This article first appeared in Personal Wealth, The Edge Malaysia Weekly on December 16, 2019 - December 22, 2019

The best way to master a new skill, some say, is by following in the footsteps of an expert. The mirroring strategy, which sees novices modelling the trades of more experienced traders, has emerged out of this demand.

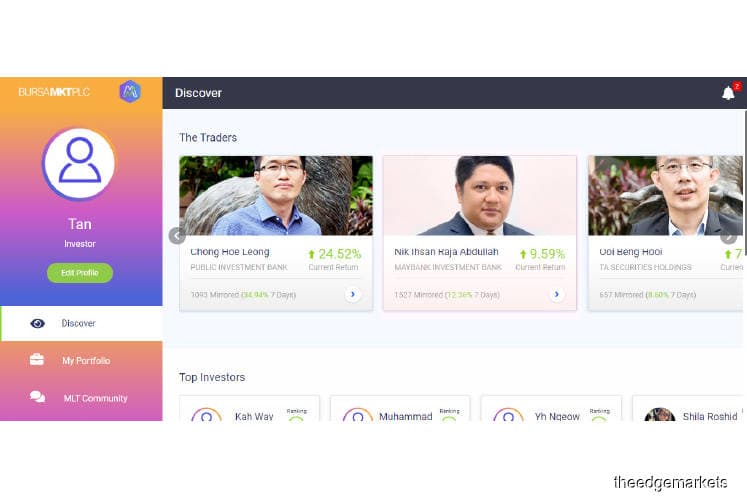

Noticing an opportunity to educate investors, Bursa Malaysia has introduced the Mirror, Learn & Trade (MLT) platform on its investment education portal, Bursa Marketplace. The MLT platform, launched last month, uses the concept of mirror or copy trading to help investors understand how experienced analysts make buy or sell decisions for specific stocks.

It is the first such virtual education programme in Malaysia, launched in collaboration with local licensed and experienced research analysts. “We have assessed this and understood that many factors affect an individual’s interest and eventual participation in the stock market. For example, a risk-averse person may deem the stock market too risky for his liking,” says Bursa CEO Datuk Muhamad Umar Swift in an email interview.

“On the other hand, some may find acquiring the information needed to invest in the stock market too tedious and time consuming, while others stay away because they lack the knowledge and confidence to invest. Thus, many Malaysians tend to miss out on the opportunities to grow their wealth through the stock market.”

Apart from a lack of knowledge, investors may also be misled by the many anonymous sources of investment information provided online, he adds. “The industry recognises this. Hence, when we invited the Participating Organisations of Bursa Malaysia to nominate an analyst to participate on the platform, the response was positive.”

The MLT platform provides registered users with RM100,000 in virtual cash. They can use the money to mirror the trading strategies of participating analysts, who will share their reasons for each buy or sell decision in real time. The analysts, who are trading the same amount of virtual cash, will also provide the latest stock market updates and information.

Currently, the nine analysts on the platform include Chong Hoe Leong of Public Investment Bank, Ooi Beng Hooi of TA Securities Holdings, Kong Seh Siang of CGS-CIMB Securities and Nik Ihsan Raja Abdullah of Maybank Investment Bank Bhd.

The prices on the MLT platform are reflected in real time. Both analysts and users are allowed to maintain a maximum of 10 counters in their portfolio at any given time. Users can mirror the trades of specific counters by multiple analysts, but they cannot trade counters that are not managed by the participating analysts.

Increasing retail participation

The main target group of the MLT platform are millennials and those who have yet to invest in the stock market, according to Bursa Malaysia. The platform was designed to be engaging and similar to social media platforms.

“We designed the MLT platform to appeal to the younger generation’s preference for self-paced online learning. The information is bite-sized and presented in a concise and easy to digest manner,” says Muhamad Umar.

The focus on millennials is part of Bursa’s push to increase retail participation in the stock market. Since the 1997/98 Asian financial crisis, retail participation in the local bourse has been weak, falling from 42% in 2004 to 22% last year (based on total trading value), according to Bursa’s annual reports. Attracting young, first-time investors helps to address this problem.

“Growing retail participation in our marketplace continues to be a key focus for Bursa. Investor participation in the local stock market is growing. As at end-October, retail investor participation was at 26% of the total average daily value, the highest since 2014,” says Muhamad Umar.

“Additionally, we have seen an increase of 9% in new retail investors entering the market compared with the previous year. This is an encouraging sign as retail investors tend to adopt a ‘wait and see’ approach with low trading activity in a bearish market.”

According to previous reports, Bursa’s goal is to lift retail investor participation to 30% over the long run. The MLT platform comes after the stock exchange regulator launched the Bursa Anywhere app in June. The app allows investors to manage multiple Central Depository System accounts on one platform.

Not the typical mirror trading platform

Some may point out that the MLT platform may encourage novice traders to take up mirror or copy trading without understanding the risks that come with it. There are platforms around the world that allow users to completely copy the trades of investors in a network or mirror automated trading strategies offered by a company. This could be risky, especially if the user copies the strategies blindly without understanding the fundamentals of an asset and the risks being taken by the investor whose strategy he or she is copying.

Muhamad Umar clarifies that the MLT is different from those platforms as it only allows users to mirror the trades of licensed investment analysts and all of their buy or sell calls can only be made on counters covered by their respective research houses.

“We believe that such an approach promotes transparency and allows users to build confidence to eventually mirror the trades in an actual trading environment. On top of that, it is compulsory for each participating analyst to share their rationale for each trade that they make on the MLT,” he says.

“Similar to social media platforms, character length limitation is imposed to ensure analysts’ comments are written in a simple and concise manner. This enables the general public to grasp and understand the fundamentals and strategies of stock investing easily.”

Going forward, Bursa is open to expanding the number of participating analysts. It is exploring ways for users to be directed from Bursa Marketplace to their actual trading platforms so they can key in actual trades based on their activities on the MLT platform.

Bursa also intends to build a portfolio analyser and an artificial intelligence-powered chatbot and profiler on Bursa Marketplace. These are part of its initiatives to stay relevant in terms of how Malaysians increasingly consume information, says Muhamad Umar.

“The objective of Bursa Marketplace is to provide Malaysians with a safe, virtual ‘playground’ to learn about the stock market before investing in the real environment. We continue to evolve and innovate with new ideas to improve our offerings and tools for users to learn and make informed decisions in the stock market.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.