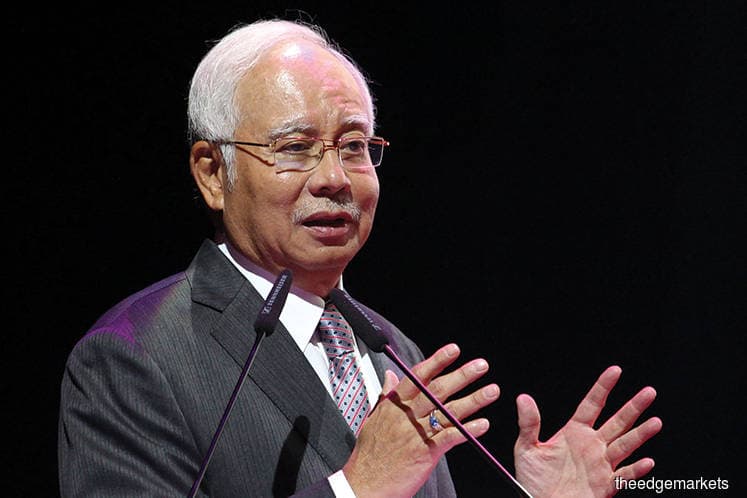

KUALA LUMPUR (March 6): Datuk Seri Najib Razak stressed that the sharp depreciation on Khazanah Nasional Bhd’s net asset value and RM6.3 billion net loss happened after the change of government.

The former prime minister said he is not sure whether Malaysians could “easily forget” about the RM3 billion impairment on Malaysia Airlines and massive loss that Khazanah incurred — the first loss making year since 2005 — in response to Minister of Economic Affairs Datuk Seri Mohamed Azmin Ali’s tweet to Malaysians to move on as Azmin believes Khazanah will be profitable in 2019.

“RM25 billion evaporated in just one year, it is easy for him (Azmin) to urge people to just forget about it. My other question is why do we still force Khazanah to pay RM1.5 billion dividend to the Ministry of Finance last year despite incurring huge loss,” commented Najib, who is currently facing corruption and money laundering charges related to 1Malaysia Development Bhd.

It is not clear what divestments Najib, formerly the chairman of Khazanah, was referring to when he blamed the the sharp RM25 billion fall on Khazanah’s asset value to “billions of its assets being sold after Pakatan Harapan took over”.

Khazanah’s asset values are marked to the market values. Hence, some of its asset values are subjected to fluctuation of market prices. The loss of asset value at Khazanah in 2018 is mainly because the fall of the share prices of companies in which the sovereign fund has invested. The year 2018 has largely been seen as a bad year for equity markets worldwide.

According to Khazanah’s managing director Datuk Shahril Ridza Ridzuan, the sovereign fund's first pre-tax loss in 13 years for 2018 is mainly because of significant impairment provisions made during the year — a big chunk of which was due to Malaysia Airlines Bhd (MAB).

Khazanah reported a pre-tax loss of RM6.3 billion for 2018, compared to a pre-tax profit of RM2.9 billion in the preceding year, after recording impairments totalling RM7.3 billion — more than triple the RM2.3 billion seen in 2017.