KPS Consortium Bhd (-ve)

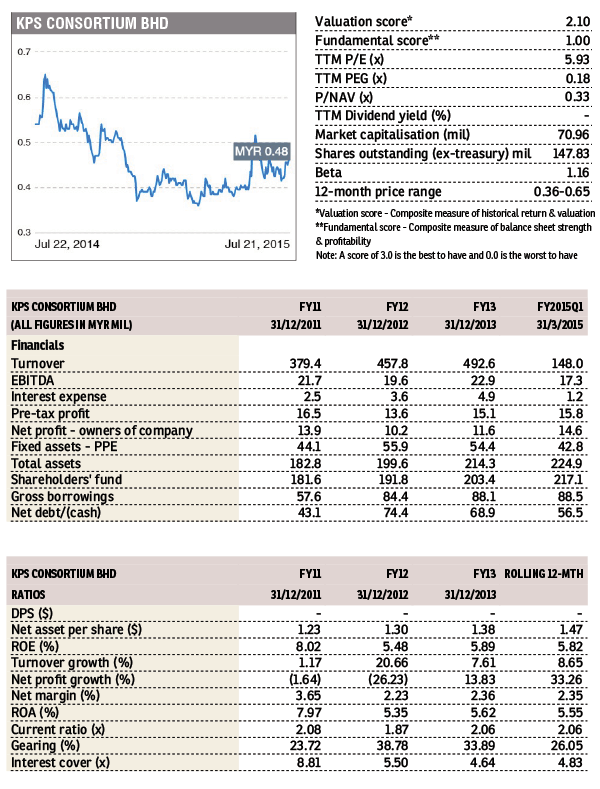

SHARES of KPS Consortium (Fundamental: 2.1/3, Valuation: 1/3) saw active trading yesterday with its share price up 2.1% to 49 sen.

The low-profile company is primarily a distributor of building materials such as plywood, cement, and steel bar; it also manufactures tissue paper and tissue-related products.

For 2014, revenue declined 6% to RM464.4 million, its first decline after five consecutive years of revenue growth, hit by lower building materials sales. Excluding net impairment charges of RM8.8 million, normalised pre-tax profit fell 43% to RM8.9 million.

Stripping out the disposal gain of RM13.6 million on property, plant and equipment, core pre-tax profit for 1Q15 increased 9% y-o-y to RM2.2 million, underpinned by a 54% growth in building materials sales.

The stock is trading at a trailing 12-month P/E of 5.9 times and 67% below book. While valuations are undemanding, no dividends were paid for the past five years.

This article first appeared in The Edge Financial Daily, on July 23, 2015.