The sharing economy, or the concept of matching people who have underutilised assets with those who would like to use those assets at a lower price, has changed the way people live and work in many cities around the world. Following a trip to the US late last year, Tho Li Ming explores how the concept is changing our views of commerce in the first part of this series.

SHARING one’s resources with someone else in exchange for a fee is not a new phenomenon, but doing so in a digitally powered marketplace with strangers is.

This concept, known as the sharing economy, essentially dismisses the long-held assumption that the usage of a product is inherently tied to who owns it.

In the sharing economy, the use of app-based platforms allows consumers to gain access to a product or service for a pre-determined period of time. Financial transactions are usually conducted on the digital platform as well.

Dr Arun Sundararajan, professor of information, operations and management sciences at New York University’s Stern School of Business, says the sharing economy has changed the way the modern generation views things. “Usage [of a product or service] does not necessarily have to be tied to exclusive ownership anymore.

“In the past, if you wanted a car, you bought one. If you wanted a home, you rented or bought one. But now, multiple persons can access [a product or service] by paying for and using it together in a market-based manner.

“You can pay to use it only for the time that you need it rather than to hold on to it permanently. If you need a car, you get into a car, drive and leave it somewhere else. Everyone pays for the usage of the car, but no one is necessarily owning it exclusively.”

People helping people

With the sharing economy, there has been a shift towards greater interaction between individuals (also known as peer-to-peer communication), and away from those between individuals and organisations.

Sundararajan, who has researched the rise of the digital economy over the past three years, observes that the sharing economy has created new marketplaces and alternative forms of consumption.

“In the past, most commercial transactions were made with large institutions or companies. It was the dominant model of production and exchange in the US and Western Europe. We bought televisions from a particular TV manufacturer and clothes from a clothing manufacturer.”

The sharing economy concept grew in popularity during the 2008 global financial crisis, when unemployment rates soared. There wasn’t much of a safety net for workers in the US at the time, says James Parrot, deputy director of Fiscal Policy Institute, which focuses on fiscal and economic policies in New York.

“The unemployment compensation, which pays workers, ends between six months and two years. Wages have fallen and many of the jobs that have been added back to the economy are concentrated in low-wage sectors such as restaurants and retail. Incomes only started to recover in 2013.

“Against a very weak economic backdrop, we saw the emergence of the sharing economy in New York City and other parts of the country. It bolstered income for those who wanted to rent out their house or cars.”

As the sharing economy gains momentum, so will entrepreneurship opportunities. This could mean a shift in employment patterns as more people become self-employed and have irregular incomes.

Sundararajan sees the possibility of such a shift. “We may see a society where 80% to 90% of the people who used to be employed by big companies suddenly shift to one where a large number are self-employed. There will be an adjustment if that happens.

“People will have to get used to not having a salary on a regular basis. Some of your company benefits, such as healthcare, may no longer be there.

“On the other hand, in economies where many people are already self-employed, this could represent a big opportunity because you can take the people running their own businesses and let them grow their businesses through the [sharing economy] platform.”

The sharing economy will also allow the wealth and income gap that exists in so many societies to be narrowed, as people who previously could not afford to buy assets will now have access to more resources.

“We could create markets where you can get access to things owned by others, such as a car, a vacuum cleaner or even tools for carpentry. People who have access to such things can grow their income or wealth. There is an equalising effect here [between the haves and have-nots],” says Sundararajan.

While the peer-to-peer concept is not new, the use of third-party mobile and/or web applications allows transactions to be done on a much wider scale. Payment gateways which use this platform help to facilitate transactions and establish trust between users and owners who may not have met each other.

The sharing economy, also known as collaborative consumption, has helped society deal with some pressing issues, such as inadequate transport infrastructure. Car and bicycle-sharing services are just some of the solutions available in this space.

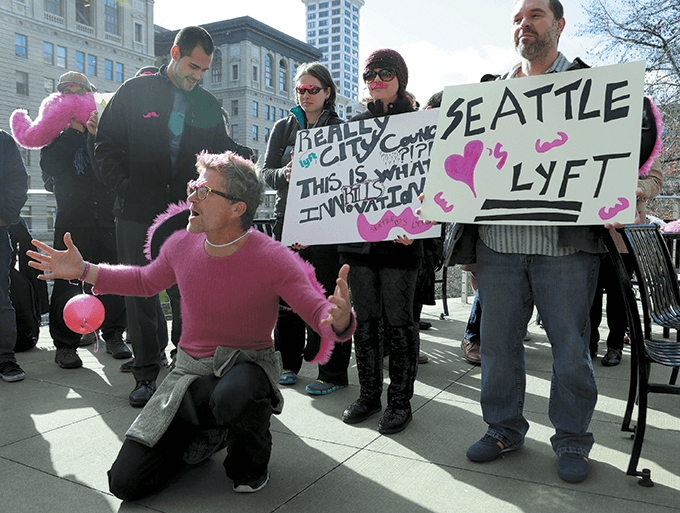

In the US, Uber and Lyft allow individuals to provide ride-sharing services, which helps reduce the number of cars on the road as well as pollution. Meanwhile, bicycle-sharing services such as Citibike provide bikes at designated stations throughout New York City. Commuters can rent bicycles at one station and drop them off at another.

Peer-to-peer transactions have led to innovations in the funding space. Experimental ideas that were once deemed too small-scale or risky for traditional loan providers, such as banks and venture capitalists, can now be funded by a group of strangers.

A successful example is Kickstarter, an online platform that allows the creators of artistic projects to connect with contributors who believe in their cause enough to fund them. In return, the contributors get rewards, ranging from an electronic thank you card to being one of the first recipients of the product.

Such crowdfunding platforms allow people to directly invest their savings in other people, instead of traditional bank accounts, says Sundararajan. “Kickstarter allows one to donate money to a cause, whether it’s building a public space in your neighbourhood, making a movie or funding some research.

“It is a mix of investment and philanthropy. You are donating the money, so there is no financial return. But you get to support something you believe in.”

There are also platforms that allow affluent individuals to invest their money in a company directly. This offers companies an alternative way of raising funds, instead of the usual route of bank loans or venture capital.

“AngelList allows individuals to be investors in a company. Whatever value the company creates, you will have a fraction of that. [In the past], religious organisations such as the church might have this role in

society. Now, the individual can do it directly by connecting to the projects of other individuals,” says Sundararajan.

Above all, these platforms allow anyone to make some extra income. Sundararajan cites the example of Lyft. “The majority of people who drive for Lyft are not professional taxi drivers; they don’t do this full-time. They use their own car, and they drive 5 to 10 hours a week to earn extra income.”

Economic growth

Collaborative consumption is about changing the economic landscape by making better use of assets and providing more options to the consumer. Historically, whenever capital assets or labour have been put to better use, the economy as a whole benefits, Sundararajan points out.

“We are creating more variety, which increases economic activity. Instead of having a few dozen hotel chains to choose from, you can have this wide variety — from someone’s couch to a small spare bedroom. For US$5,000 a night, you can rent a loft in Soho, New York.”

That shift from business-to-consumer transactions to peer-to-peer will soon have implications on the economy. Sundararajan says the sharing economy represents a new kind of capitalist economic activity at scale.

“You see people who are transacting with people on the same scale as the big businesses are able to grow. [You are taking] these micro-entrepreneurs and tying them together in a marketplace that is starting to become as big as the largest companies in the world. When this happens, what does this mean for the economy, for the [country’s] gross domestic product?”

The sharing economy is already making waves in industry with its valuations. For example, Uber Technologies Inc, an app-based transport service, was valued at US$40 billion after it received a new round of financing totalling US$1.2 billion in December last year.

A Jan 21 report by Bloomberg revealed that Uber had raised US$1.6 billion in convertible debt from Goldman Sach’s wealth management clients. According to sources quoted in the report, the six-year bond will convert into equity at a 20% to 30% discount to Uber’s valuation if it decides to go for an initial public offering. Otherwise, the bond’s coupon will increase over time if the company does not list within four years.

Airbnb, another player in the sharing economy, is a digital platform that matches those who have accommodation space to offer with those who need it for a specified period. Last October, investors valued the company at about US$13 billion.

This gives Airbnb a higher valuation than the two largest listed hotel chains — Wyndham Worldwide Corp and Hyatt Hotels Corp — which have market capitalisations of US$9.8 billion and US$9.2 billion respectively.

However, it is still early days to know how much these companies have actually contributed to the economy. “In terms of real hard economic numbers, we are still a year or two away from robust estimates of growth. There are consulting firms that have come up with top-line projections. The numbers I have seen range from US$9 billion to US$300 billion, as the size of the sharing economy,” Sundararajan says.

“You can [calculate the figures] on an industry level. We can say that peer-to-peer accommodation has tripled in the last year. Also, there are almost 10,000 cars connected to the Uber platform. [In comparison,] there are 40,000 yellow cabs in New York City.

Just three years ago, there were no Uber cars. My projection is that by next year, there will be more Uber cars than yellow taxis in New York City.”

This article first appeared in Personal Wealth, a section of The Edge Malaysia, on March 16 - 22, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.