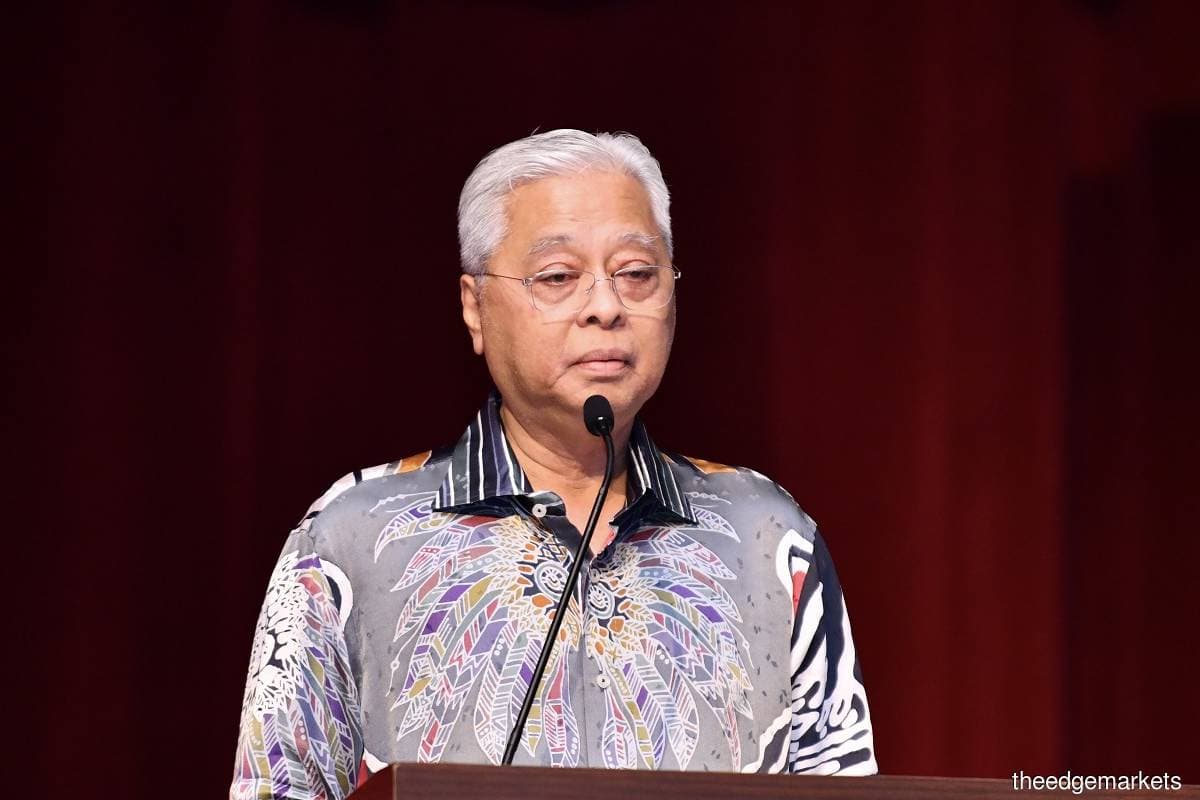

KUALA LUMPUR (July 1): The Keluarga Malaysia Vehicle Insurance Financing programme is to be expanded to encompass those working in government-linked companies (GLCs), government-linked investment companies (GLICs) as well as the private sector, according to Prime Minister Datuk Seri Ismail Sabri Yaakob.

During his speech at the official launch of the programme on Friday (July 1), Ismail Sabri said the programme will be expanded to also include employees of GLCs, GLICs and the private sector “in the near future”.

“I have also discussed with Minister of Human Resources Datuk Seri M Saravanan for the myezycover.com Keluarga Malaysia Vehicle Insurance Financing programme be extended to employees of GLCs, GLICs and the private sector in the near future,” the prime minister said.

The programme, implemented via the digital platform myezycover.com, enables civil servants to renew their motor insurance and road tax in instalments of up to 10 months without incurring any interest charges.

Ismail Sabri noted that the Keluarga Malaysia Vehicle Insurance Financing scheme is set to benefit some 1.6 million civil servants, permanent and contracted.

He said this programme demonstrates the government’s commitment towards the welfare of civil servants in line with its Keluarga Malaysia aspirations, which emphasise the values of inclusion, togetherness and gratitude.

He added the government is fully cognisant of the economic challenges Keluarga Malaysia faces, including the cost of renewing road tax and motor insurance, and therefore urged civil servants to utilise the financing scheme to ease their financial burden.

Ismail Sabri noted that the Russia-Ukraine conflict affected the global food supply chain which in turn affected the Malaysian people, including civil servants. He added that this situation especially affected those working in support services who serve as the backbone of government administration.

The syariah-compliant scheme was realised via a strategic public-private collaboration, which Saravanan dubbed a “win-win” collaboration for the three parties involved, namely the Social Security Organisation (Socso), Angkatan Koperasi Kebangsaan Malaysia Bhd (Angkasa) and A Tech Insure Sdn Bhd (ATech).

Meanwhile, in terms of the expanded coverage of the programme, Saravanan noted that his ministry will continue to discuss with the respective bodies in regard to reaching a “middleground” or “win-win situation” to expand the programme to GLCs, GLICs and the private sector.

“This will be done in stages, we may start with the advanced GLCs such as TNB (Tenaga Nasional Bhd), TM (Telekom Malaysia Bhd), and then see the effects,” he told the press after the event.