Volatility in markets like China, the US and Malaysia looks set to continue. Investment and financial planning professionals recommend strategies to ride out turbulent times.

3. Hold cash and wait

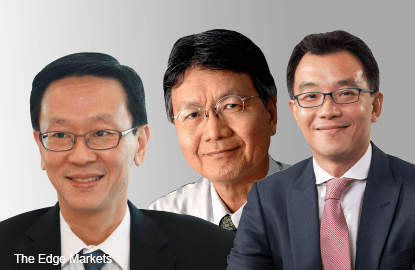

It’s time for investors to sell their holdings, keep cash, and wait for the opportunity to come and move into the market again, says Pong Teng Siew, head of research of Inter-Pacific Research Sdn Bhd.

“This is the simplest thing investors can do now as many missed the timing to sell out near the top and buy in during the lowest point.”

He says the current global economic outlook remains challenging and market volatility is unlikely to end in the near future. To stay invested requires a lot of nerve. “It is true to say that instead of wealth creation, it is more about wealth preservation now.”

Most people, except for a few, missed the perfect timing to sell their holdings in July last year, when oil prices were just beginning to fall, says Pong. There were convincing signs showing oil prices were set to plunge but not many grabbed the opportunity, he adds.

Before the Fed raises its interest rate, he recommends looking at companies that have the following criteria: export-oriented with earnings in US dollars due to high foreign currency earnings, those with businesses in diverse sectors and a broad customer base, and companies expanding into new markets yet maintaining their growth momentum.

Export-oriented companies with USD earnings include those in the technology, glove and furniture manufacturing sectors.

Companies with businesses in diverse sectors are usually more stable in times of turbulence as they usually hedge their risk in many ways, while companies expanding into new markets and maintaining their growth momentum are also worth keeping an eye on, says Poh.

He says however, that company that fulfils all three criteria is hard to come by.

Even though the US economy expanded 3.7% in the second quarter, which is more than a percentage point above the initial estimate of 2.3%, the details behind the growth still don’t look good, Pong says. Instead, signs such as inventory accumulation and weaker sales could be a pre-cursor of a US recession.

“If you read beyond the headline [numbers] in detail, GDP growth came from the production sector, with factories churning out more goods. But the sales did not follow. This has led to inventory accumulation,” he says.

“Stocks are piling up as they can’t be sold. If this continues, factories will curtail their production and this is negative for [US] economic growth. Production will once again slow down and it will affect employment.”

He also doesn’t rule out the possibility that the Fed could launch another round of quantitative easing in the near future if the US stock market falls, given China’s economic slowdown and sluggish global growth.

“Looking at China, its exports are reducing, the stock markets have fallen and the currency is under pressure. Its move to devalue its currency suggests the economy is slowing,” he says.

“Compare this to the 1997-98 Asian financial crisis, when China did not devalue its currency and eventually allowed the crisis to simmer down quickly.”

Pong says it is difficult to predict China’s next move. “China is the anchor of stability for the global economy. If it [China] wants to launch a competitive currency game, no one will gain from it. Will it? If it stops devaluation, then the market will settle down faster.”

4. Stay invested

Manulife Asset Management Sdn Bhd chief investment officer Jason Chong recommends that investors remain invested for the long run as opposed to attempting to time their entry and exit points.

“This is because it is virtually impossible to be able to consistently time the market in the long haul as an investor’s judgement is easily clouded by human emotions like fear and greed,” he says.

However, he suggests adopting different investment strategies for investors to park their wealth.

“Investors can choose to put their money in balanced funds, flexible funds and dynamic asset allocation funds in which the fund managers will seek portfolio out-performance by not only investing in stocks or bonds that they think will outperform the benchmarks but also switch between different asset classes to maximise returns and minimise downside risk,” says Chong.

He says the current volatility is expected to persist, caused by growing risk factors such as the knock-on effects on other currencies following the devaluation of the renminbi, investor concerns over a hard landing in the Chinese economy, the rapid fall in commodity prices and the timing of an impending rate hike in the US.

“As such, the volatility will persist as long as these risk factors remain as financial markets generally dislike uncertainties,” Chong says.

According to a Manulife investment note, titled Global market turmoil: Where do we go from here?, released on Aug 25, the current market turmoil has little similarity to the 2008 global financial crisis.

“The global economy is undoubtedly sluggish but to say recessionary conditions exist would be a stretch at best. A typical recession would see an inverted yield curve, the manufacturing purchasing managers’ index (PMI) fall below 50 or capital spending as a percentage of GDP peak out near 30%. We do not have any of those conditions present today,” states the note.

“Historically, one of the after-effects of a debt-induced financial crisis is that GDP grows 1% slower on average during the 10 years after the crisis. As a result, excesses do not build up in the system. On the other hand, economic growth seems persistently weak and will rarely get above the average of the growth trend preceding the crisis.”

In another investment note on Aug 21, the fund house says its base-case scenario is that the devaluation signals increased equity and fixed income market volatility across Asia, wider fixed income credit spreads and weaker Asian currencies in the short to mid-term.

While the note adds that it is too soon to project a worst-case perspective, if the current climate persists, it could include lowering economic growth forecasts for China and potentially for other affected markets.

However, despite the fluctuations, Chong says that economic recovery in the US — the world’s largest economy — appears positive as consumption continues to show a healthy trend, the labour market continues to improve, wages are growing and housing starts rising.

This article first appeared in Money + Wealth, digitaledge Weekly, on Sept 7 - 13, 2015. Click here to subscribe from RM30 for the digitaledge Weekly and digitaledge Daily.