This article first appeared in The Edge Financial Daily, on October 21, 2015.

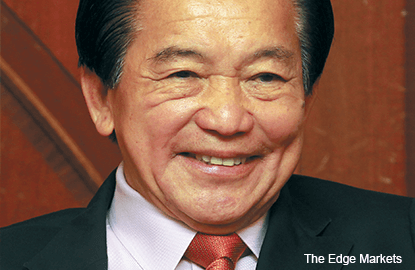

KUALA LUMPUR: IOI Properties Group Bhd’s (IOI Prop) controlling shareholder and founder Tan Sri Lee Shin Cheng and his family are injecting a massive 399.7 acres (161.75ha) of land bank in Sepang into the property firm for RM1.58 billion.

In return, Lee and his family would receive cash and new shares in IOI Prop.

“The land bank of the target companies [acquired] is located within IOI City Resort and is strategically fronting the entrance of Putrajaya and next to the South Klang Valley Expressway.

“It is also adjacent to the current development of IOI Prop. The target companies have land bank totalling 399.7 acres in area and post completion of the proposed acquisitions, the land bank of IOI Prop and in IOI Resort City will be enlarged to 449.7 acres from its existing 50 acres,” the group said in an announcement to Bursa Malaysia.

The proposed land purchase is to be done through acquiring companies, which own the tract.

IOI Prop has entered into a conditional share sale agreement (SSA) with its chairman Lee and his wife Puan Sri Hoong May Kuan to acquire the entire stake in Mayang Development Sdn Bhd (MDSB) for RM1.26 billion. The purchase will be satisfied by RM126.35 million in cash and RM1.14 billion in new shares.

The group has also entered into another SSA with Lee, Hoong and their son Datuk Lee Yeow Chor, a director of IOI Prop, to acquire the entire stake in Nusa Properties Sdn Bhd (NPSB) for RM319.83 million, to be satisfied by RM31.98 million in cash and RM287.84 million via new share issuances.

In total, IOI Prop will be funding the acquisition with RM158.33 million in cash, and issuing 664.78 million new shares for the proposed acquisition.

Vertical Capacity Sdn Bhd (VCSB) and Summervest Sdn Bhd have been nominated to receive the consideration shares for the divestments by the Lee family. The two companies are the investment vehicles from which the Lee family controls IOI Prop and IOI Corp Bhd.

Upon completion of the deal, VCSB's stake will comprised 2.2 billion shares, or 49.92%, while Summervest's stake will be increased to 373.72 million shares, representing an 8.47% stake from 1.35% before the acquisition. Consequently, Lee will eventually control 58.56% of IOI Prop.

The market values of the land bank, investment properties and ongoing developments of MDSB and NPSB stand at RM2.06 billion and RM440.1 million respectively, as appraised by Jones Lang Wootton.

The group said the land bank of the two companies is expected to be worth RM20 billion in gross development value, with the land to be used for future product offerings within IOI Resort City and also for the development of the second phase of IOI City Mall.

“The proposed acquisitions are envisaged to offer significant development potential for IOI Resort City and allow IOI Prop to proceed with the future expansion of IOI Resort City in an efficient and structured manner,” said IOI Prop.

IOI Resort City will span over 780 acres upon completion of the acquisition, comprising an integrated mixed development, which includes hotels, a golf course, retail malls and commercial and residential properties.

The group expects to complete the acquisition by the third quarter of financial year ending June 30, 2016.

Trading in IOI Prop shares was suspended yesterday for the announcement. It will resume trading today. IOI Prop’s share price was last traded at RM2.12 on Monday, with a market capitalisation of RM7.99 billion.