Jaya Tiasa Holdings Bhd

(Jan 29, RM1.85)

Maintain sell with a target price of RM1.55: Jaya Tiasa Holdings Bhd’s second quarter ended Dec 31, 2014 (2QFY15) log and fresh fruit bunch (FFB) production declined partly due to bad weather that affected the harvesting process. Strong demand and tight log supply helped keep timber product average selling prices (ASPs) high.

In 2QFY15, Jaya Tiasa’s total log production declined by 4.6% year-on-year (y-o-y) to 272,537 cu m.

Meanwhile, its FFB production was also down in 2QFY15 by 14.4% y-o-y to 182,672 tonnes. These declines were unexpected although we are aware that the unfavourable weather condition during the monsoon season potentially slowed down the harvesting process.

We expect Jaya Tiasa’s palm oil division revenue to grow by about 48% to RM477 million in FY15. This is underpinned by increasing production of FFB and crude palm oil (CPO), as well as yield; and rising maturity of its plantation estates.

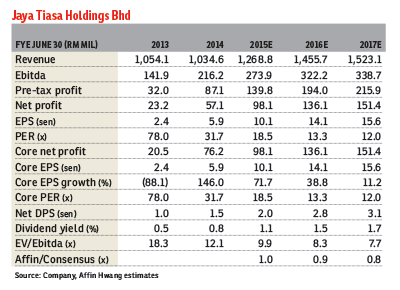

Despite the healthy earnings outlook, we maintain our sell rating on Jaya Tiasa as we think the stock is overvalued and has already priced in the expected earnings growth from its timber and palm oil divisions. Our sum-of-total-parts-derived 12-month target price is unchanged (implied 13 times calendar year [CY15] price-earnings ratio [PER], based on 11 times CY15E PER for its timber division, 14 times PER for its plantation division, and one times book value [BV] for its forest plantation).

At its current price, the implied PER for Jaya Tiasa’s timber business is at a high 15.3 times

CY15E earnings, assuming its oil palm plantation and forest plantation divisions are valued at 14 times PER and one times BV respectively.

Upside risks would be much higher-than-expected log and plywood production; much higher-than-expected FFB and CPO production; and a sharp increase in ASPs for timber, FFB and CPO products. — AffinHwang Capital, Jan29

This article first appeared in The Edge Financial Daily, on January 30, 2015.