KUALA LUMPUR (Nov 17): A PKR lawmaker expressed worry that the dealings between state-owned investment fund 1Malaysia Development Bhd (1MDB) and United States private fund DuSable Capital Management LLC in the Yurus Private Equity Fund (Yurus PE Fund), was done at an arms-length basis.

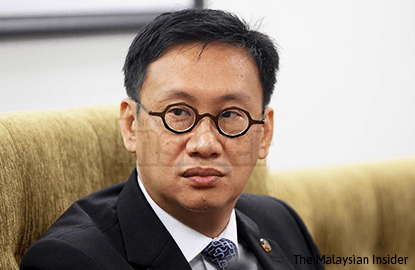

PKR Kelana Jaya MP Wong Chen said that Aabar Investment PJS, a subsidiary of Abu Dhabi sovereign-wealth fund International Petroleum Investment Co (IPIC) was named in the Wall Street Journal report on Nov 11, as the main investor of the Yurus PE Fund.

"This is the same IPIC that is currently involved in a financing deal of US$3.5 billion to help 1MDB's rationalisation scheme.

"This revelation is worrying, as it raises questions [on] whether the US$69 million (RM300 million) deal was done at an arms-length basis," Wong said in a press conference at the Parliament lobby today.

Wong wants 1MDB-DuSable to answer as to whether IPIC is the main investor in the Yurus PE Fund as reported by WSJ, and was the deal done on an arms-length basis.

He said IPIC is a related party to many dealings involving 1MDB.

In a recent statement, 1MDB-DuSable said that 1MDB acquired the entire 49% interest of Yurus PE Fund in the Master JVA, for a final amount of US$69 million on Oct 2, 2014.

This acquisition ensured 1MDB and Edra would own 100% of the rights to develop up to 500MW of solar power plants, prior to the launch of a proposed IPO of Edra, the statement said.

Wong also asked 1MDB-DuSable to answer the question as to how much DuSable had made from the deal.

He estimated that DuSable as the manager, could have possibly profited a handsome RM60 million in fees, for six months of work.

"Most managers of private equity funds have a profit sharing arrangement of 80%-20% between the investors and manager. If the sale was conducted at minimal costs, a 20% of the share for DuSable will be around RM60 million," Wong added.

He reiterated the issue should be resolved before the arrival of US President Barack Obama next week, as this involved his chief fund raiser Frank White Jr.