DESPITE the volatile and speculative trading on Bursa Malaysia’s ACE Market (previously known as the Malaysian Exchange of Securities Dealing and Automated Quotation), dealers opine that there are companies with good fundamentals to be found on it.

DESPITE the volatile and speculative trading on Bursa Malaysia’s ACE Market (previously known as the Malaysian Exchange of Securities Dealing and Automated Quotation), dealers opine that there are companies with good fundamentals to be found on it.

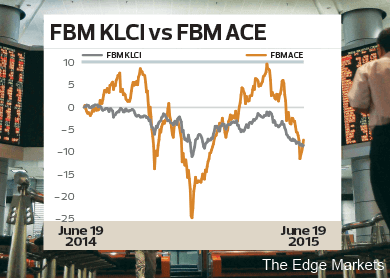

The FBM ACE had dropped 19.4% from April 21 to 6,011.28 points last Monday. By comparison, the FBM KLCI had lost 7.55% to 1,722.16 points. But by last Thursday, the ACE Market had regained 2.98% to close at 6,190.58 points whereas the FBM KLCI continued to trend downwards, closing at 1,718.12 points.

“The ACE Market is cooling down and finding its downward support,” says Alliance Investment Bank remisier Raymond Foo Chee Guan. Though it will likely recover soon, it is still declining, he adds.

Hong Leong Investment Bank dealer Frank Lin notes that trading on the ACE Market is usually lacklustre. “What you have seen in recent months is different counters being played by speculators every day. We call it rotational play. It is not sustainable but it provides the market with some excitement.”

He says the reasons for the volatility in the local market are the probe against 1Malaysia Development Bhd and, to a lesser extent, the split among the opposition parties, which will have serious implications for the Selangor government. Also, he adds, institutional funds prefer better quality stocks and have no appetite for the smallish ACE Market counters, thus, their impact on this market is minimal.

“The FBM KLCI is still high as it is supported by the government-linked companies but there are many gems among the second and third liners,” he observes.

Alliance Investment Bank’s Foo says stocks such as Oceancash Pacific Bhd, IFCA MSC Bhd, Systech Bhd and Opensys (M) Bhd can grow further despite their high price-earnings ratios. “There are good stocks in the ACE Market but beware that most of them are played by the syndicates.”

He believes the ACE Market is volatile because it is controlled more by the syndicates than institutional investors. “The secondary market is highly speculative and unhealthy. It’s not easy to find gems like Inari Amertron Bhd.”

Another dealer tells The Edge that most of the ACE Market counters are expensive at the moment. He suggests looking at stocks with stable business and revenue growth, such as Oceancash, Eduspec Holdings Bhd and Managepay Systems Bhd.

Meanwhile, IFCA MSC (fundamental: 3; valuation: 0.80) — the stock that accounted for about one-third of total trading volume on the ACE Market recently — posted solid results in its first quarter ended March 31, 2015. Net profit skyrocketed 23 times from a year ago to RM9.69 million while revenue soared 133.63% to RM31.98 million. Earnings per share was 1.8 sen compared with last year’s 0.09 sen.

In a May 20 note, the GST-compliant software provider says the results represent a strong billing quarter for software implementation work. However, Foo remains sceptical about the sustainability of IFCA MSC’s results. “Although net profit has increased, EPS is still low,” he comments.

After the implementation of the Goods and Services Tax (GST) in April, IFCA MSC shot up 1,572.73% to an all-time high of RM1.84 on May 18. However, it had slipped 50.82% to 90.5 sen last Monday.

CIMB Research analyst Nigel Foo says in a June 16 note that the recent selldown in IFCA MSC offers investors an opportunity to accumulate its shares. The research house has an “add” call on the stock and a target price of RM2.04.

“We think the worst is over for IFCA MSC after its sharp decline over the past month. Its fundamentals are strong,” remarks Nigel. He believes that while its 1Q2015 revenue and profit were driven by domestic GST software upgrades, earnings over the next few quarters will be driven by China, domestic customers’ migration from Windows to mobile-based platforms and SaaS (software as a service).

It is worth noting that IFCA MSC received an unusual market activity (UMA) query — the third in over six months — from Bursa last Tuesday over the recent sharp drop in its share price and high trading volume. However, in its reply to Bursa, the company said it was not aware of any corporate developments that would have caused its shares to tumble.

Meanwhile, TA Securities has a “buy” call on semiconductor player Inari Amertron (fundamental: 3; valuation: 1.50) and a higher target price of RM4.25. It says it continues to be upbeat on the company’s prospects. Its analyst Paul Yap says in a May 15 report that the company’s future earnings will be driven by the recent completion of its plant, P13. “This is supported by robust demand in the smartphone sector and a favourable exchange rate.”

Inari weathered the recent selldown in the ACE Market to climb 68.07% from Oct 16 last year to RM3.30 last Friday.

In a May 27 announcement to Bursa, education stock Eduspec (fundamental: 2.50; valuation: 0.80) said it expects to achieve higher revenue contribution from its ventures in Indonesia, Vietnam and the Philippines and will continue to grow its products and services in the domestic market.

Eduspec is one of the counters that contributed to the decline on the ACE Market. Its shares closed at 32.5 sen last Friday, after having gained 90.91% from Oct 16 last year to a high of 42 sen on April 16.

On a brighter note, ManagePay’s wholly-owned subsidiary, ManagePay Resources Sdn Bhd (MRSB), has received a letter of notification from UnionPay International Co Ltd on the registration of MRSB as a UnionPay third-party service provider. Upon registration, the electronic payment solutions provider will be responsible for switching and gateway services, system operation and product management of UnionPay card issuance in Malaysia, Myanmar, Thailand, Singapore and Indonesia.

In a May 26 announcement to Bursa, the company said it hopes to capture the growth in the payment industry by offering end-to-end ePayment and eMoney solutions to large retailers, shopping complexes and business communities in the next five years.

ManagePay (fundamental: 1.30; valuation: 0) climbed 105.71% from Dec 15 last year to a high of 36 sen on May 15. It finished at 29.5 sen last Friday.

Thermal and acoustic applications manufacturer Oceancash (fundamental: 1; valuation: 0.80) is trading at a historical PER of 15.63 times. Its net profit rose 24.18% year on year to RM2.22 million in its first quarter ended March 31, 2015, while revenue was 17.22% higher at RM20.4 million. EPS improved to one sen from 0.8 sen.

In an announcement on May 28, the company said the improved revenue was due to the better performance of its felts division in Malaysia and non-woven division in Thailand.

For its full year ended March 31, 2015, Systech (fundamental: 1.65; valuation: 1.10) posted a net profit of RM3 million, which was up 70.46% from last year. Revenue was 17.57% higher at RM2.57 million. The company attributed the higher revenue to the contribution of its franchise software system. The web-based solutions provider has a current PER of 27.6 times.

OpenSys (M) Bhd (fundamental: 1.30; valuation: 1.40), meanwhile, raked in a net profit of RM3.12 million in its first quarter ended March 31, 2015. This was up 67.47% y-o-y. Revenue soared 194.87% to RM27.43 million while EPS improved to 1.39 sen from 0.83 sen. In a May 26 statement to Bursa, the financial services provider said the results were due to higher revenue achieved from business process outsourcing and the sale of a cash recycling machine. It has a PER of 12.21 times.

Apart from IFCA MSC, solar power plant player Vsolar Group Bhd and consumer electronics outfit K-One Technology Bhd too fluctuated wildly. Vsolar jumped 245.45% from Jan 9 to 38 sen on April 22 while K-One soared 163.84% from Oct 16 last year to 64 sen on May 18. But by last Thursday, the stocks had retreated to 14 sen and 26 sen respectively.

Note: The Edge Research’s fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations. Visit www.theedgemarkets.com for more details on a company’s financial dashboard.

This article first appeared in Capital, The Edge Malaysia Weekly, on June 22 - 28, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.