Scientex Bhd

(Dec 18, RM6.98)

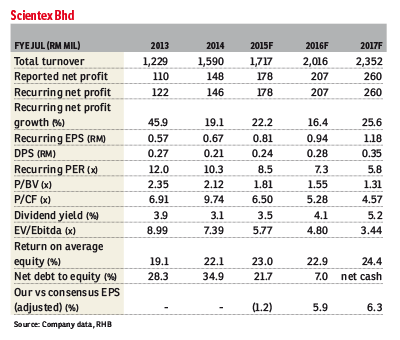

Maintain “buy” with a target price (TP) of RM8.64: The first quarter of financial year 2015 (1QFY15) revenue closed at RM431.1million (18.2% year-on-year [y-o-y]), driven by both its packaging arm (10.8% y-o-y) as well as its property development segment (46.5% y-o-y).

Earnings before interest and tax, meanwhile, grew by a smaller 15.5% y-o-y to RM44.9 million due to higher depreciation in tandem with its capacity expansion, and revised pricing under its packaging arm to increase market penetration to fully utilise its new capacity.

All in, 1QFY15 core earnings of RM35.5 million came in at 19.7% and 19.9% of consensus and our full-year estimates respectively. We deem this in line with our expectations, as the second half of FY15 is seasonally stronger.

Recall that Scientex has proposed to invest over RM240 million in capital expenditure over the next two years to quadruple production capacity under its consumer packaging segment to 120,000 tonnes come 2017 from 54,000 tonnes currently.

We continue to believe funding should not be an issue, given its relatively manageable net gearing level of 0.34 times currently; operating cash flow of over RM200 million per year, and an additional RM40 million cash inflow from Japan’s Futamura Chemical Co Ltd or FutChem’s subscription of 5% stake in its consumer packaging arm.

With the results coming largely in line, we make no changes to our FY15 to FY17 forecasts. Key risks include a potential slowdown in property sales amid rising costs of living and potential fluctuations in the prices of resin, which is its core production input.

Scientex’s share price has retraced by over 11%, in tandem with the recent market selldown. We see this as an appealing opportunity for investors to accumulate, as we continue to like the stock for its long-term earnings prospects leveraging on its expansion strategy to quadruple its consumer packaging capacity by 2017; relatively sturdy balance sheet; and committed management team.

Maintain “buy” with our sum-of-parts-based TP unchanged at RM8.64. — RHB Research, Dec 18

This article first appeared in The Edge Financial Daily, on December 19, 2014.