Mah Sing Group Bhd

(June 9, RM1.74)

Maintain add with unchanged target price of RM2.02: Mah Sing’s share price has gone ex of a 1-for-4 bonus issue of up to 607.4 million new shares.

This will enlarge its share base from 1.92 billion shares to 2.4 billion shares. The bonus shares will be listed on Bursa Malaysia tomorrow.

Mah Sing’s two warrant issues will also be entitled to a 1-for-4 bonus and their exercise prices will be adjusted down accordingly.

This bonus issue marks the completion of the rights and bonus issues first announced in 2014.

We view the bonus issue positively as it should help increase share liquidity, one of the complaints that investors have about the stock.

Recall that on Jan 22, Mah Sing’s share price went ex of a 3-for-10 rights issue and 3 free warrants-for-10-rights shares.

The rights issue yielded RM630 million in proceeds, RM530 million of which was allocated for land and property development, RM92 million for working capital and RM8 million for proposal-related expenses.

Together with the recent perpetual bond issue, Mah Sing’s net gearing is now zero.

This gives the group ammunition to buy up to RM1.8 billion worth of land bank, which will increase its net gearing to 0.5 times.

Investors should continue to accumulate the stock.

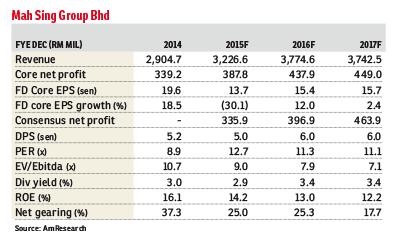

Along with most property stocks, Mah Sing’s share price has been flattish this year. But Mah Sing remains one of the few developers targeting stable sales this year, despite tough market conditions.

Also, earnings growth in 2015 should be strong, driven by record unbilled sales.

Furthermore, Mah Sing is a good proxy for the Malaysian property sector given its exposure to all major geographical locations, including the Klang Valley, Johor, Penang, Negeri Sembilan and Sabah. — CIMB Research, June 9

This article first appeared in The Edge Financial Daily, on June 10, 2015.