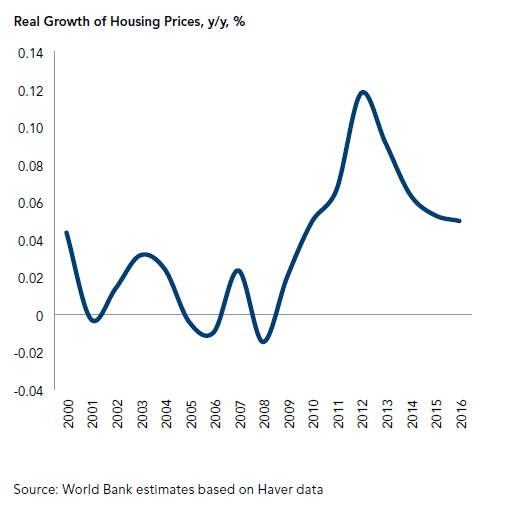

PETALING JAYA (Dec 19): The rapid rise of Malaysia’s real housing prices since 2008 could be a source of future instability, the World Bank said in a recent report.

“Increases in housing prices can relax borrowing constraints and allow existing homeowners to increase consumption, thereby boosting the economy. However, the rapid increase in prices creates incentives for the construction of new properties, which could potentially lead to a burst in prices and an abrupt adjustment to economic activity. This risk warrants close monitoring, especially since prices are still increasing, albeit at a lower rate,” according to the bank in its 17th Malaysia Economic Monitor, entitled “Turmoil to transformation: 20 years after the Asian financial crisis”.

The World Bank also noted that the higher cost of living, largely due to high food price inflation and the rising cost of housing, is disproportionately impacting lower-income earners, especially those in urban areas, as they spend more on these items.

Rising housing costs are attributable to a structural undersupply of housing in the lower end of the market, especially in the highly urbanised part of the country, it said.

“Concurrently, while the government has implemented a number of measures to address the structural undersupply of affordable housing by increasing new low-cost constructions, the rate of supply could be accelerated to bridge the immediate supply-demand gap,” it said.

This is especially crucial in addressing the high cost of living for the B40 group, to ensure that they enjoy real income gains, it added.

The Malaysia Economic Monitor series provides an analytical perspective on the policy challenges facing Malaysia. The series also represents an effort to reach out to a broad audience, including policymakers, private sector leaders, civil society and academia.