This article first appeared in The Edge Financial Daily on July 10, 2019

KUALA LUMPUR: Debt-laden Practice Note 17 firm Barakah Offshore Petroleum Bhd said its unit’s operating licence has been suspended by Petroliam Nasional Bhd (Petronas) for three years beginning July 8 this year.

The announcement yesterday came just a day after Barakah announced the planned entry of a white knight to revive its financial health. Barakah, in a filing with Bursa Malaysia, said its unit PBJV Group Sdn Bhd received the suspension notification on Monday.

“The letter from Petronas indicated an adverse report from Petronas Carigali Sdn Bhd (PCSB) pertaining to the non-performance of PBJV in relation to the contract relating to the provision of underwater services for PCSB. Resulting from that, Petronas decided to suspend PBJV’s licence for three years, effective from the date of the letter,” the filing read.

The Edge reported in March this year that PBJV had been suspended by Petronas since June 2018 due to non-performance, citing a letter from Petronas to several oil and gas players, sighted by the weekly.

In the letter, Petronas also highlighted complaints about PBJV being financially distressed and not paying its subcontractors. It suggested a risk assessment and due diligence be undertaken before any jobs are awarded to PBJV.

In its filing yesterday, Barakah said the licence suspension effectively renders PBJV unable to undertake and bid for new contracts from Petronas, its subsidiaries and any petroleum arrangement contractors (PACs) during the suspension period.

“Nevertheless, PBJV is still allowed to continue and complete its existing and ongoing contracts with Petronas, including [those with] its subsidiaries and PACs, in accordance with the respective existing and ongoing contracts’ terms and conditions,” it said.

Barakah said it will seek clarification from Petronas and appeal against the suspension.

In a separate filing, Barakah said the High Court of Malaya had ordered that the court convened meetings between creditors and Barakah as well as PBJV — to be held on July 31 — to approve the proposed debt settlement announced on Bursa on Monday.

The regularisation plan includes the disposal of a pipelay barge to Singapore’s Lecca Group Pte Ltd, as well as a share capital reduction, share placements, plus debt settlements through issuing redeemable unsecured loan stocks after a total waiver of some RM153.99 million owed by Barakah and PBJV.

The regularisation plan to address its debt situation will see Lecca Group emerge as the largest shareholder of Barakah with a 44.87% stake.

As at May 31, the outstanding liabilities due to the scheme creditors of Barakah and PBJV totalled RM106.65 million and RM287.99 million respectively.

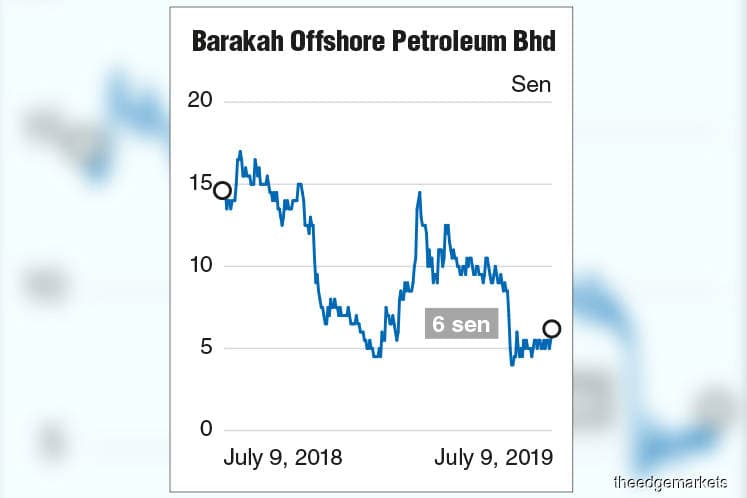

Barakah shares rose half a sen or 9.09% to six sen apiece. It was the most actively traded stock of the day with 145.54 million shares traded. Its current share price gives it a market capitalisation of RM50.15 million.