This article first appeared in Capital, The Edge Malaysia Weekly on August 19, 2019 - August 25, 2019

THE Dow Jones Industrial Average saw its biggest single-day percentage decline this year last Wednesday, falling 800.49 points or 3.05% to 25,479.42, and shortly after, #TrumpRecession began trending on Twitter.

The Twittersphere seems to be in consensus that the 45th president of the US was to blame for the Dow’s drop, as investors were spooked by a phenomenon known as an inverted yield curve — the US 10-year Treasury yield dipped below that of the two-year Treasury for the first time since 2007. The inversion of the yield curve is regarded as a signal that a US recession could be on the cards.

Not surprisingly, recession fears brought about a rush for gold, with the spot price skyrocketing to US$1,522.29 per ounce last Thursday — the highest level since 2012. Year to date, the price of gold has appreciated 18.7% and some quarters expect it to surpass its record of US$1,921.17 per ounce in 2011.

Bank of America Merrill Lynch (BAML) metals strategist Michael Widmer sees scope for gold to rise towards US$2,000 per ounce in the next two years, premised on the correlation between negative-yield assets and gold prices.

Widmer says a key driver of the recent gold rally has been negative bond yields, with around US$14 trillion worth of debt now having negative yields, including Germany’s 30-year Bund.

“With more easing to come, this dynamic will likely sustain a bid for the yellow metal,” he says in a note to investors.

However, Widmer notes that successive rounds of monetary easing by central banks have delivered less “bang for the buck”, and markets are much less enthusiastic about further stimulus.

“This can become counterproductive if it ultimately prompts market participants to de-lever, rather than taking out new loans, making monetary policy transmission ineffective.

“Quantitative failure, under which markets refocus on elevated debt levels or the lack of global growth, would likely lead to a material increase in volatility, potentially pushing yields and equity markets lower. At the same time, and perhaps perversely, such a sell-off may prompt central banks to ease more aggressively, making gold an even more attractive asset to hold.

“We have a relatively conservative second-quarter 2020 forecast of US$1,500 per ounce but, in this scenario, we see the scope for gold to rise towards US$2,000 per ounce,” he says.

The price of gold usually correlates to that of the inflation rate. In other words, a higher inflation rate could push up the price of gold as the latter is seen as a hedge against inflation.

According to Widmer, this time, however, the gold market seems to be rallying in a low inflationary environment.

“Remarkably, the gold market has taken a different take and is completely unfazed by the lack of inflation. To that point, long-standing correlations between consumer price index changes and prices of the yellow metal have broken down,” he says.

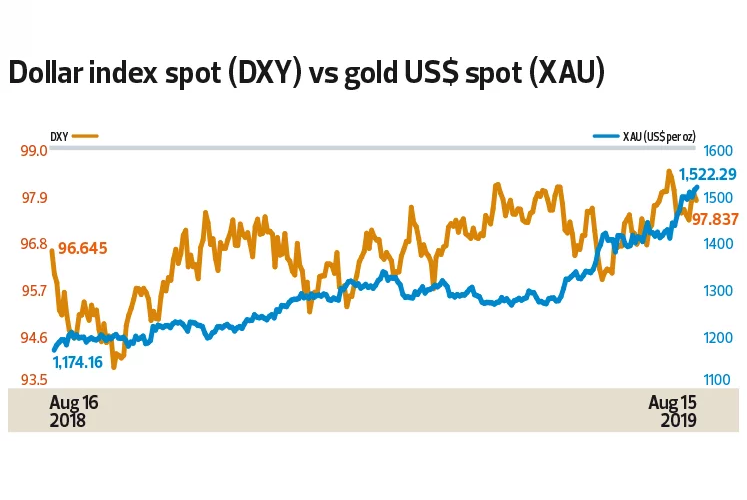

Valour Markets Pte Ltd managing partner Stephen Innes says the movement of gold prices will depend on the strength of the US dollar.

“The rally could extend, but to what degree the stronger US dollar will play is the big question in my view as, over time, gold prices are most closely tied to the underlying movement of the US dollar and real interest rates,” he says.

Gold prices have an inverse relationship with the greenback, hence a stronger US dollar against other currencies would mean lower prices for gold as it becomes more expensive to acquire in other currencies.

Innes adds that the global trade uncertainty, with the US-China trade war and its corresponding risk to growth, will continue to support gold prices.

“This will continue to make gold extremely attractive from an asset diversification perspective, especially with the lower opportunity costs of holding gold. This trend is apparent in the demand for [gold-backed] exchange traded funds [ETFs] and the extended positions in the COMEX [the primary futures and options market for trading metals such as gold, silver and copper],” says Innes.

He points out that as a percentage of global funds’ assets under management (AUM), gold positions are not stretched at all.

“This suggests there is ample room for asset managers to add gold positions as a percentage of AUM as investors seek out diversification amid elevated uncertainty around trade and the US debt ceiling,” says Innes.

FXTM global head of currency strategy and market research Jameel Ahmad believes that the current gold rally will last for as long as global economic weakness remains on the minds of investors and unresolved issues, such as the trade war and Brexit, stand without solutions.

“These factors are weighing down on market sentiment, and the International Monetary Fund has needed to revise downwards global economic expectations as many as four times since the final quarter of 2018, due to the many risks surrounding the global economy, which were mostly political.

“If US-China relations do worsen due to trade tension escalations, then investors will argue that this is enough reason to stock even more gold in a portfolio,” he says.

Jameel believes that the price of gold can reach US$1,700 per ounce.

“There are heightened fears that the world economy could suffer a slowdown not seen since the last global financial crisis a decade ago, meaning there is not a ceiling in place when it comes to the ongoing gold rally this year.

“My assumption is that for as long as world economic health is on the firing line due to a number of unpredictable political risks — such as the US-China trade tensions and a continued decline in global economic data that is encouraging central banks across all corners to act — there is still plenty of room for gold prices to climb higher,” he says.

According to data from the World Gold Council (WGC), central bank buying and healthy ETF inflows were the driving forces behind gold demand throughout the first half of this year.

“Central banks bought 224.4 tonnes of gold in 2Q2019. This took 1H2019 buying to 374.1 tonnes — the largest net first-half increase in global gold reserves in our 19-year quarterly data series,” the WGC says.

BAML’s Widmer says central banks have also pushed up gold quotations through persistent purchases.

“In fact, monetary authorities [last] week decided not to renew the central bank gold agreement [which limits the amount of gold that signatories can collectively sell in any one year] as central banks have become net buyers.

“According to the WGC, the majority of central banks expect global central bank gold reserves to increase over the next year,” he says.

Gold constituted US$1.8 billion of Bank Negara Malaysia’s international reserves as at July 31, up from US$1.5 billion five years ago.

Data from the WGC also shows that holdings of gold-backed ETFs grew 67.2 tonnes in 2Q2019 to a six-year high of 2,548 tonnes. The main factors driving inflows into the sector were continued geopolitical instability, expectation of lower interest rates and the rallying gold price in June.

A key development that gold investors will be looking out for is whether the US Federal Reserve will cut rates in September and, if so, would it do so more aggressively, which would help gold rally further.

With US President Donald Trump blaming the recession fears on the Fed and its chairman Jerome Powell — whom he labelled as “clueless” and being “too slow to cut rates” — the pressure is definitely on for the Fed to make a drastic easing.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.