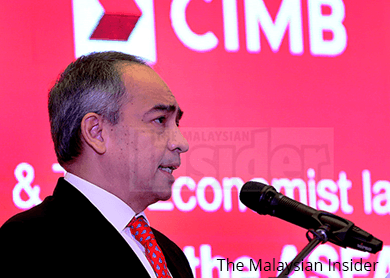

KUALA LUMPUR (Aug 20): CIMB Group Holdings Bhd chairman Datuk Seri Nazir Razak said the ringgit should be trading around 3.70 against the US dollar based on fundamentals, but the recent weakening suggests that sentiment is playing a part in the decline.

"Our research analyst said, on a trade-weighted basis, the ringgit should be at 3.70 or so. There seems to be some indication that sentiment is playing a part in the recent decline," he said.

He added that investors are moving their investments elsewhere, following the recent political developments in Malaysia.

"With the exit of foreign investors, we have this exodus of capital. This can cause the ringgit to overshoot in terms of its lower value," he said.

When asked if interest rates could be used as a tool to stem the weakening of the ringgit, Nazir said this could be one of the options.

"The interest rate is one policy option. At these levels, there's a limitation on how effective interest rates can be in this climate, because our consumer debt is very high.

"If you're trying to raise interest rates to defend the currency, I would have some concerns about the impact it will have on the rakyat," said Nazir.

He said a proper diagnosis of the current economic headwinds is important for the government to respond with the right policy measures.

Nazir was speaking to the press on the sidelines of The Economist's South-East Asia Summit 2015 today.