong despite the drop in average selling price due to softening global commodity prices. Rubber prices are expected to be stable anchored by the collaboration of six countries, namely Malaysia, Thailand, Indonesia, Cambodia, Laos and Myanmar. — M&A Securities, June 12

This article first appeared in The Edge Financial Daily, on June 15, 2015.