This article first appeared in Personal Wealth, The Edge Malaysia Weekly on September 9, 2019 - September 15, 2019

Loans backing acquisitions by private equity (PE) firms in Asia-Pacific ex-Japan have increased over the past year, according to early August data by financial services research firm Debtwire. According to the firm, loan-backed acquisitions have grown 46.5% year on year to US$10.41 billion so far this year, with much of the activity being driven by deals that targeted real estate and medical assets.

Loans for real-estate buyouts topped the overall volumes in the space, accounting for US$3.28 billion or about 31.2% of the total volume. Loans backing property-related acquisitions were also the largest by volume during the same period last year, accounting for 26.2% of the total.

Year to date, Hong Kong and Chinese properties captured the most attention from PE firms. Deals in this space included Gaw Capital Partners and Chinese tycoon Chen Chang Wei’s HK$15 billion joint acquisition of Cityplaza Towers Three and Four in Hong Kong. The assets, purchased from Swire Properties, were backed by a HK$9.9 billion loan.

In China, global private equity giant Partners Group purchased Dinghao Plaza in Beijing’s technology hub Zhongguancun from Sino Horizons for US$1.34 billion. The deal was partly funded by a US$673.6 million loan.

Loans backing medical-asset buyouts came in at US$2.42 billion year to date. This represented 23.1% of the region’s total, significantly higher than the 8.5% in the same period last year. The primary contributors were made up of Australian transactions. Brookfield Business Partners took hospital operator Healthscope private in an A$5.7 billion deal. The purchase was backed by an A$2.15 billion loan.

US-based financier TPG Capital conducted an A$970 privatisation of Australian veterinary-clinic operator Greencross, backed by an A$660 million loan. Navis Capital Partners made an A$700 million purchase of medical-equipment supplier Device Technologies Australia. The deal was partly funded by an A$388 million loan.

What are leveraged buyouts?

This type of acquisition model is popularly known as a leveraged buyout (LBO). According to two experts with local law firm Wong and Partners, LBOs are a common buyout model for PE firms in Malaysia. The prevailing low interest rate environment has made LBOs a more attractive acquisition option, assuming that the target asset’s valuation does not change.

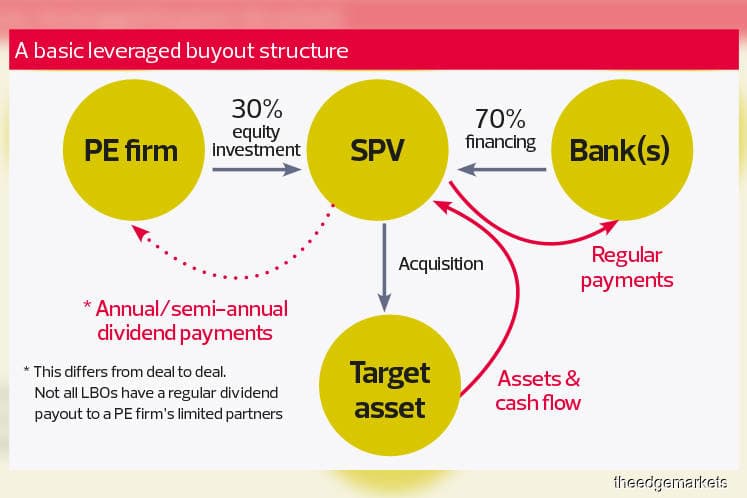

Mark Lim, partner for finance and projects at Wong and Partners, points out that a loan-backed PE acquisition is basically an LBO undertaken by PE firms where the leveraged component is funded through financing provided by the bank(s) to the acquirer to finance the proposed acquisition. The PE firm then adds a portion of equity investments to the pot.

LBOs are generally structured so that the target asset is purchased outright, with the majority of the purchase price comprising bank financing while the PE fund puts down a minority equity investment. An LBO can be executed on public-listed or privately held assets. A special purpose vehicle (SPV) is created to hold the funds of both parties and it is via the SPV that the asset is purchased and subsequently controlled.

Leverage financing is typically secured based on the strength of assets and cash flow of the target company, says Stephanie Phua, partner for mergers and acquisitions at Wong and Partners. Phua and Lim have been involved in many LBOs and PE acquisition deals. Following the acquisition, per the terms of the LBO, the acquired asset begins the process of supplementing the debt financing payments out of its own cash flow, through distributions made to shareholders.

LBOs almost always entail a full takeover of the target asset because the bank wants to be certain that the PE firm has full control of the target asset and by extension, its ability to generate the kind of returns that the firm pitched to the bank, says Lim. “Banks may not have the appetite to fund an acquisition just for a minority stake because there is no control of the target asset. That is why in a nutshell, it is easier to acquire financing for an out-and-out takeover rather than for a simple investment stake,” he adds.

According to a local PE firm, it is not uncommon for a firm in an LBO scenario to take money out of the SPV in the form of annual or semi-annual dividend payouts to investors (limited partners), assuming that there is meaningful excess cash leftover from the instalments to the bank.

This is one way for a PE firm to distribute money to investors in advance of any share buybacks, trade sales or listing exercises. The dividend payout, however, is structured on a deal-to-deal basis and depends on the cash flow strength of the target company.

LBOs also tend to provide superior returns to PE investors compared with equity-only investments. “Having a higher debt-to-equity ratio generally increases the deal’s internal rate of return (IRR). That is because the cost of capital for investors is much higher than the cost of debt when they acquire equity. That is why when one injects debt into an acquisition structure [as is the case with LBOs], it generates better returns for the PE firm, which translates into better returns for investors,” says Lim.

LBOs are a useful strategy for PE firms to stretch their dry powder (cash reserves), despite sitting on huge amounts of unspent capital. “The need to deliver target IRRs to investors means that PE firms must spread their dry powder across multiple investments. If it is utilised on just a handful of acquisitions, there may be insufficient capital for other opportunities that may arise,” he says.

In a March report by PE giant Bain and Co, dry powder in Asia-Pacific had risen to US$317 billion by the end of last year. This was equal to three years of future supply at the current pace of investments. It was significantly higher than the US$267 billion in dry powder available in 2017.

For all its advantages, however, investors have to be mindful that the injection of debt into an acquisition structure can add pressure on the PE firm to effectively monetise the target asset because there is now financing involved. This, in turn, can add further pressure on the amount of returns investors obtain from the buyout.

“Further, they need to make sure that the valuation of the asset does not fall below their initial entry level. Should this occur, the PE firm’s IRR will be affected because what is borrowed must be repaid and there will be no room to bargain with lenders,” says Lim.

Should the acquired asset end up becoming distressed and is no longer able to support the financing payments out of its own assets and cash flow, depending on the security package for the financing, the PE firm may be required to step in and manage the terms of repayment to the bank. In such a scenario, the acquisition debt ranks senior to equity, says Phua.

“So, should the value of an asset decrease, the lender will be prioritised ahead of equity investors. This will obviously impact investors’ returns, in that the payments now draw on the capital they have committed to the particular fund,” she adds.

However, limited partners in PE firms generally cannot be held liable for any more money than they have committed to the firm, says Phua. “It is important to point out that this class of investors — family offices or high-net-worth individuals more broadly — tend to be listed as ‘limited partners’ in a PE firm. Banks are generally not able to demand payment from limited partners beyond what is already committed to the PE firm.

“The general partners of the PE firm are usually the ones tasked with managing the limited partners’ funds.”

Wong and Partners is a member firm of Baker McKenzie International.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.