KUALA LUMPUR: Loss-making wireless network products provider Key ASIC Bhd aims to return to the black in its next financial year ending December 2016 (FY16), driven by its two newly launched products, the K-Card and K-Drive.

Its chairman Eg Kah-Yee said the two products, on which the company had spent up to US$7 million annually over the past four years, will account for the bulk of its future revenue.

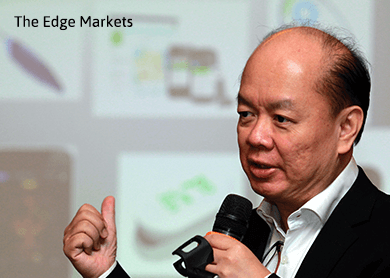

“We’re hoping to turn around next year. If our new products sell, we will definitely make a profit for next year. These are new products, not just for us, but also for the market,” Eg told reporters after the company’s annual general meeting yesterday.

He explained that the K-Card is a secure digital (SD) card with Wi-Fi capability that enables devices without WiFi capability, such as cameras, to transfer data into a cloud storage.

The K-Drive, meanwhile, is a USB WiFi drive with 32GB of storage, which allows users to back up data from devices such as mobile phones and laptops, through a Wi-Fi network.

The investments in the new products have drained Key ASIC’s cash flow, Eg said, which led to its proposed private placement earlier this year.

“We got the approval for the private placement just a few days ago. The proceeds will be spent on the production of the goods and for marketing,” he said.

Eg added that the K-Card has placed Key ASIC in a better position to capitalise on the Internet of Things market, as the product can be utilised by any device that has an SD card slot.

For FY15, he said breaking even is a possibility, but said the outlook is still cloudy.

“It will be clearer six months from now, as we have only recently launched our products,” he said.

For the first quarter ended March, Key ASIC posted a wider net loss of RM4.9 million, compared with its net loss of RM4.75 million a year earlier, on the back of a revenue that declined 42% to RM2.72 million from RM4.68 million.

This article first appeared in The Edge Financial Daily, on June 19, 2015.