This article first appeared in City & Country, The Edge Malaysia Weekly on May 20, 2019 - May 26, 2019

Affordable housing and the property overhang have been and will remain the government’s core focus, according to Zerin Properties’ latest Property Market Overview and Outlook. The real estate investment house notes that several initiatives have been announced and are being planned.

These include initiatives under the National Housing Policy 2018-2025, such as setting a target to build one million affordable homes in 10 years with prices capped at RM300,000; the opportunity to reconcile the market mismatch through government and private collaboration; Bank Negara Malaysia’s RM1 billion fund for properties priced up to RM150,000 at 3.5% and a focus on rent-to-own schemes.

The government, financial institutions and private developers have also introduced various financing schemes, including MyDeposit, MyHome and Fund My Home, and developers, particularly premium developers, are offering good deals.

Zerin Properties believes transit-oriented developments (TODs) and infrastructure-based real estate investments will continue to be popular.

“Integrated developments and TODs have become a noticeable trend in Malaysia, with developers opting for mixed-use developments over the traditional focus on one property type. The shift is a response to the changing market demands as the younger working people prefer mixed-use developments over the conventional divided nature of purely residential or commercial developments,” says Zerin Properties in its report.

It also expects to see more retirement and wellness (assisted living) villages in the future as the population aged 60 years and above is expected to increase by 210%, from 1.05 million in 1990 to 3.26 million in 2020.

Zerin Properties expects the economy to remain on a steady path this year as the country’s macroeconomic fundamentals are still strong despite domestic and external challenges.

Investment opportunities

Zerin Properties says opportunities still exist on the primary and secondary markets. Landed homes in good locations will continue to command a premium, while freehold terraced and semi-detached houses in well-located gated and guarded developments will be in demand. Houses located near future MRT and LRT stations will continue to be hot sellers.

However, while demand remains fairly healthy for high-end condominiums, there is an expected significant supply entering the market. Hence,

Zerin Properties expects the segment to continue to be flat and smaller units will see more demand due to budget constraints.

Positive movements

The residential sub-sector continues to lead the market with a 62.9% share in volume and 49% in value, both positive movements.

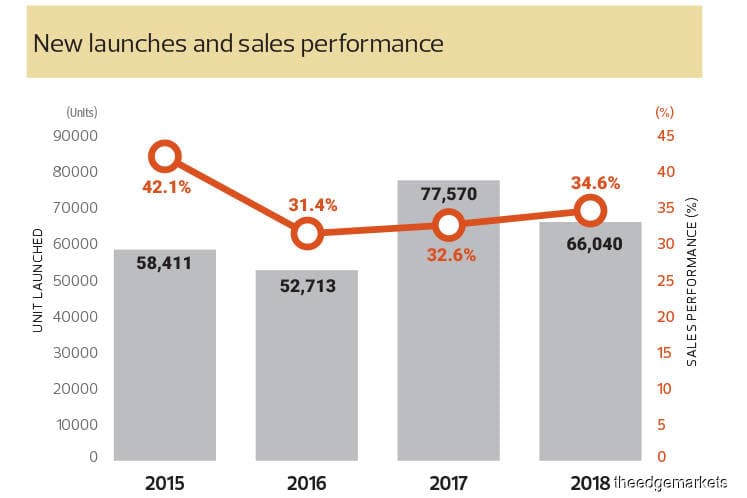

According to Zerin Properties, last year saw new launches of 66,040 units, down 14.9% compared with 2017. The number of new launches in Kuala Lumpur and Selangor was down 56.1% and 9.9% respectively, while Johor recorded an increase of 17.3% during the same period.

Condominiums and apartments formed the bulk of new launches at 36.8%, while 2-storey terraced houses came in second with 29%. Sales performance moderated at 34.6% across the board, says Zerin Properties.

The residential overhang remained an issue last year as volume increased 30.6% to 32,313 units and value 27% to RM19.86 billion. High-rise units led with 43.4%, or 14,031 units, of the total volume.

In terms of prices, the Malaysian House Price Index (MHPI) continued to increase, rising 3.1% last year to 193.3 points compared with 2017. Terraced houses took the lead at 6.4%, followed by semi-detached homes at 2%.

Zerin Properties notes that for the first time since 2010, high-rise units and detached homes recorded negative growth on MHPI, at -1.2% and -1.8% last year. Johor and Selangor registered the highest increases at 5.6% and 3.3% respectively.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.