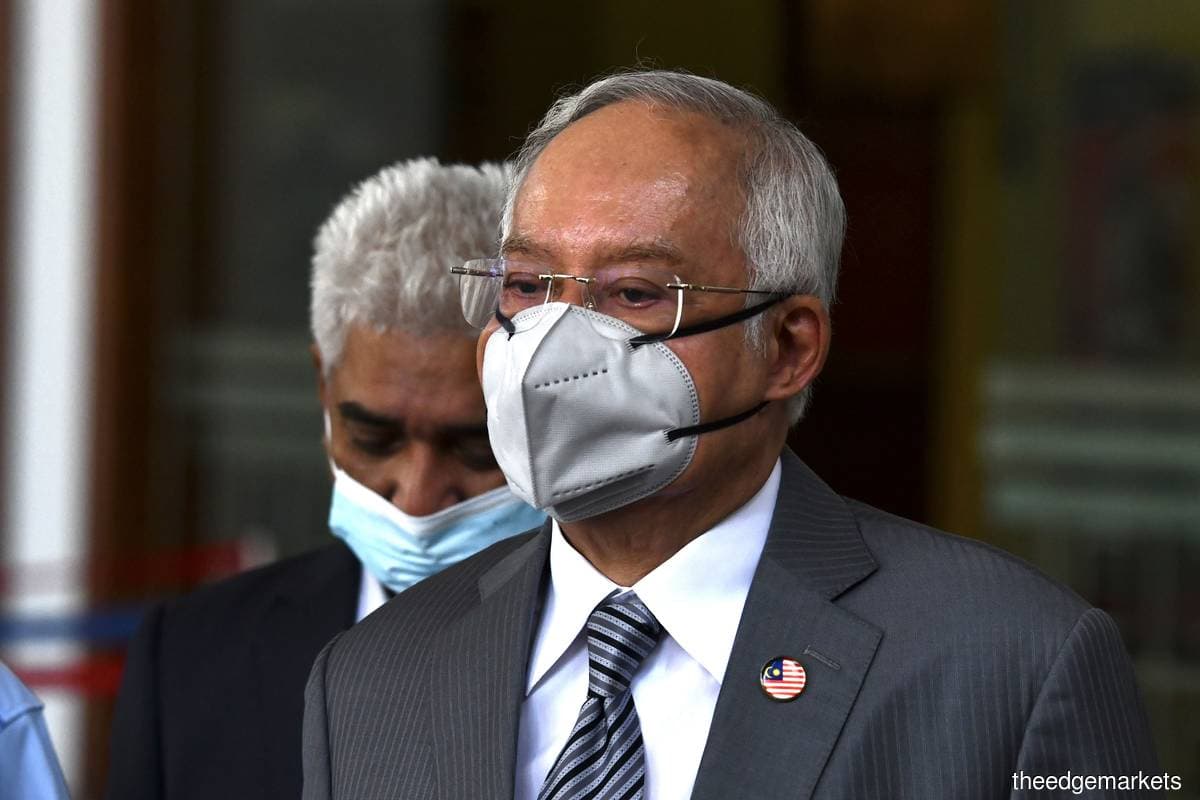

PUTRAJAYA (May 10): The Federal Court on Tuesday (May 10) granted leave (permission) for former prime minister Datuk Seri Najib Razak and his son Datuk Nazifuddin Najib to challenge a summary judgement entered against them to pay RM1.69 billion and RM37.64 million respectively to the Inland Revenue Board (IRB). The matter will be heard on its full merits, a three-member bench led by Chief Justice Tun Tengku Maimun Tuan Mat decided.

The bench took only three minutes of recess after hearing submissions before unanimously granting leave for the nine questions of law posed by the duo. The leave questions were also supported by the Malaysian Bar despite opposition from the IRB.

“We are unanimous in our decision to grant leave as it has met Section 96 (a) and (b) of the Courts of Judicature Act 1964 (revised 1972) (CJA). We grant terms as with the enclosure [for the nine questions],” said Tengku Maimun, who sat with Justices Datuk Nalini Pathmanathan and Datuk Mary Lim Thiam Suan.

The apex court will fix a date to hear the full merits of the appeal.

Section 96 of the CJA reads that leave would only be given by the Federal Court or Court of Appeal:

(a) in civil cause involving a question of general principle decided for the first time or a question of importance upon which further argument and a decision of the Federal Court would be to public advantage; or

(b) from any decision as to the effect of any provision of the Constitution including the validity of any written law relating to any such provision.

The challenge mounted by the former premier and Pekan Member of Parliament and Nazifuddin relates to Section 106 (3) of the Income Tax Act 1967 (ITA) that the court shall not entertain any plea that the amount of tax sought to be recovered is excessive, incorrectly assessed, under appeal or incorrectly increased.

Section 106 (3) is considered an ouster clause as it denies the court any jurisdiction to hear matters concerning income tax calculation, appeals or payment.

On July 22, 2020, the High Court entered the summary judgement against Najib and Nazifuddin requiring them to pay the said amounts of RM1.69 billion and RM37.64 million respectively. The decision was upheld by the Court of Appeal on Oct 21, 2021 but the appellate court granted a stay of the summary judgement decision requiring them to pay the tax.

Shafee says there are novel issues to be decided

Senior counsel Tan Sri Muhammad Shafee Abdullah appearing for Najib and Nazifuddin argued that leave should be given for the apex court to decide as this is a novel issue that had yet to be decided by the apex court on the “atrocious claim”. He contended that a judgement would benefit taxpayers.

Central to the issue is that once a person receives the certificate of assessment, the person is liable to pay the amount and Section 106(3) makes it impossible for anyone to challenge it where it is the IRB that brings the action to the court.

“Once you obtain the certificate from the IRB, you are required to pay and this cannot be argued.”

“In light of the landmark decision on Semenyih Jaya (that ruled ouster clauses can be challenged), we argue that this should be looked at based on Articles 5 and 8 and also Article 121 of the Federal Constitution,” Shafee said.

Article 5 relates to the liberty of a person, Article 8 on equality and 121 on the judicial powers of the Federation.

IRB counsel Dr Hazlina Hussain in her submissions told the court that Najib and Nazifuddin had filed their appeal to the Special Commissioner of Income Tax (SCIT) to challenge the certificate requiring them to pay.

She said that it had already been a practice where in matters concerning the country's revenue, taxpayers are required to pay first. Moreover, they can take the matter up to the SCIT and not the court.

“Taxpayers cannot dispute the tax assessment,” Hazlina argued.

This prompted Tengku Maimun to question whether a judgement by the apex court on the issue would be beneficial to both the IRB and the public as this is a novel issue that had not been decided before at the apex level.

However, Hazlina maintained that the proper avenue for Najib and Nazifuddin remains at the SCIT as they had already filed an appeal and the hearing is pending.

Meanwhile, Anand Raj for the Malaysian Bar said a judgement from the apex court would benefit taxpayers and the IRB in general.

“This follows as at times, or most of the times, taxpayers could not pay the additional tax imposed and they could not challenge it.

“In this case, it is the IRB who had brought the action to seek a summary judgement and we say that the jurisdiction in such appeals should be returned to the courts. Waiting for the SCIT to decide may limit public access to dispute the tax assessment,” he added.

Shafee further added in his reply that the IRB had gone one step ahead after obtaining the summary judgement to apply for bankruptcy against his clients, which was not proper in this case.

Nine questions of law posed

When Najib and Nazifuddin filed the motion for leave to appeal, they posed nine questions of law that are central to Section 106 (3) of the ITA:

- Whether Section 106(3) of the ITA 1967 contravenes Article 121 of the Federal Constitution;

- Whether Section 106(3) of the ITA 1967 is unconstitutional and/or ultra vires as it usurps the judicial power of this court guaranteed by Article 121 of the Federal Constitution;

- Whether, by reason of Sections 103 and 106(3) of the ITA 1967, this court is wholly prevented from considering whether or not there are triable issues and/or some other reason warranting a trial (within the meaning of Order 14 Rule 1 and Order 14 Rule 3 of the Rules of Court 2012), before deciding whether or not to give judgement in favour of the plaintiff, despite the fundamental liberties, rights and powers enshrined in, inter alia, Articles 5, 8 and 121 of the Constitution;

- Whether Article 121 of the Federal Constitution, which guarantees the judicial power of this court, is relevant in the determination of civil recovery proceedings in tax matters (including in summary judgement proceedings therein);

- Whether Order 14 Rule 3 of the Rules of Court 2012, which provides that a summary judgement application may be dismissed if a defendant can show “some other reason” for a trial to be held, applies in civil recovery proceedings in tax matters;

- Whether in instances of manifest and obvious errors in calculation of a tax assessment, a court is entitled by virtue of its inherent and judicial powers to consider a defendant’s defence of merit to dismiss or set aside an application for summary judgement by a plaintiff and order a full trial on the matter;

- Whether the judicial power of the federation that is vested in the High Court, Court of Appeal and Federal Court may be suspended and/or abrogated in a tax recovery suit filed under Section 106(1) of the ITA 1967 on the basis of Section 106(3) of the same Act;

- Whether the judicial power of the federation vested in the High Court, the Court of Appeal and Federal Court may be suspended and/or abrogated in a tax recovery suit filed under Section 106(1) of the ITA 1967 on the grounds that an appeal to the SCIT has been filed under Section 99 of the same Act: and

- Whether a defendant’s defence as to the plaintiff’s conduct of bad faith, mala fide, oppression, unconscionability, irresponsibility, unreasonableness and/or abuse of process falls within the scope of Section 106(3) of the Income Tax Act 1967, and whether the courts are entitled to consider such a defence as a triable issue and/or some other reason warranting a trial in the context of civil recovery proceedings in tax matters (including in summary judgement proceedings therein).