This article first appeared in The Edge Financial Daily on July 3, 2019

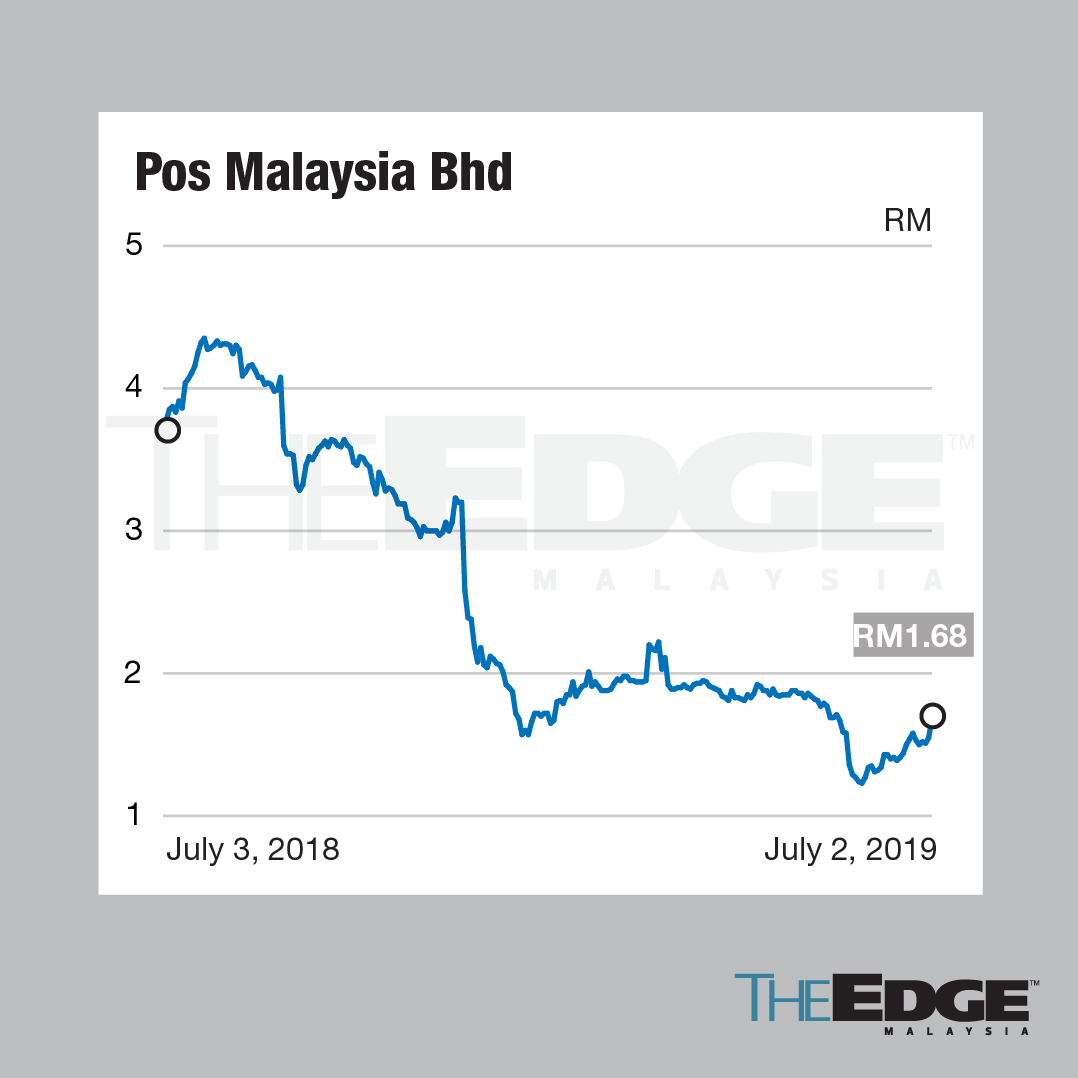

KUALA LUMPUR: Pos Malaysia Bhd’s share price bounced back strongly in recent weeks after it had been bashed down to a 10-year low of RM1.23 in late May.

The surge in share price fanned speculation that the postal group, in which Tan Sri Syed Mokhtar’s flagship DRB-Hicom Bhd owns a 53.4% stake, might be near to obtain a postage hike — a positive catalyst that investment analysts expect to drive up share price.

There is no official announcement or clear indication from the government in relation to the postage hike thus far.

The postal group, which appeared to have fallen out of favour due to its dismal earnings performance, has climbed 36.6% in the past five weeks to RM1.68 yesterday. It soared 10.3%, or 16 sen, yesterday with 10.04 million shares changing hands, valuing the company at RM1.32 billion. The trading volume exceeded its 200-day average volume of 1.62 million.

Over the past 12 months, the stock, however, slid some 56% from its peak of RM3.85.

Several analysts contacted by The Edge Financial Daily, on condition of anonymity, commented that the expected postage hike is one possible factor that has spurred buying interest in the counter.

Notably, the previous postage hike granted in 2010, when standard mail weighing under 20g was set at 60 sen, from 30 sen previously.

While the possible postage hike will help to boost Pos Malaysia’s earnings, still analysts are concerned about the declining volume of snail mail. Analysts were in consensus that any postage tariff hike will be only positive for the company in the short term.

“It (postage tariff hike) may help to improve earnings in the first two years at most. But if we look beyond the medium term … the snail mail volume has continued to contract.

“The [traditional] postal business is an old economy. Nothing you do could reverse the gradual decline in snail mail, because we now have electronic mail. No one really sends letter these days as it takes too long,” said the analyst.

The analyst noted that even courier business, which garnered excitement in the last couple of years, has been hit with competition causing pricing pressure.

On Monday, Pos Malaysia announced a recommended final single tier dividend of four sen per share for the financial year ended March 31, 2019.

This was despite reporting an annual net loss of RM165.75 million, versus a net profit of RM93.25 million in the previous financial year.

Besides DRB-Hicom, Pos Malaysia’s other shareholders are the Employees Provident Fund holding an 8.16% and Retirement Fund Inc 7.8%.