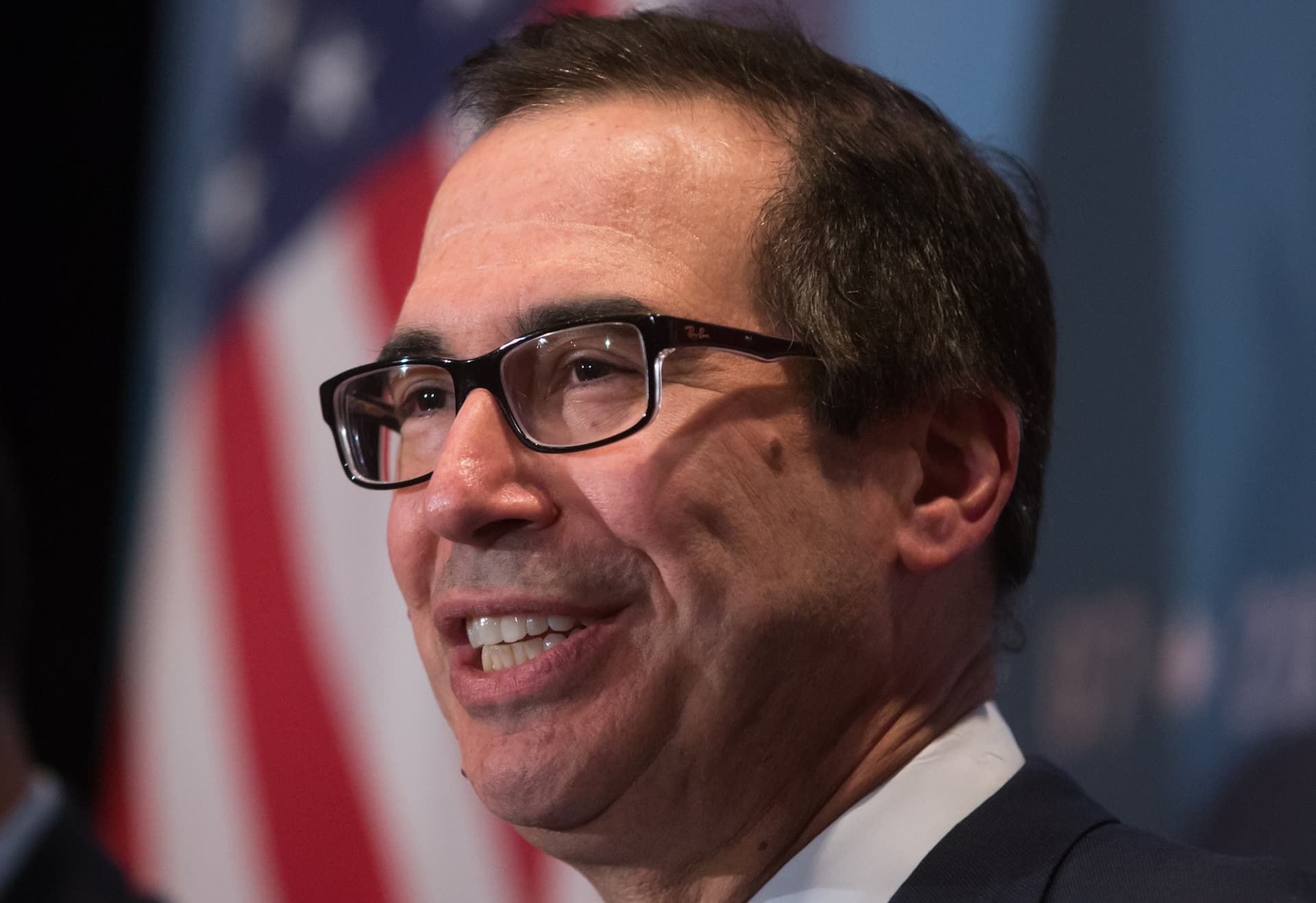

WASHINGTON (July 29): The surge in the US economy in the second quarter shows the US is “well on the path” for four or five years of sustained annual growth of 3%, said Treasury Secretary Stephen Mnuchin – an outlook at odds with many economists.

“We can only project a couple years in the future, but I think we’re well on this path for several years,” Mnuchin said on “Fox News Sunday,” as US President Donald Trump’s economic team fanned out across morning talk shows to cheer-lead the economy.

The US economy accelerated in the second quarter to the fastest pace since 2014, the government reported on Friday, allowing Trump to link the increase with his economic policies, including the biggest tax overhaul since the Reagan era and a push for deregulation.

The president “deserves the victory lap,” White House economic director Larry Kudlow said on CNN, adding that faster economic growth could continue for a “bunch” of years.

Mnuchin said that Trump respects the independence of the US Federal Reserve (Fed), despite the president’s recent criticism of the central bank for raising interest rates.

Managing inflation

In fact, Mnuchin said it was responsible for the Fed to raise rates as the economy grows faster and inflation rises.

“The Fed has been targeting 2% inflation, and obviously with 2% inflation we have to have at least slightly higher interest rates to manage through that,” he said.

Trump tweeted on Sunday that the “best results coming out of the good GDP report was that the quarterly Trade Deficit has been reduced by US$52 Billion and, of course, the historically low unemployment numbers, especially for African Americans, Hispanics, Asians and Women.”

The 4.1% uptick in gross domestic product (GDP) was propelled by consumer spending, business investment and a decline in the trade deficit. Yet as the effects fade from the tax cuts, economists expect the pace to moderate, with forecasts showing growth will come in around 3% this year.

While there’s evidence that tax reforms and cuts are helping to stimulate activity, the strength of consumer spending in the second quarter is unlikely to continue into the second half of the year, Bloomberg economists Carl Riccadonna and Tim Mahedy said in a note.

Strong US dollar

"Dollar strength will slow exports, and importers will adjust supply lines widening the trade balance," they wrote. "Furthermore, residential investment looks to remain weak, due in part to last year’s tax reform, and consumer spending will moderate in the second half as the Fed continues to remove policy accommodation."

The Trump administration’s official goal is for sustained GDP growth of 3%, which would well exceed the average 2.3 percent pace during the current expansion, and the Fed’s longer-run expectation of 1.8%.

“These numbers are very, very sustainable. This isn’t a one-time shot,” Trump said at the White House Friday. “Everywhere we look we are seeing the effects of the American economic miracle.”

Trade agenda

Trump vowed that future trade deals would spark further expansion as he pursues a hawkish trade agenda that includes tariffs on steel and aluminum and a threat to slap duties on US$500 billion in Chinese imports. Trump and European Commission President Jean-Claude Juncker agreed last week to negotiate lower barriers to transatlantic commerce and put auto tariffs on hold.

While net exports contributed 1.06 percentage points to second-quarter growth, the most since 2013, the boost is probably temporary. The numbers reflected a 9.3% gain in shipments abroad, boosted partly by a surge in soybean shipments ahead of retaliatory tariffs.

Few analysts are counting on this component to keep delivering in the face of a strong dollar and tariffs that have been proposed or already implemented. Meanwhile, steady domestic demand from households and businesses means imports will pick up, potentially causing the trade deficit to widen.