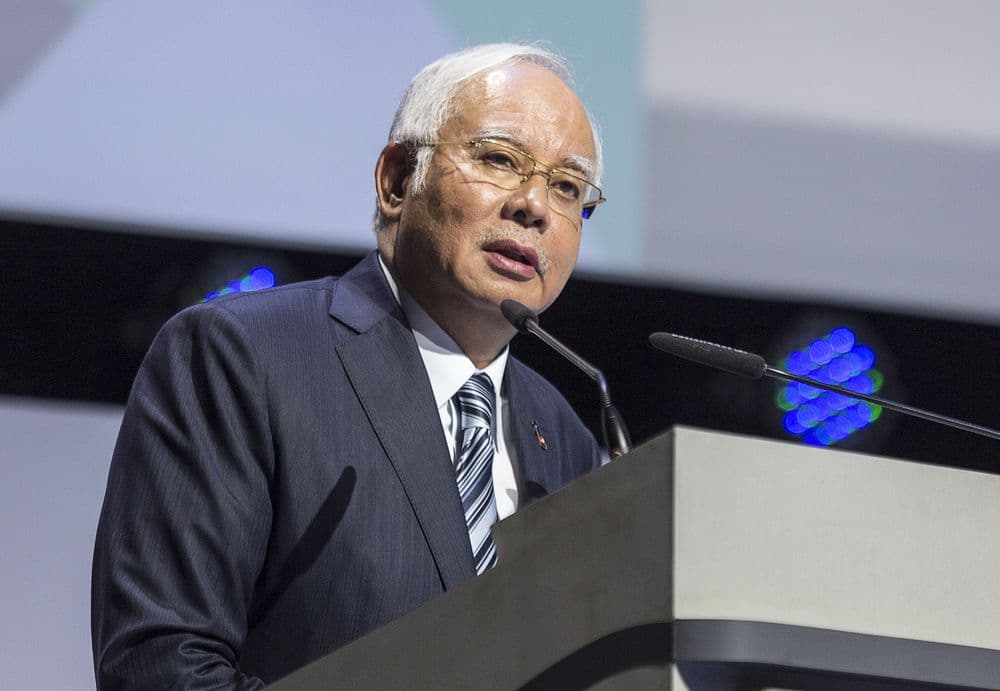

KUALA LUMPUR (June 7): The Inland Revenue Board of Malaysia (IRB) will reexamine the tax treatment on the RM2.6 billion that was deposited into former Prime Minister Datuk Seri Najib Razak's personal account in 2013, which was claimed to be a personal donation from the Saudi royal family.

"In light of the disclosure by the current chief commissioner (Datuk Seri Mohd Shukri Abdull) of the Malaysian Anti-Corruption Commission (MACC) and ongoing investigations pertaining to all issues related to 1Malaysia Development Bhd (1MDB), the tax treatment of the said RM2.6 billion payment that was decided on Feb 16, 2016 is now subject to further examination," said IRB chief executive officer Datuk Seri Sabin Samitah in a statement today.

He added that IRB will work closely with all agencies and the newly-formed Task Forces that are involved in the 1MDB-related investigation, to ascertain the true nature of the payment.

"On Feb 16, 2016, based on the findings made by the agencies that had been given the task to investigate the said RM2.6 billion, the amount received was found to be a donation payment and voluntary in nature and as such had no income characteristics," said Sabin.

Therefore, it was not an income which is subject to tax under the Income Tax Act 1967.

However, Sabin pointed out that a voluntary payment may change in character and be subject to tax if it is given repetitiously, as consideration for services rendered, in return for any benefit of any kind or the amount is used in a business activity in order to sustain business operations.

"On this point it should be highlighted that voluntary payments received by charitable institutions which have these characteristics are subject to tax unless the institution is exempted under the Income Tax Act 1967," he added.

Former Attorney-General Tan Sri Mohamed Apandi Ali had on Jan 26, 2016 cleared Najib of any wrongdoing in relation to investigations into the RM2.6 billion deposited into his personal bank account. In March that same year, then Minister in the Prime Minister’s Department Datuk Seri Azalina Othman was reported as saying that the MACC had confirmed that the RM2.6 billion in Najib’s account was a private contribution from the Saudi royals.

Sabin said IRB will also reexamine the tax treatment on the cash and other valuable items recently seized from Najib's residence and other premises.

"The purpose of the notice is to ascertain whether sufficient disclosure of income has been made to IRB that commensurate with the assets (cash and valuables) owned by a particular individual," he said.

"In the event of an unexplained wealth, additional tax will be raised together with penalty of a maximum of double the amount of tax under-declared.

"Failure by a person to comply with the notice within the specified time is an offence and can be prosecuted under the Income Tax Act 1967," added Sabin.

On May 25, Federal Commercial Crime Investigation Department director Commissioner Datuk Seri Amar Singh announced that the police had seized cash in various currencies from condominium units linked to Najib amounting to RM114 million, while another 37 bags contained jewellery and luxury watches.