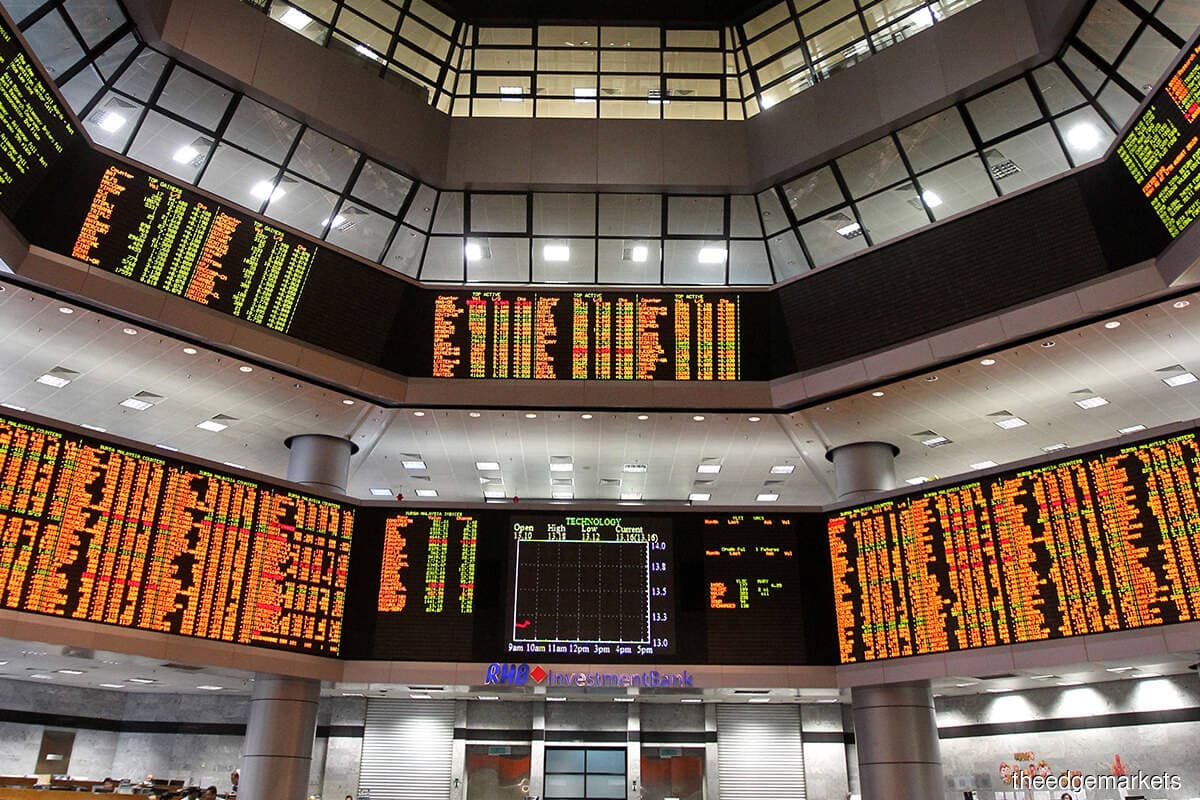

KUALA LUMPUR (Sept 27): Inter-Pacific Securities Sdn Bhd said tThe FBM KLCI’s inability to make a pass at the psychological 1,550 level is leaving it in a state of flux again after it barely recovered from its recent consolidation.

In its daily bulletin today, the research house said there was no follow through buying on Friday and quick profit taking actions permeated instead to leave the key index below the 1,550 level.

It said market conditions were left wanting due to the weakness in regional markets after Evergrande missed repayment of its USD-denominated borrowings.

However, it added that the lower liners and broader market shares were mixed-to-lower ahead of the weekend as profit taking also emerged on some of last week’s big movers.

“This could leave the market directionless and may also result in the market drifting for longer.

“As it is, positive leads are still far and in-between which is likely to prolong the insipid market environment.

“Market players are also still waiting for further clarity on the potential introduction of new taxes, and this could still leave them cautious for now,” it said.

Inter-Pacific said with the insipid trend set to continue, the FBM KLCI may extend its consolidation with the supports pegged at the 1,530 and 1,525 levels, while the resistances are at the 1,540 and 1,550 levels respectively.

“Many of the lower liners and broader market shares have held up well of late and we think there are still rotational interest that would sustain their recent run of upsides.

“In particular, technology stocks are still attracting strong interest that could lead to more near-term upsides as market players remain confident of their earnings performance for the rest of the year,” it said.