This article first appeared in Forum, The Edge Malaysia Weekly on October 29, 2018 - November 4, 2018

The rising risk aversion among global investors has been the product of geopolitical and economic risks that are not specific to Asia, yet they have taken a toll on Asian equities and currencies in the past two weeks. The unrelenting flow of bad news has not helped the mood. The serious deterioration in US-Chinese ties and the potentially grave implications for Middle East stability of the shocking murder of Saudi dissident Jamal Khashoggi have unnerved investors. Continuing worries about trade wars and the further slowing of the global economy, especially in China, have added to the sense of foreboding among investors.

Our take is that some trends are indeed of concern, but that the overall picture for emerging Asian economies remains reasonably good through 2019. The headwinds to economic growth will cause some slowing, but the impact will be contained. Asian countries are also likely to successfully limit the depreciating pressures on their currencies. Moreover, over time, we could even see some positives emerge from recent developments, such as a stepped-up pace of production relocation from China to Southeast Asia.

How much downside to economic growth in 2019?

There certainly have been signs that the global economy is losing momentum. The latest Organisation for Economic Co-operation Development lead indicator is pointing to deceleration in the coming six to nine months. Purchasing manager surveys show weakening order books while lead indicators for export demand point to a slowdown.

The International Monetary Fund recently issued its latest forecasts for the world economy. Overall growth forecasts were revised downwards, pretty much across the board. In essence, they found that the advanced economies were slowing while the emerging economies were not picking up enough speed to offset this. Higher oil prices and tightening financial conditions were combining to slow the world economy. The IMF also felt that the possibility of upside surprises had receded while the downside risks had become more pronounced.

Nevertheless, even after this somewhat downbeat assessment, the bottom line was that the IMF still saw economic growth in the US, Europe and Japan at around their long-term potential. They also noted that large emerging economies ex-China such as India, Brazil and Russia would enjoy a significant improvement in economic growth, putting behind several years of desultory performance.

We would go even further, as we believe there is still a good chance for some upside surprises, particularly as the US economy could do better than expected:

• First, US President Donald Trump has proposed yet another tax cut, this time for the struggling middle class in the US. Many observers have been quick to dismiss this as election talk to boost the chances of his Republican Party candidates in the midterm congressional elections in early November. However, Treasury Secretary Steve

Mnuchin has noted that he would be following up on this idea and that discussions would be held with congressional leaders to move this proposal forward. Additional fiscal stimulus would help to boost US economic growth, since the impact of earlier tax reforms and additional spending will begin to recede by the middle of next year.

• Second, there are tentative signs of better-than-expected wage growth in the US and Europe. Certainly in the US, as the labour market tightens, we can reasonably expect stronger wage growth to propel consumer demand in 2019.

• Third, we remain confident of a rebound in capital spending in developed economies. Small businesses in the US remain optimistic about the future and are planning capacity expansions. In Japan, data on core machinery orders was positive. Ten years after the global crisis, companies in developed economies are regaining confidence, with many finding that they have to invest in order to exploit new technologies, or risk losing their edge to competitors.

• Fourth, Chinese policymakers are clearly more worried about slower growth and are likely to act forcefully to support the economy. This was clear when four of China’s most senior economic policymakers took turns a week ago to reassure the Chinese people that they would pull out all the stops to ensure that the economy remained on a track of strong growth. The government has announced a slew of measures to stimulate the economy. Tax cuts to the tune of more than 1% of GDP are to be rolled out next year. Finance Minister Liu Kun announced that new measures aimed at supporting the economy and promoting technological innovation would reduce the burden on enterprises by more than RMB1.3 trillion (RM779.9 billion) this year. The state authorities have also approved fixed asset investment projects amounting to close to RMB700 billion in the first nine months of this year. The central bank is also adding its firepower through a range of measures including a concerted effort to help the private sector raise funds. These stimulus efforts go beyond just the central government. Even the local governments are stepping in. For instance, the Shenzhen city authorities have allocated funds to improve the liquidity of publicly listed firms registered in the city.

In short, while we do expect challenging times as the US pursues its aggressive trade strategy and as turbulence continues to hit financial markets, we also believe that the damage to global economic growth can be limited. This means that export demand for Southeast Asia should continue to grow into 2019, albeit more slowly.

What about the US-China spat and the risks of protectionism?

There is little doubt in our minds that a decisive shift in US foreign policy has taken place. Vice-president Mike Pence’s speech a couple of weeks ago laid out his government’s case against China. Clearly, there is now a determination to counter China on all fronts. The US intends to step up its military build-up, with an eye on China. For example, the Trump administration has just said it would pull out of the Intermediate Range Nuclear Forces treaty it signed with Russia 30 years ago. Although the reason given was that Russia had allegedly violated the treaty, the real reason seems to be that the treaty constrained the US from matching China’s progress in short to medium-range missiles. The US will also be tougher on Chinese acquisition of technology and will act more vigorously against Chinese intelligence operations.

This is certainly not a good development for the smaller countries in East Asia, since their region will become the primary arena for US-China jostling, which always carries the risk of an unintended clash. However, while the strategic rivalry between the two great powers is not welcome, will it necessarily cause an economic headache for the region? That would be the case only if the current trade skirmishes spun out of control into a full-blown trade war. We doubt this. Chinese President Xi Jinping and Trump are now expected to meet each other at the end of next month on the sidelines of the G20 meeting. It is not in the interest of either side to allow trade frictions to escalate, so our bet is that both sides will use that summit to work out a ceasefire on trade and for a new set of talks to begin.

In other words, while trade will remain a thorn in US-China relations, we do not see it escalating to a point where the economic damage to global growth becomes significant.

What about more positive developments?

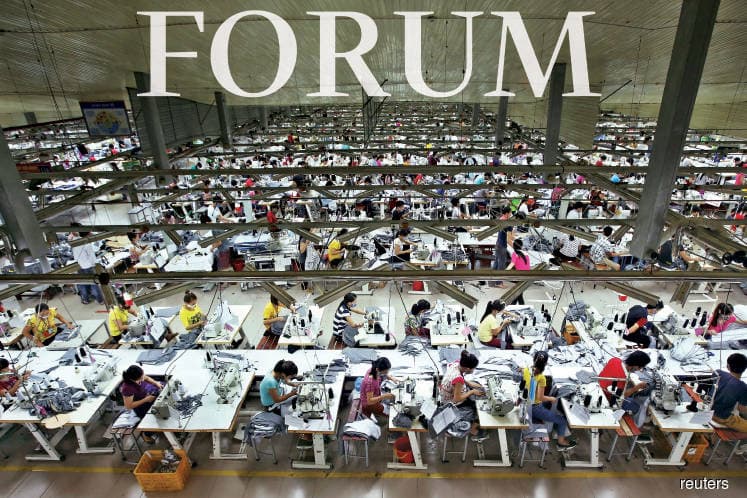

The main positive is that Southeast Asia is set to win more production that is relocating out of China.

Although it is early days yet, it does look like more and more companies are now committing to relocate production out of China. Such relocation was already underway in a limited way, affecting labour-intensive activities such as garments and shoes because of rising labour and other costs in China. Now, this relocation is accelerating. One reason is the higher US tariffs on Chinese-made products. But it goes beyond that. Many companies are now concerned about protecting their intellectual property and worry about Chinese efforts to force technology transfer from foreign investors in China to local enterprises.

Not all of this relocation will be to China’s low-cost competitors. Some of it is reshoring, a return of production to the home base of MNCs, where technological advances now allow cost-efficient production in the US or Japan or South Korea. Another portion of this relocation is “near-shoring”, or the movement of production to a low-cost location that is geographically close to the home base. In the US case, this would be Mexico; in the European case, it might be Turkey; in the case of South Korea or Taiwan, it is likely to be Southeast Asia.

A careful read of media reports and company statements shows two things. The relocation is accelerating and Southeast Asian countries such as Vietnam, Thailand, Cambodia and Malaysia are emerging as the biggest beneficiaries of this relocation, together with Mexico.

A second likely positive is that, as countries in the region realise the growing risks from trade protectionism and other inward-looking policies in their traditional markets in developed economies, they will undertake reforms to help them withstand those risks:

• One way would be reforms to improve the domestic engines of growth. Regional countries could take a leaf out of South Korea, where minimum wages have been raised and more efforts made to strengthen small and medium enterprises.

• Another would be to step up the pace of regional economic integration. Progress has been slow in getting initiatives such as the Asean Economic Community to produce the full range of benefits that were expected. Asean could also push harder to overcome obstacles to the conclusion of the Regional Comprehensive Economic Partnership. And, more countries in the region could agree to join the Comprehensive and Progressive Trans-Pacific Partnership agreement.

Conclusion

The world has certainly become a more uncomfortable place for emerging economies including in our region. There will be discomfiting developments in geopolitics, trade and global finance (as central banks tighten policy). So, some slowing in economic growth is likely and financial markets will probably also continue to be hit by turbulence.

The point of this column is not to downplay these risks, but instead to, first, remind everyone that these very real risks can be mitigated by sound policies. Second, that there may even be some good that could come out of the difficulties we currently face — production relocation to Southeast Asia could well be one of those positives.

Manu Bhaskaran is a partner and head of economic research at Centennial Group Inc, an economics consultancy

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.