This article first appeared in The Edge Financial Daily, on September 25, 2015.

Jaks Resources Bhd

(Sept 23, RM1.09)

Maintain buy with a revised target price (TP) of RM1.60 from RM1.20 previously: We are positive that Jaks, together with China Power Engineering Consulting Group Co Ltd (CPECC), has secured US$1.4 billion (RM6.15 billion) financing for the US$1.87 billion coal-fired power plant in Vietnam, which will be funded by 75% (US$1.4 billion) debt and 25% (US$470 million) equity.

We believe there is now a higher likelihood to meet the project’s financial close deadline on Oct 31. CPECC, which is supposed to inject a total of US$7 million as security deposit, will deposit the third and final tranche of US$2 million this month.

We understand that Jaks can now proceed with the relevant approvals required from the relevant authorities in respect of CPECC’s investment in the project.

We are now more confident that Jaks’ construction division will drive its earnings growth, as the non-technical engineering, procurement and construction portion of the Vietnam project worth US$454.5 million is now quite likely to begin as scheduled in the fourth quarter of financial year 2015, and that the plant should be completed by 2020.

We maintain our “buy” call with a TP of RM1.60, based on a lower discount of 20% to our realisable net asset value valuation of RM2.

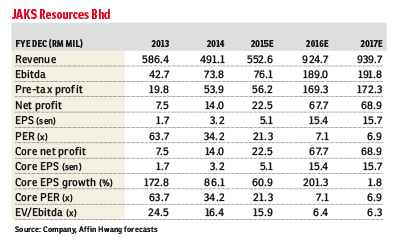

Unlocking value in the Vietnam project is the key rerating catalyst for Jaks. We make no changes to our earnings forecasts. — Affin Hwang Capital, Sept 23