This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on Dec 21 - 27, 2015.

Your golden years may be far away, but the time to begin strategising is now. Needs are evolving at a quicker pace and ideally, the methods to protect your nest egg should also change with time. How you plan and invest for wealth protection hinges on how emotionally, physically and mentally fit you are, especially with rising life expectancy. Maintaining a good social circle and learning new skills will not only help you stay intellectually stimulated but also age happily and healthily.

Is gold a good investment?

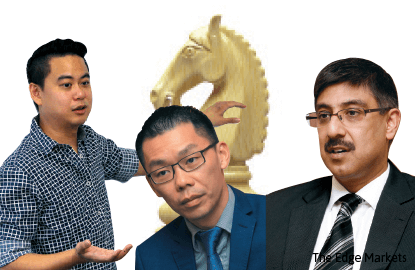

Gold is largely regarded as a tool to hedge inflation, but fund managers paint a gloomy view on holding this precious metal for retirement.

Manulife’s Chong says gold prices tend to rise when there is high inflation, but many parts of the world are suffering from deflation. The European Central Bank, for one, has been easing monetary policy to boost economic growth and end the deflation cycle. Japan is still struggling to revive its economy through Abenomics, and China’s growth is slowing — its inflation rate has been below 2% this year.

“If you are rich and you do your maths, you may say, ‘Okay, I can afford to have 5% of my assets in gold that may not yield any return. But it does not significantly hurt my overall assets’.”

StanChart’s Chang is succinct when he says gold is “priceless and worthless”. “It can be used as a global inflation hedge. But a person has to be extremely pessimistic for him to look at gold. We would use it more to trade than to keep in our portfolio,” he says, noting that gold prices remained flat between October 1987 and September 2013.

Devadason, however, has a slightly different view. He suggests including four precious metals to make up 5% to 8% of a retiree’s portfolio. These metals are gold, silver, platinum and palladium.

“I believe having this percentage is sufficient. Remember that there have been long periods when all precious metals fell. Many observers believe we have seen the end of the commodity super-cycle for this decade, at least,” he says.

Looking at other alternative asset classes, Knight Frank Luxury Investment says the 10-year return provided by classic cars from the fourth quarter of 2004 (4Q2004) to the fourth quarter of 2014 (4Q2014) was 487%. Its five-year and one-year performance was 140% and 16% respectively.

This is followed by art, wine, coins, stamps, jewellery and coloured diamonds, with a 10-year return of 252%, 234%, 232%, 195%, 168% and 167% respectively. The returns look attractive.

However, fund managers do not encourage retirees to look at alternative asset classes unless they are sophisticated investors. Chong says alternative investments normally should not exceed 10% of a sophisticated investor’s portfolio.

“These assets do not have liquidity, unlike stocks. If you want to buy stocks, you can. And if you need cash tomorrow, just call your broker and sell. Alternative assets are also very subjective. I might like the picture, but others may not,” he adds.

“If you want to invest in classic cars, paintings or whatever, it depends on whether you appreciate them. The first consideration is not to view them as an investment.”

StanChart says alternative asset classes should only comprise 5% to 10% of a client’s portfolio. Chang says alternative assets could have hidden costs. For instance, storage and insurance. It could be a strategic investment for retirees who are sophisticated investors, but not for others.

A straightforward and efficient way of saving for retirement is to retire at a later age. Briggite Miksa, head of international pensions at Allianz Asset Management AG, says a person could compound the pool of money accumulated over the years and shorten the retirement years effectively by working longer.

“If you retire early, the time you spend in retirement is longer. If you retire later, it is shorter. If your human capital is your main source of income and you are not very rich, then it is relevant for you to work longer.”

Miksa points out that a Malaysian worker close to retirement age today will have exhausted his assets in the first five years of retirement based on EPF data. A younger worker is advised to have an annual private savings rate of 13% to 18% under the current EPF framework.

However, the private saving rate would drop by extending a person’s working life by 5 to 10 years. “With retirement postponed by as little as five years, workers can afford to lower their annual savings rate to 9% and still achieve a replacement rate of 70% of final salary. Delaying retirement to age 65 allows for a savings rate of 3%,” she says, explaining that the replacement rate is the monthly income you get after retirement, as opposed to your last drawn salary.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.