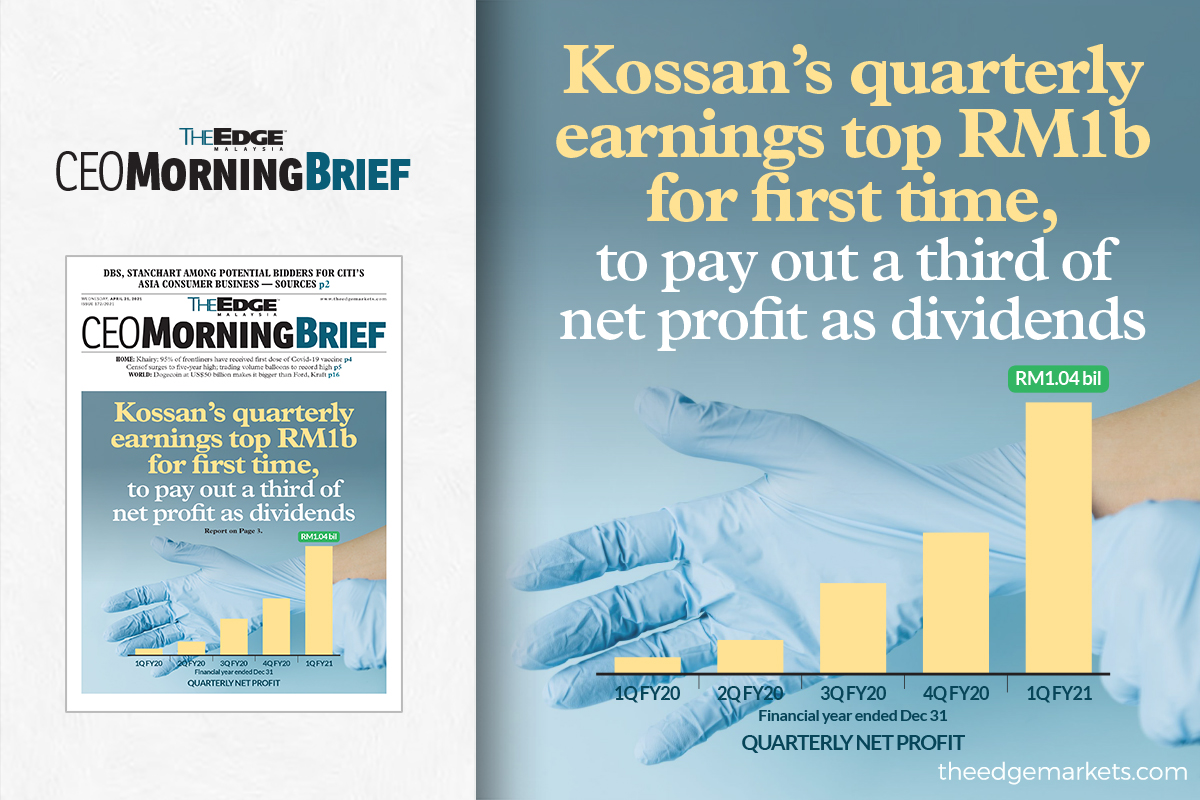

KUALA LUMPUR (April 20): Kossan Rubber Industries Bhd reported today a record high quarterly net profit of RM1.04 billion for the first quarter ended March 31, 2021 (1QFY21). The glove maker will pay out roughly one-third of its quarterly net profit as interim dividend.

"Against this backdrop, Kossan has delivered its best-ever performance with profit before tax surpassing the RM1 billion mark in the quarter under review, driven by the unprecedented demand for the group's glove products," it said in a filing with Bursa Malaysia today.

Earnings per share for 1QFY21 ballooned to 40.76 sen compared with 2.53 sen for 1QFY20, while revenue for the quarter soared more than three times to RM2.19 billion from RM611.47 million a year ago.

On a quarter-on-quarter basis, its 1QFY21 net profit almost doubled from RM543.82 million posted for 4QFY20, as revenue jumped 67.72% from RM1.31 billion.

The glove maker declared a first interim dividend of 12 sen per share, payable on May 20 .The dividend's ex and entitlement dates will be on May 6 and 7, respectively.

Noting that the global demand for the glove products is forecast to grow between 15% and 20% by the Malaysian Rubber Glove Manufacturers Association (MARGMA), Kossan expects its glove division to continue to perform significantly better in 2021 compared with in 2020.

Citing MARGMA again, Kossan said Malaysia's glove export revenue for 2021 is expected to hit RM38 billion compared with RM35.3 billion as global demand for gloves is predicted to grow to 420 billion pieces in 2021.

Post-pandemic, it said the demand for gloves will continue to undergo structural growth as a result of higher healthcare standards and hygiene awareness in both the medical and non-medical sectors.

"As such, even though average selling prices are projected to moderate as the demand-supply imbalance eases, demand will remain above pre-pandemic levels," it noted.

For the technical rubber products (TRPs) division, the anticipated gradual uptick in economic activity and infrastructure spending domestically and regionally will continue to bode well for the infrastructure and automotive segment, and the group expects this division to remain profitable in 2021.

"With the strong long-term relationships with our customers and robust demand for the group's products in the gloves and cleanroom division coupled with a stable TRPs division, management is confident that (financial year 2021) will be an exceptional year for the group," it concluded.

The share price of Kossan closed down four sen or 1.04% to RM3.80 today, for a market capitalisation of RM9.72 billion. There were 5.98 million shares transacted.

To receive CEO Morning Brief please click here.