This article first appeared in The Edge Financial Daily on July 8, 2019

KUALA LUMPUR: A valuation at over 50 times price-earnings (PE) may not be any fund manager’s cup of tea, but it does not seem to deter investors of Nestle (Malaysia) Bhd, whose share price has climbed 3.5% since May.

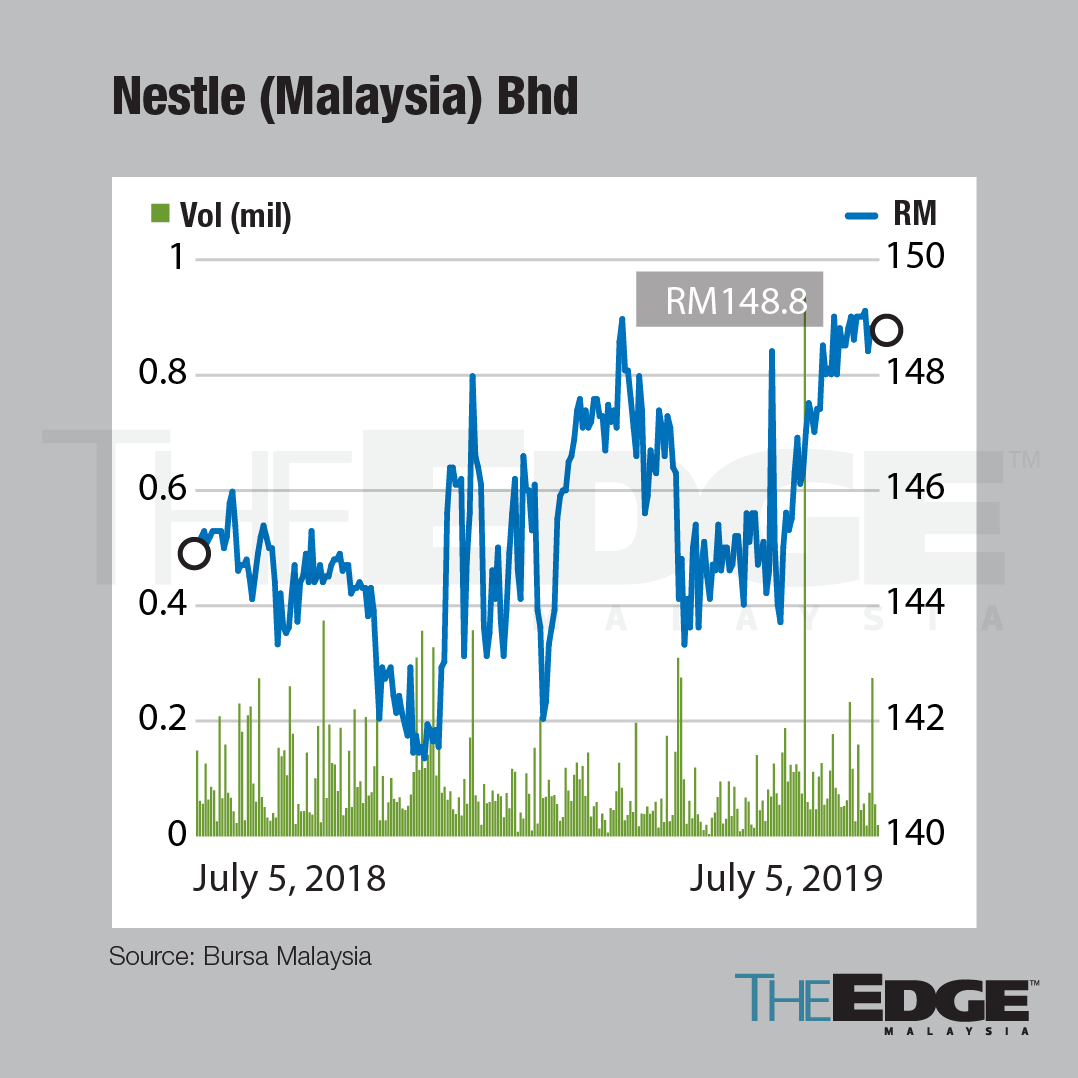

Last Friday, the counter closed unchanged from the previous day at RM148.80 — 52.64 times its trailing 12-month earnings. However, its high valuation has been a point of contention with analysts, and none of the 12 research houses covering the stock have a “buy” call.

This is notwithstanding the fact that Nestle’s operations have performed well.

“We like Nestle for its established presence and position as the market leader in the fast-moving consumer goods space and its efforts to streamline its operations, which should translate into improved operating margins,” AmInvestment Bank said in a April 23 note on the food and beverage company.

“However, as the [stock] is trading at 51.4 times PE, which is close to 1.5 standard deviation of Nestle’s one-year forward PE of 46.2 times, we believe that it is fully valued,” AmInvestment added.

Given this scenario, why is Nestle’s share price still climbing? An analyst with a local investment bank believes that investors are continuing to reward Nestle for its consistent delivery of earnings.

“Looking at Nestle’s performance over the past 10 years, it has been delivering a steady set of earnings, thanks to its operational efficiency, which translated into an improvement in profit margin.

“So if you ask me why the share price is where it is at today, I believe it’s because investors are willing to pay a premium for a quality stock like this, a company that does not disappoint on earnings delivery.

“However, we do not have a ‘buy’ call on the stock as valuations are elevated, and we don’t see catalysts for re-rating,” the analyst, who requested anonymity, told The Edge Financial Daily.

He added that some investors would view Nestle as “a blue chip safe haven”, and benchmark its performance against that of the FBM KLCI. Nestle was added to KLCI’s list of 30 component stocks on Dec 18, 2017—when its shares were trading at RM96.84.

Since then, Nestle’s shares have appreciated by 53.6% or RM12 billion in market capitalisation, outperforming the KLCI which declined by 3.9% during the same period.

TA Investment Management chief investment officer Choo Swee Kee is also of the view that Nestle’s current trading price is fully reflective of its value.

“We have no interest in Nestle. Nonetheless, it is a good stock with very consistent business. At the moment it also has a certain amount of pricing power to raise prices in order to increase profits in the short term,” he said.

Choo added that the Nestle is not a very liquid stock, and hence its share price has been fluctuating between RM145 and RM155.

“Existing shareholders do not sell. If you buy at the current price, the dividend yield is only 1.88%, but for existing shareholders [especially those who bought many years ago] their cost is lower, and hence their yield is much higher so they do not need to sell,” he said.

Nestle’s shareholding structure consists of its holding company Nestle SA which is headquartered in Switzerland, and the Employees Provident Fund. The former has a 72.6% stake in Nestle Malaysia, and the latter 7.3%. Its public float is at 15.5%.

Areca Capital chief executive officer Danny Wong Teck Meng attributes Nestle’s share price’s upwards trajectory to positive sentiment among investors on consumer stocks in general.

“There is still uncertainty[among investors] with regards to the other sectors (but) the consumer sector has been neutral towards developments on the US-China trade war, hence the share price of consumer stocks have held up,” he said.

However, for some quarters, a defensive play in consumer stocks may be one that excludes Nestle, and the reason for that, again, is due to high valuations.

“There is no doubt that investors are turning defensive. But on a stock specific basis, investors would need more clarity on why they should pay a high premium for Nestle. The growth of the company needs to justify the higher PE.

“For us, we would prefer those stocks which are less than 30 times PE,” said a fund manager who declined to be named.

At Nestle’s Hari Raya open house last week, its chief executive officer Juan Aranols told reporters that the group still sees good demand for its products in Malaysia.

“This has been reflected in our first quarter financial results. We are constantly working to keep demand for our brands very much alive, and that involves innovation, quality [control] and meeting the taste profiles [of consumers]

“Honestly we see there are growth opportunities in the Malaysian market, and we keep working hard to capture them, and make them happen. Competition is tough, but we are confident that we can continue to grow in Malaysia,” he said.

On the introduction of the sugar tax with effect from July 1, Aranols said this would not have a major impact on Nestle.

“The impact [on] to us is not material as only a limited number of our products are affected, and at this stage we are not going to increase the prices of our products because of the sugar tax,” he said.

For the first quarter ended March 31, 2019, Nestle reported a 1.7% increase in net profit to RM235.22 million — its highest ever quarterly net profit — on the back of a 1.6% rise in revenue to RM1.45 billion. This was driven by robust domestic sales which grew by 4.9% during the quarter, fuelled by strong sales momentum during the Chinese New Year period.

For the full year, the group has set aside a capital expenditure of RM220 million — its highest in five years — of which RM100 million is for the expansion of its Chembong plant, and the rest for its six other manufacturing facilities across Malaysia.

It is worth nothing that the group has not seen a double-digit growth in its earnings since 2013, mainly due to a high base effect.

Whether its expansion plans will help accelerate the group’s growth is yet to be seen, but this would definitely be the rerating catalyst that analysts are looking for.