Kawan Food Bhd

(Nov 21, RM2.21)

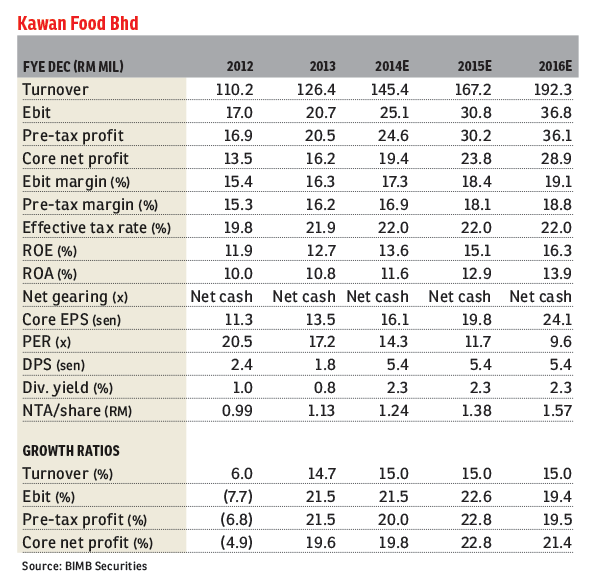

Maintain “buy” with a target price (TP) of RM2.97: Kawan Food’s (KFB) nine months of financial year 2014 (9MFY14) revenue and net profit were up 13.5% and 35.3% year-on-year respectively, due to higher sales registered in the Europe, North America, Oceania and Asia regions.

Quarter-on-quarter revenue declined 6.2% mainly due to seasonal factors and low exports to the affiliated companies. However, net profit increased to RM5.8 million from RM5.4 million in the second quarter of FY14 (+6.8%) due to higher sales. Favourable ringgit/US dollar exchange rate combined with strong consumer demand led to higher sales that have resulted in a higher profit margin of 13.9% at a profit before tax level vis-a-vis 6.1% in the previous quarter. However, uncertainty in the economic condition of the US and Europe may affect the volatility of the ringgit/US dollar exchange rate; as such KFB will increase its efforts to improve overall efficiencies.

Budget 2015 listed down the items (including basic necessities) that will not be subjected to the goods and services tax to be implemented in April 2015.

Hence, Kawan Food may benefit from this. Growth in the consumer sector is seen to be elastic as the incentives by the government will keep consumers’ wallets open. We have revised our FY14 and FY15 net earnings forecast at RM19.4 million (+9%) and RM23.8 million (+17%) respectively. No dividend was declared during the quarter .

The recent selldown made the stock look attractive. We maintain “buy” with a new TP of RM2.97, based on 15 times price-earnings ratio over FY15 earnings per share. Valuation is justified by its strong operating cash flow, well-established brand name, and strong and visible growth.— BIMB Securities Research, Nov 25

This article first appeared in The Edge Financial Daily, on November 26, 2014.