KUALA LUMPUR (Feb 18): Petra Energy Bhd reported an improvement of 19.65% in net profit to RM12.54 million from RM10.48 million for the fourth quarter ended Dec 31, 2021 (4QFY21).

Earnings per share (EPS) was higher at 3.91 sen from 3.27 sen a year prior, a bourse filing on Friday (Feb 18) showed. Quarterly revenue was lower by 41.32% to RM77.33 million, from RM131.77 million last year.

Petra Energy declared a single-tier interim dividend of two sen per share for its financial year ended Dec 31, 2021 (FY21), to be paid on April 15 with the ex-date of March 21.

For FY21, the oil and gas company’s net profit and revenue declined by 0.46% and 23.68% to RM15.94 million and RM322.34 million, from RM16.01 million and RM 422.36 million respectively.

EPS was marginally lower at 4.97 sen for FY21, against 4.99 sen for FY20. It declared a total dividend for FY21 of four sen, unchanged from FY20.

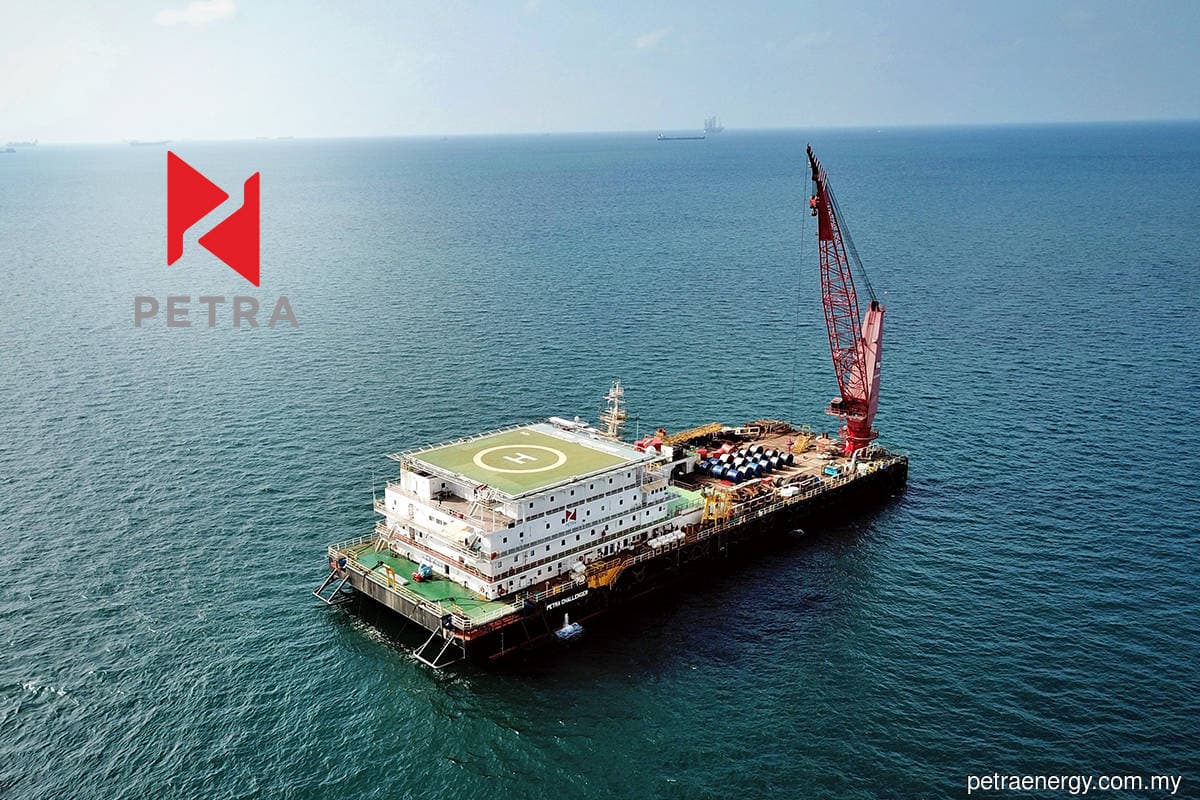

The company said its services and marine assets segment had recorded lower revenue of RM126.7 million and RM209.2 million, while its production and development segment recorded a higher revenue of RM88.1 million for FY21.

All of its segments except for services (RM4.02 million in FY21, from RM21.73 million in FY20) recorded higher segment profit. Its marine assets segment posted a profit of RM6.95 million, from RM 4.2 million; and its production and development segment RM19.94 million, from RM5.91 million.

Its services segment had suffered from lower activities in FY21, while its marine assets segment and production & development segment had benefited from efficiency in marine cost management and improved operational efficiency in project execution.

Looking ahead, Petra Energy said it is cautiously optimistic and will explore new opportunities within the energy sector, while continuing to manage cost and improve its execution efficiency amidst signs the oil & gas industry is recovering from a period of low activities.

At market close on Friday, Petra Energy shares were two sen or 2.25% lower to 87 sen, giving the oil & gas counter a market capitalisation of RM279.22 million, based on 320.94 million shares. It is currently trading at 20.86 times price to earnings and has gained seven sen or 8.75% so far in 2022, from 80 sen.